Pennsylvanias unemployment rate was down one-tenth of a percentage point over the month to 73 percent in March. The new employer rate remains at 36890 for non-construction employers and 102238 for construction employers.

Pennsylvania Unemployment Rate is at 570 compared to 600 last month and 710 last year.

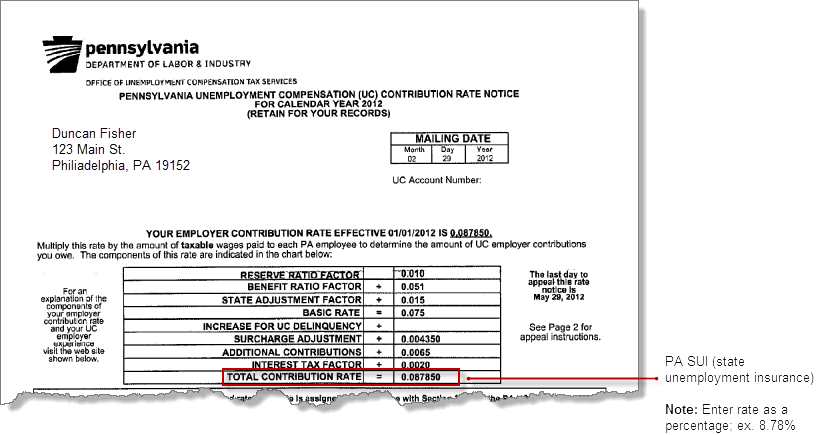

Pa unemployment tax rate. FREE Paycheck and Tax Calculators. The Pennsylvania Office of Unemployment Compensation Tax Services mails annual tax rate notices out to employers doing business in its state at the end of December each year. City of Philadelphia Wage Tax.

Wages subject to unemploy-mencontrt ibutions for employees are unlimited. The employee rate for 2022 remains at 006. Pennsylvania Department of Labor Industry Office of Unemployment Compensation website.

Pennsylvania Unemployment Tax Rate The chart depicted above shows the statistic history. This is lower than the long term average of 646. What is PA federal tax rate.

52 rows SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. Its increases and decreases beginning 15 years ago spanning until present day What is the Unemployment Rate in Pennsylvania. UCMS also offers TPAs the opportunity to manage UC Tax and account information online on behalf of their clients.

Wages subject to unemploy-ment contributions for employers re-mains at 10000. Pennsylvania 501c3 nonprofits need to review their annual state unemployment insurance SUI tax rate notice and monitor their SUI tax overpayment. Rates are determined based on the employers location.

The taxable wage base or amount of wages that are taxable under state unemployment laws also varies by state. Wages subject to unemployment contributions for employers remains at 10000. If you meet these criteria complete form REV-it it to your employers payroll office along with any required documentation.

Pennsylvania does not have a form exactly like the federal W-4 form since Pennsylvania Personal Income Tax is based on a flat tax rate and everyone pays the same rate of 307 percent. FREE Paycheck and Tax Calculators. The calendar year 2021 employer state unemployment insurance SUI experience tax rates continue to range from 12905 to 99333.

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Employers must pay both federal and state. Industry how long youve been in business your particular hiring and firing history etc.

1 2022 total tax rates for experienced employers are to range from 12905 to 99333 and are to include a 075 state adjustment factor a 54 solvency surcharge and a 05 additional contributions tax the. A percentage known as the tax rate or contribution rate of the wage base limit. New 2018 Pennsylvania.

The new employer contribution rate will apply to an employer for the first two or three calendar years that the employer pays wages. Pennsylvanias Unemployment Compensation tax are experienced-rated with such rates ranging from 221 percent to 105 percent. New Employer Rates Standard Rates Computed Experience Based Rate Delinquency Rate Appealing a UC Tax Rate An employer who wishes to appeal a contribution rate may do so by accessing the UCMS employer self-service portal at wwwuctaxpagov.

Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and. Wages subject to unemployment contributions for employees are unlimited. A new employer will pay contributions at 375 percent for non-construction employees and 104 percent for construction employees on up to the first 8000 in taxable wages paid to each employee for the calendar year.

The withholding rate for 2022 remains at 307. Pennsylvanias unemployment tax rates are not to change for 2022 the state Department of Labor and Industry said Aug. Rates vary and should be determined per Act 32 See below for more information regarding Act 32 Local Services Tax LST rate.

What is PA state tax rate for 2021. Under SUTAs tax rates in each state range from a low of 1 to 34. The employee rate for 202 remains at 1 006.

The withholding rate for 2021 remains at 307. Employer UC tax services important information Pennsylvania Department of Labor Industry website November 2019 As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019. These rates are adjusted by the City of Philadelphia on July 1 of each year.

Access Clients Accounts Online. You should have received yours for 2020 very recently. Make an Online Payment.

If you have you may have noticed a significant decrease in your tax rate compared to the prior year. The new employer contribution rate is multiplied by the amount of taxable wages paid by the employer to determine the employers contribution liability. There is a range that details the minimum and maximum contribution rate for each state.

PA Unemployment Compensation06 tax 0006 on employee wages. This percentage amount varies depending on factors like. Currently the lowest is at the 7000 FUTA rate but the taxable wage base goes to a high of 47300 in Washington State.

The Self-Services that are available will vary depending on the TPAEmployer relationship. Regional and State Employment and Unemployment. This picture shown compares figures of the recent years of 2010 to 2011 and 2011 to 2012.

Pennsylvania Income Tax Rate. Effective July 1 2018 tax rates are 38809 for Philadelphia residents and 34567 for nonresidents. The annual tax amount is either 10 or 52.

Wages subject to unemployment contributions for employers remains at 10000. Submit Quarterly Tax Reports Via File Upload.

State Unemployment Insurance Sui Overview

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania Tax Rate H R Block

Pennsylvania Unemployment Insurance Paui Setup Cwu

1099 G Tax Form Why It S Important

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Pennsylvania How Unemployment Payments Are Considered

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Pennsylvania Unemployment Rate 2020 Statista

No comments:

Post a Comment