There must be at least 1500 in one of the 4 quarters or the claim will be invalid. You will receive a maximum of 522 each week.

My Resume Design That Portrays A Fun And Creative Personality Buy The Template For Just 15 Resume Design Template Cv Template Resume Design Creative

Kentuckys Office of Employment and Trainings OET website features a weekly unemployment benefits calculator that uses quarterly income date earned during a base year to provide a projection for potential unemployment benefit amounts.

Ky unemployment benefits amount. Effective July 1 2020 the minimum rate is 39 and the maximum rate is 569 per week regardless of how high the wages are. The total wages earned during the base period will also influence how much maximum benefit amount and weekly benefit amount you may receive. How much will I receive.

The minimum weekly benefits claimants will receive in Kentucky is 39 and the. DUA weekly benefit amount is 415 per week. You must have earned at least a minimum amount in wages before you were unemployed.

The weekly benefit amount is determined at a rate of 11923 of the total income during the base pay period. You can apply online in person at your local Kentucky Career Center or over the phone at 1-502-875-0442. The new relief bill provides up to 11.

The weekly benefit rate in Kentucky will be 11923 of their total wages during the base period. The amount of benefits received varies based on the base period income and will be between 39 and 415 per week for a maximum of 26 weeks. Keep in mind that the projected amount can change due to factors such as dependents and deductible income.

Amount and Duration of Unemployment Benefits in Kentucky If you are eligible to receive unemployment your weekly benefit rate in Kentucky will be 11923 of your total wages during the base period. The Kentucky OET determines eligibility for workers claiming benefits in the state. Amount and Duration of Unemployment Benefits in Kentucky If you are eligible to receive unemployment your weekly benefit rate in Kentucky will.

If you have insufficient wages to compute a weekly benefit amount or if your weekly benefit amount is less than 145 then your weekly benefit amount will be 145. You will not receive a payment for the first week in which your claim was made. Your weekly benefit amount will be 11923 of your total base period wages except it cannot be less than 3900 nor more than the maximum that is set by law each year currently at 552 per week.

You will receive a maximum of 522 each week. Weekly Benefit Amount Starting July 1 2020 the minimum weekly benefit amount WBA for UI is 39 and the maximum amount is 560 per week. Amount and Duration of Unemployment Benefits in Kentucky If you are eligible to receive unemployment your weekly benefit rate in Kentucky will be 11923 of your total wages during the base period.

This period is called a waiting week and no benefits are provided. The total wages outside of the highest quarter must be at least 1500. The state of Kentucky checks recent work history during a one year base period in order to determine the eligibility and amount an applicant can claim from unemployment benefits.

Kentucky Unemployment Benefit Amount. Amount and Duration of Unemployment Benefits in Kentucky. In Kentucky you can receive unemployment benefits for a maximum of 26 weeks under state law.

If your weekly benefit amount is calculated to be 248 your DUA weekly benefit amount will be 248. Kentucky unemployment benefits are paid for a maximum of 26 weeks though a Kentucky unemployment extension may be put in place to increase this limit during times of high unemployment. Additional federal help resuming soon.

The calculation to determine the weekly benefit amount is 13078 percent of the total amount earned during the base period. In Kentucky your weekly benefit amount will be 11923 of your wages during the entire base period. In addition they will receive a maximum of 415 each week.

Kentucky has waived the one-week waiting period for unemployment benefits. The maximum unemployment benefit available to individuals in Kentucky was 852 a week or about 22 per hour through September 6 2021. You must meet the following three eligibility requirements to collect unemployment benefits.

The minimum DUA weekly benefit amount is 145. 300 unemployment supplements to begin next week. How Long Your Unemployment Benefits Will Last in Kentucky.

The Kentucky unemployment amount is calculated at roughly 119 of your total earnings during your base period. Originally set at 600 the benefit expired in July 2020. Eligibility Requirements For Kentucky Unemployment Benefits.

In order to qualify an applicant must have earned a minimum of 750 in one quarter of the base period. The maximum amount the claimant may collect on unemployment in Kentucky is 415 for a period of 26 weeks. People who have passed the conditions stated above can receive unemployment benefits.

The maximum weekly benefit in Kentucky is 569 per week. The minimum amount is 39. The maximum weekly benefit for individuals is now 552 a week or about 14 per hour.

The minimum amount is 39 in 2021. If you are eligible to receive unemployment your weekly benefit rate in Kentucky will be 11923 of your total wages during the base period. You will receive a maximum of 522 each week.

If You Are Unemployed Kentucky Career Center

Pin By Rhode Island Kids Count On Economic Well Being Where To Get Stamps Stamp Collecting Stamp

Taken Aback Learn The Meaning Of The Useful Idiom Taken Aback 7 E S L In 2020 Other Ways To Say Learn English For Free Idiomatic Expressions

Archived Ui Alerts And Notices Kentucky Career Center

Archived Ui Alerts And Notices Kentucky Career Center

What You Need To Know Kentucky Career Center

Updated Complete Info For Filing For Unemployment Insurance

How To Be Rich Guide How To Be Rich How To Get Rich Wealth Building

009 Audit Report Template Internal Stupendous Ideas Word Pdf With It Audit Report Template Word Cumed Org Internal Audit Report Template Policy Template

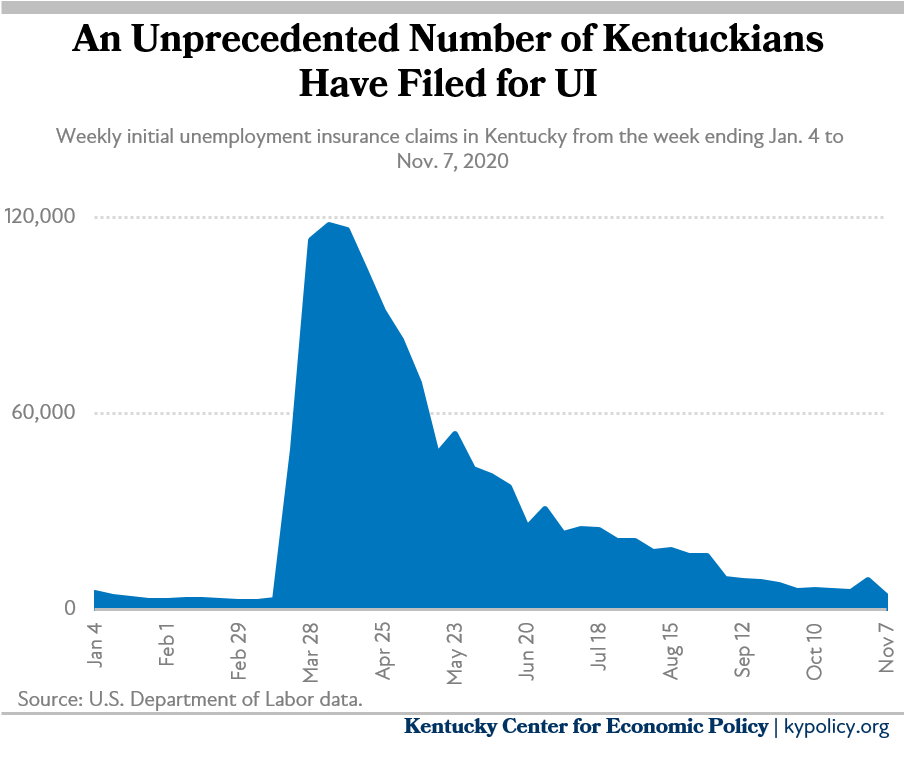

Covid 19 Crisis Demonstrates Need For State Improvements To Unemployment Insurance In Kentucky Kentucky Center For Economic Policy

Unemployment And Underemployment Rates Of Young College Graduates Social Science Project Student Loan Debt Student Loans

The Black Scholes Formula Explained Implied Volatility Finance Tracker Partial Differential Equation

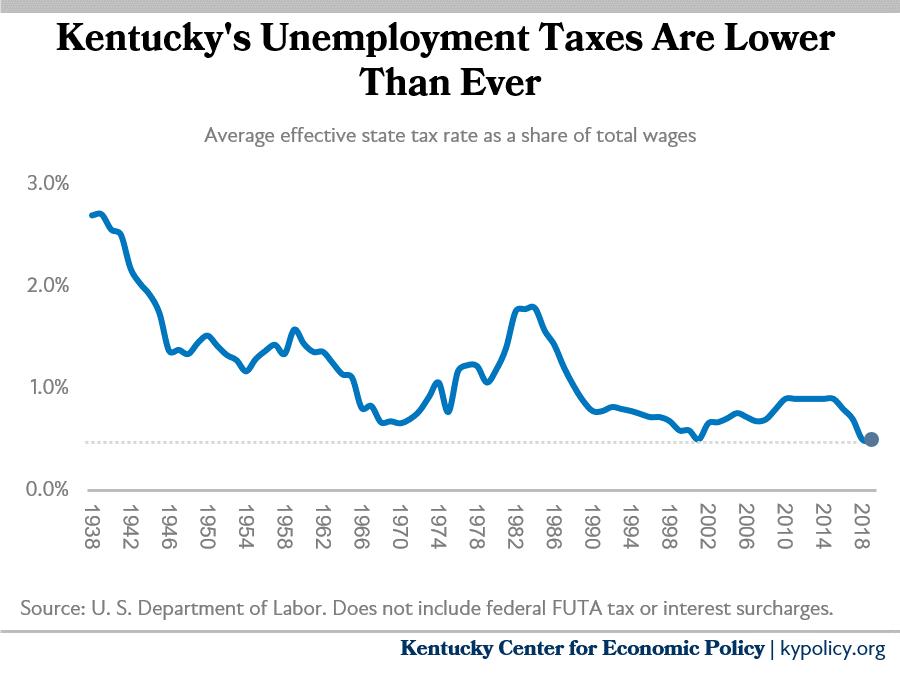

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Unemployment Insurance Resources Northern Kentucky Career Center

No comments:

Post a Comment