The only benefit if you can call it that is that Social Security is not 100 taxable he said. Report the suspected fraud by calling.

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

The New Jersey Department of Labor and Workforce Development released its proposed annual regulatory update to reflect an increase to the calendar year 2022 state unemployment insurance SUI temporary disability insurance TDI and family leave insurance FLI taxable wage basesNew Jersey Department of Labor and Workforce Development.

Is nj unemployment taxable. The filing threshold is 20000 10000 for married filing separately but since you will subtract all of the unemployment benefits your income will. We hope this post on the question Is Unemployment Taxable was helpful. Under the proposed rules 53 NJR.

They are California New Jersey Pennsylvania and Virginia. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. No New Jersey does not collect taxes on money paid out from unemployment benefits.

To help offset your future tax liability you may voluntarily choose to have 10 of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service IRS. Unemployment benefits are not taxable for New Jersey. However Unemployment compensation is taxed by New York State.

Unemployment is taxable for federal purposes but not for New Jersey as is Social Security he said. No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ. Also is unemployment not taxable in NJ.

Be sure to check out our other articles on Unemployment Benefits including Monthly Unemployment Rates for all 50 States. Is Unemployment Taxable Summary. You and your spouse can.

State of NJ is coming into the future. Unemployment benefits are not taxable for New Jersey. If you didnt elect to have federal taxes withheld you can go to your unemployment account and change that.

Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. If you have further questions about Unemployment Benefits please let us know in the comments section below. Report the same amount on your New York State tax return as on your federal tax return.

Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021. There are several that do not though. Below are answers to frequently asked questions about benefit payments and taxes.

However it is NY source income and is taxable to NY state. For important information on the 2020 tax year click here. How much do employers pay for unemployment in NJ.

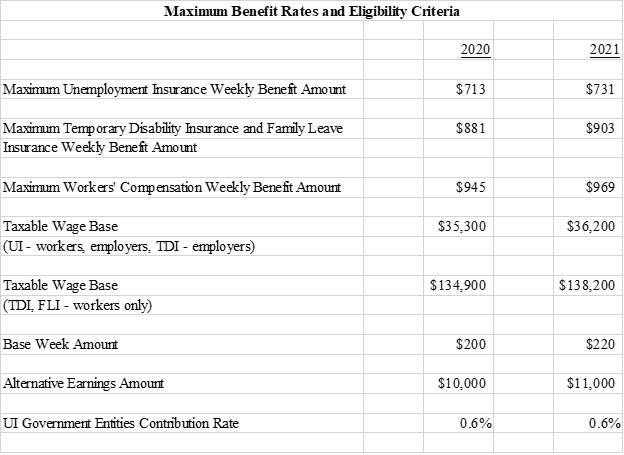

The 2020 employeremployee SUI taxable wage base increases to 35300 up from 34400 for calendar year 2019. It looks like they have started to email the form 1099-G to some. Here in NJ unemployment benefits are not taxable but for federal unemployment benefits are considered income and need to be reported on our 2020 taxes.

This wage base also is applicable for employer contributions to the temporary disability insurance program. The New Jersey Department of Labor and Workforce Development released the calendar year 2020 taxable wage bases used for state unemployment insurance SUI temporary disability insurance TDI and family leave insurance FLI. In this unemployment update I wanted to let everyone know that NJ unemployment benefits are taxable.

Four of the states that do levy an income tax dont collect it on unemployment benefits. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue. If you didnt elect to have federal taxes withheld you can go to your unemployment account and change that.

The taxpayer will still need to to a. New Jersey joins California Virginia Montana Oregon and Pennsylvania as states that dont place taxes on unemployment benefits even though they have state income taxes. You will not owe state income taxes on your New Jersey unemployment income for 2020.

1465 a the 2022 unemployment-taxable wage base is to be 39800 for employers and employees up from 36200 in 2021. Unemployment benefits are not taxable in New Jersey so a return does not have to be filed there. The percentage varies based on your total income.

California Montana New Jersey Pennsylvania and Virginia do not charge taxes on unemployment benefits. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all employers as of March 31st of the current calendar year with respect to their. Unemployment compensation received from the State of New Jersey as well as the additional 600 per week provided as part of the CARES Act is not taxable on your New Jersey tax return.

Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. New Jersey does not tax unemployment insurance payments but they are subject to federal income tax. Unemployment compensation received from the State of New Jersey as well as the additional 600 per week provided as part of the CARES Act is not taxable on your New Jersey tax return.

If you received a 1099-G form but did not file for unemployment you may be a victim of tax fraud. Unemployment is not taxable in NJ from any state. As always New Jersey exempts from taxation all unemployment compensation so the recent federal change has no impact on New Jersey.

2020 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

Unemployment Pub 17 Chapter 12 Federal 1040 Line 19 Nj Tax Ty2014 V Ppt Download

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

Unemployment Pub 17 Chapter 12 Federal 1040 Line 19 Nj Tax Ty2014 V Ppt Download

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia New Jersey Business Industry Association

Nj Does Not Tax Unemployment Benefits But The Feds Will

2021 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

New Jersey Nj Tax Rate H R Block

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

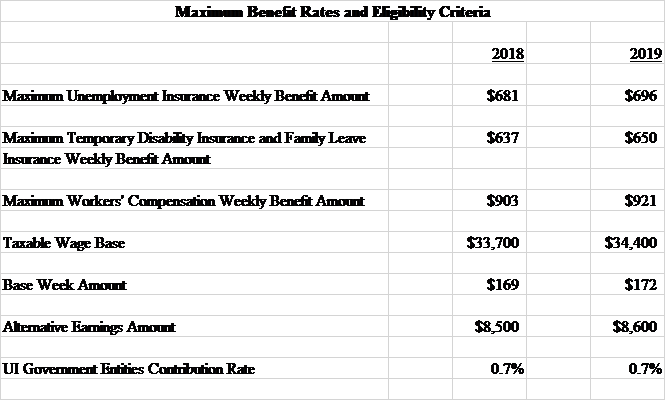

Njdol Maximum Benefit Rates For Unemployment Temporary Disability Family Leave And Workers Comp Rise In 2019 Insider Nj

No comments:

Post a Comment