If your business receives notice that an unemployment insurance claim has been filed please respond to the notice immediately. Unemployment insurance claimants in Kentucky will no longer be able to claim benefits from the following programs after that date.

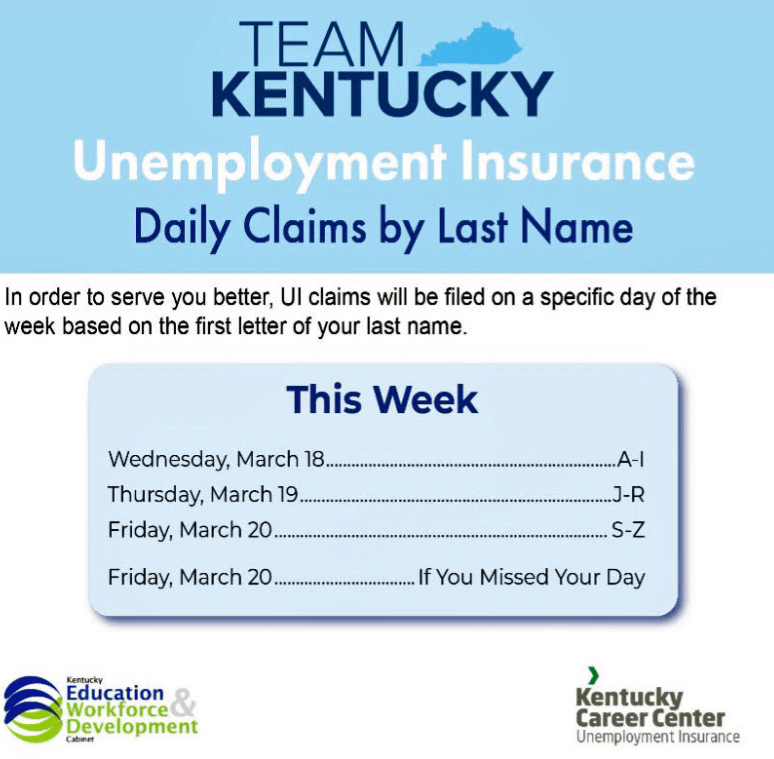

Kentucky Unemployment Benefits Eligibility Claims

First pursuant to Executive Order 2020-235 issued on March 16.

Unemployment benefits kentucky. Sunday and 6 am. Beginning October 20 2021 through. Sunday and 6 am.

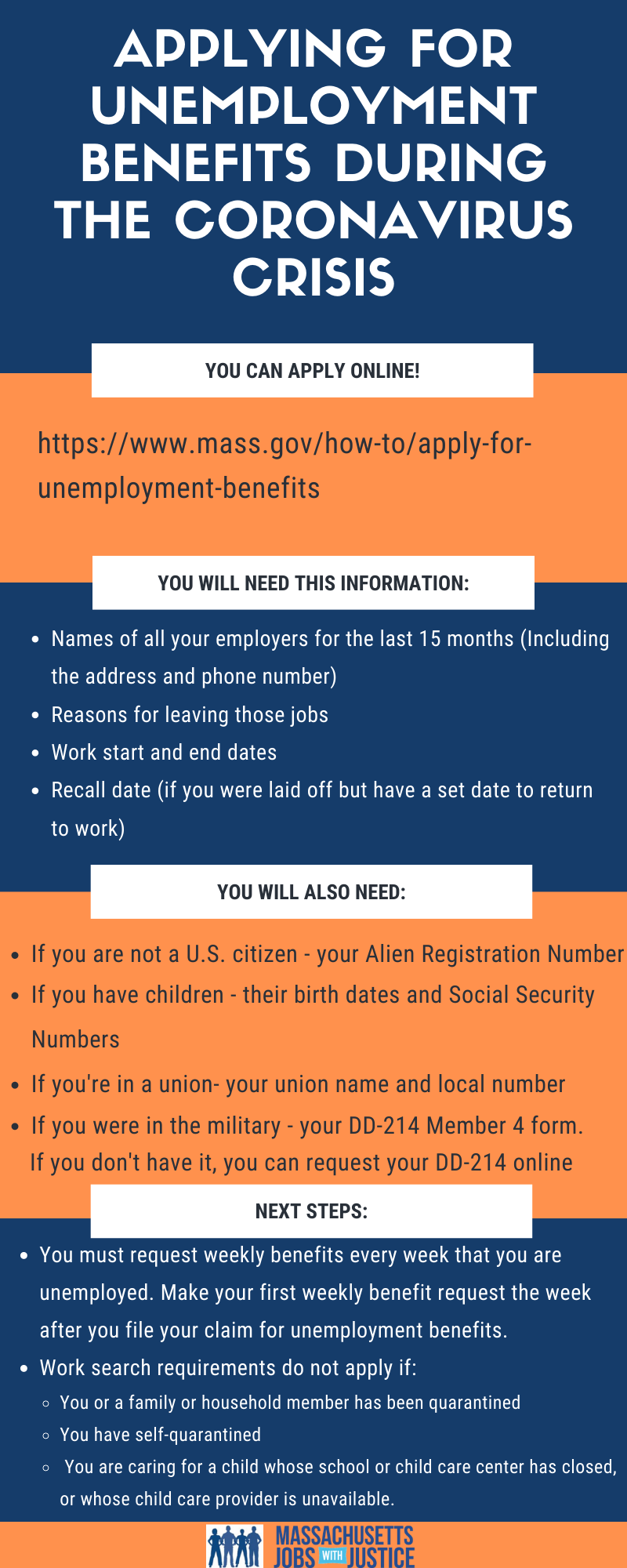

Kentucky workers who have recently lost their jobs may be eligible for unemployment benefits. Due to the Covid-19 pandemic non-traditional unemployment clients are now eligible to file for benefits. If you suspect a claim has been filed in error please promptly contact our office at 502 564-2387.

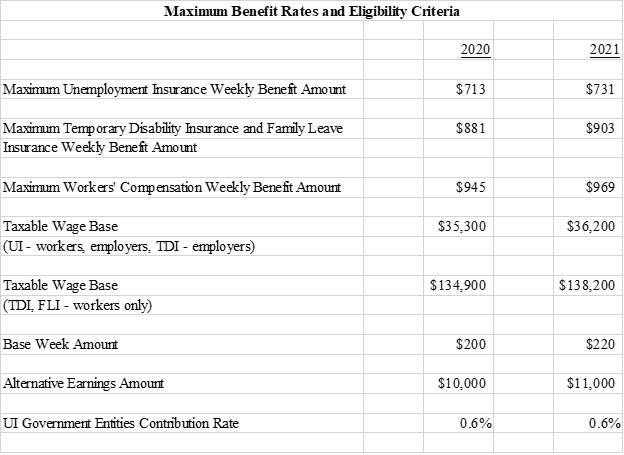

Unemployment insurance provides unemployment benefits to eligible unemployed workers. Benefit amounts ranged from a minimum of 39 a week to a maximum of 569 a week. Kentucky unemployment benefits are paid for a maximum of 26 weeks though a Kentucky unemployment extension may be put in place to increase this limit during times of high unemployment.

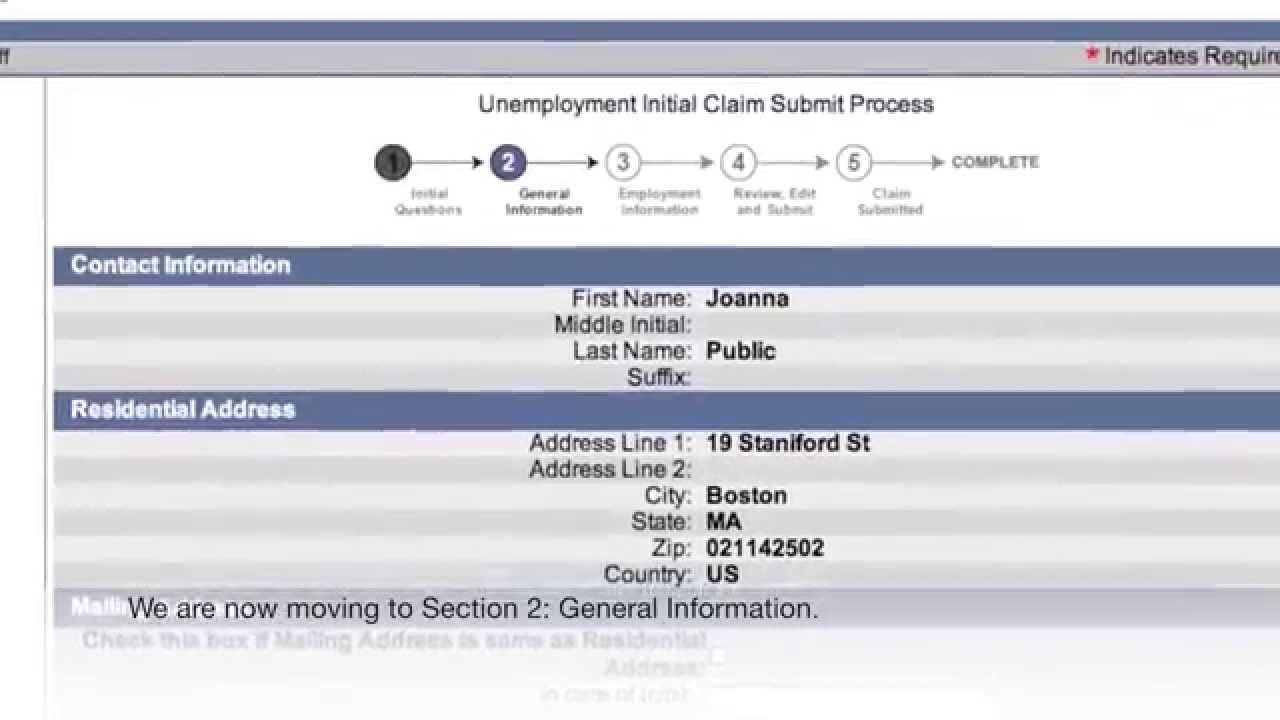

Sep 04 2021 The best way to file your biweekly claim is online from 6 am. Kentucky UI Claims System. The claimants are also mandated to serve the Waiting Week if they become eligible for Unemployment Insurance.

You will receive a maximum of 522 each week. You also can file by phone by using the PA Teleclaims system. Amount and Duration of Unemployment Benefits in Kentucky If you are eligible to receive unemployment your weekly benefit rate in Kentucky will be 11923 of your total wages during the base period.

In Kentucky the rules are lax and they always have been to be able to draw welfare and extended unemployment. Unemployment benefits also called unemployment insurance unemployment payment unemployment compensation or simply unemployment. The following sections provide information about specific benefits available through Kentuckys unemployment insurance program.

The waiting week is the first benefit week for which the claimants will request weekly benefits. Do I have to look for a job to get Kentucky unemployment benefits. Applying for unemployment benefits can be complicated so we put together these resources to help you navigate.

The Kentucky Office of Unemployment Insurance OUI runs the Unemployment Insurance UI program. Kentucky Career Center Office of Unemployment Insurance 500 Mero Street 4th Floor Frankfort Kentucky 40601 UI Assistance Line. The minimum weekly benefits claimants will receive in Kentucky is 39 and the maximum amount one may earn is 552.

One of the first changes made was waiving the seven-day waiting period to obtain unemployment insurance benefits. Unemployment Insurance Benefits KY On March 16 2020 Kentucky Governor Andy Beshear outlined changes to the states unemployment rules as a result of the COVID-19 pandemic. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021.

See the 1099-G web page for more information. Being that unemployment benefits are designed to be a temporary form of aid most. Sanderson received unemployment benefits from April through June last year when the coronavirus pandemic closed schools to in-person education and ended the substitute teaching assignments Sanderson relied on.

Kentucky Career Center- Kentucky Unemployment Insurance This page is here to help you file for Unemployment Insurance benefits. The Kentucky unemployment insurance program provided up to 26 weeks of benefits as of September 2021. The rules benefit the people who really want to.

Kentucky Unemployment Benefits Information Unemployed residents of Kentucky may find that claiming benefits for unemployment is not as difficult as they had imagined. Payments available to employees who are out of work temporarily through no fault of their own. 502-564-2900 Kentucky Relay Service 1-800-648-6057.

In response to the FFCRA and CARES Act Kentucky has announced a number of changes to the states unemployment system. 1099-G Tax Form. Request your bi-weekly benefits by calling the voice response unit at 877-369-5984.

What is it called. Sep 15 2021 Nevertheless because of the COVID-19 epidemic all non-traditional unemployment customers in Kentucky are qualified to apply for unemployment insurance benefits. How To File For Unemployment in Kentucky.

Only claimants who are exempt from the work search requirements those who have a definite recall date within 12 weeks of the initial claim filing are in an approved training program Eclaims etc may choose to request benefits by phone. Call 888-255-4728 from 6 am. Changes to Unemployment Benefits in Kentucky.

Federal Pandemic Unemployment Compensation FPUC which provides an additional 300 weekly payment to recipients of unemployment compensation. Kentucky took the approach of raising taxes and lowering benefits to attempt to balance its unemployment insurance program. Information on the process is provided by the Kentucky Career Center KCC.

In fact the process is fairly straight forward and was designed to help those who are actively seeking work. Starting in 2010 a claimants weekly benefits will decrease from 68 to 62 and the. Although the basic rules for unemployment are similar across the board the benefit amounts eligibility rules and other details vary from state to state.

The Kentucky unemployment office paid him then determined retroactively he was ineligible for benefits once the regular school year ended. Nonetheless the unemployment login at kcckygov is introduced on the. Length and amount of standard benefits.

/cloudfront-us-east-1.images.arcpublishing.com/pmn/PRDOSHRJQJBNZCJ3X7KOEKCUIQ.jpeg)