If the willful overpayment is 66666 or less the monetary penalty is 100. In many cases you will have to provide documentation of financial hardship for you to obtain the waver or even to start a.

Unemployment Benefits Overpayment Waiver Legislation Set To Be Heard By Special Committee Khqa

What to Do About Unemployment Overpayment.

Unemployment benefits overpayment. The Metro Detroit wedding photographer had just started getting back to business after a months-long pause during the pandemic when the Unemployment Insurance Agency notice arrived. Learn how to correctly report wages when certifying. The amount of the monetary penalty is calculated based on the amount of overpaid benefits.

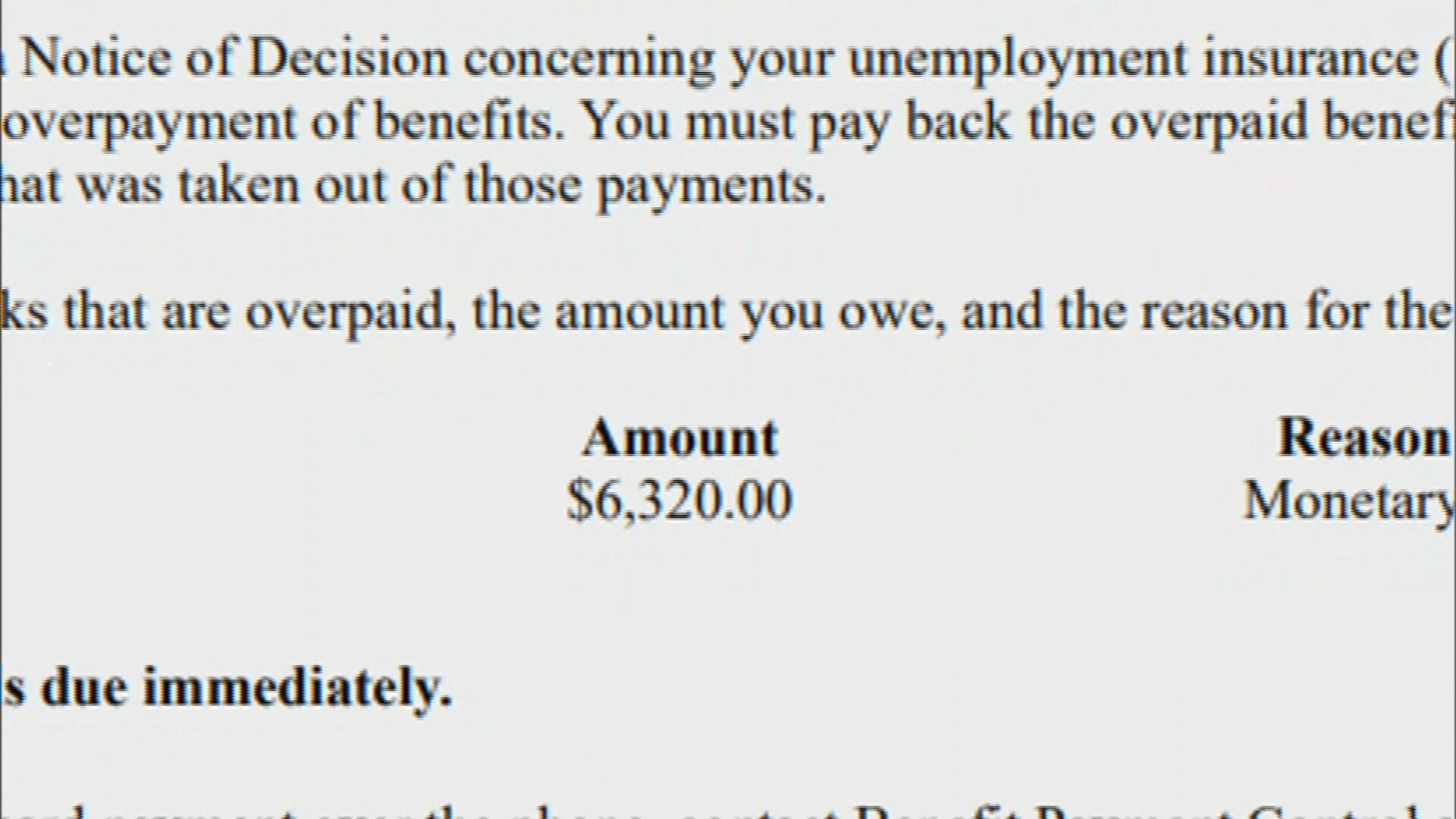

Some people who received unemployment benefits werent eligible and others were overpaid. The September letter demanding a nearly 30000 repayment was like a gut punch for Kellie Saunders. An overpayment may occur when a claimant is paid unemployment insurance benefits and is later found to not be eligible for those benefits.

It is important to note that while this amount looks daunting most of these overpayments were caused by. The court treats an overpayment like any other debt which means its possible to get this debt discharged in Chapter 7 or Chapter 13 bankruptcy provided you did not commit fraud or another unlawful act. Its not uncommon for states to overpay unemployment benefits especially during the COVID-19 pandemic.

But just like with any other debt if the creditor in this case the unemployment office feels that you intentionally misled the agency so you could continue to receive unemployment benefits they can object to the discharge of the. Does the monetary penalty apply to all programs related to unemployment. Some workers have to pay back unemployment benefits.

You can pay via credit card. An overpayment may occur when a claimant is paid unemployment benefits and is later found to not be eligible for those benefits. The overpayment waiver request form asks claimants specific questions to determine if the overpayment was due to no fault of the.

The IRS has identified 16. These claims constitute about 30 million in accidental overpayments. Also if you are overpaid because of some other mistake or you or the Department of Labor made you may have to repay those benefits.

If the willful overpayment is 66667 or greater the monetary penalty is 15 of the total overpayment. If you are paid benefits but then lose benefits when your employer appeals you can be asked to repay the benefits you got earlier. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

An overpayment of unemployment benefits occurs when you receive unemployment compensation you were not eligible for. Common reasons for an overpayment include but are not limited to. Even though this is a debt owed to a government agency it is erased by a bankruptcy discharge.

If you have an overpayment of unemployment benefits and have not repaid that debt your federal Internal Revenue Service IRS tax refunds may be subject to reduction by the overpaid amount. A benefit overpayment is when you collect unemployment benefits you are not eligible to receive. Even if the overpayment is not your fault you will be required to repay the amount of benefits that you received unless you apply for and receive a waiver of the obligation to repay.

With this application you can make payments at any time. President Joe Biden signed the pandemic relief law in March. Claimants may have the following options if an overpayment is established on their claim.

1 There are many reasons why a claim for unemployment benefits can be disqualified. Its not uncommon for states to overpay unemployment benefits. Unemployment Benefits Overpayment Waiver.

The most common reasons for an overpayment are. Michigan unemployment appeals surge amid overpayment mistakes. You are not restricted to our office hours of 800 am to 430 pm.

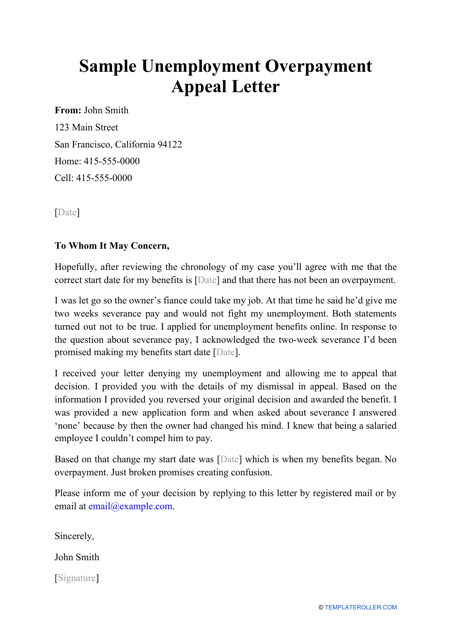

A benefit overpayment is when you receive an unemployment disability or Paid Family Leave benefit you are not eligible for. Overpayment of unemployment benefits MKO. This waiver may be able to help you avoid paying your full or partial balance of the benefits you received.

Bankruptcy Law And Overpaid Unemployment Benefits Nothing in bankruptcy law exempts overpayments from discharge. If you were in fact overpaid from the unemployment office you can ask your state unemployment office for a waiver. Updated on June 09 2021.

Overpayment Waiver - The overpayment waiver request form is only available for PUA PEUC FPUC MEUC and LWA overpayments. Common reasons for an overpayment include. The Treasury Offset Program TOP is a federal program that collects past due debts owed to federal and state agencies by capturing IRS tax refunds to offset these debts.

Unemployment overpayment is dischargeable. A claimant does not report wages or underreports wages when filing a weekly claim and later information is received with the corrected wages. It is important to repay this benefit overpayment as soon as possible to avoid collection and legal action.

This article covers the basic information concerning what to do if you receive an overpayment determination monetary penalties and the CARES Act unemployment benefit program. An overpayment or improper payment occurs if you are paid unemployment benefit payments and DUA later determines that you were not eligible to receive them. The Delaware Division of Unemployment Insurance is pleased to offer repayment of your UI overpayment balance on-line.

If benefits were paid to you in error you will receive a notice stating the amount you were overpaid and. A claimant does not report or underreports wages or pension benefits when filing a weekly claim and later information is received with the. Dedicated Unemployment Overpayment Appeal Lawyers The Pennsylvania Unemployment Department has been sending employers various unsolicited notices requesting that they report former employees to places such as RefusalofWorkpagov.

Only a small fraction of overpayments are due to fraud. You incorrectly reported your wages when certifying for benefits and were overpaid. The state overpaid roughly 96 million in unemployment benefits between January and September of last year or about 2 of all the benefits paid out.

If you receive any Unemployment Insurance benefits to which you are not entitled you will be required to return those benefits. The state began garnishing wages and putting liens on.

Paul Rutherford On Twitter Working People Unemployment Worker

Thousands Of Gig Workers Can Appeal After Being Asked To Pay Back Overpayment Of Unemployment Benefits Cbs Denver

Overpayment Information Nh Unemployment Benefits

Overpayment Of Unemployment Benefits Should I Give It Back As Com

Overpayment Information Nh Unemployment Benefits

Dbl State Disability Claim Packet Ny Sny9457 Pdf Disability Benefit Templates Disability

Unemployment Benefits Overpayment Waiver Connecticut House Democrats

Missouri Bill Aims To Forgive Unemployment Overpayments

Sample Unemployment Overpayment Appeal Letter Download Printable Pdf Templateroller

How To Fix Bank Paycheck And Government Overpayment Errors Ways To Save Money Paycheck Investing Money

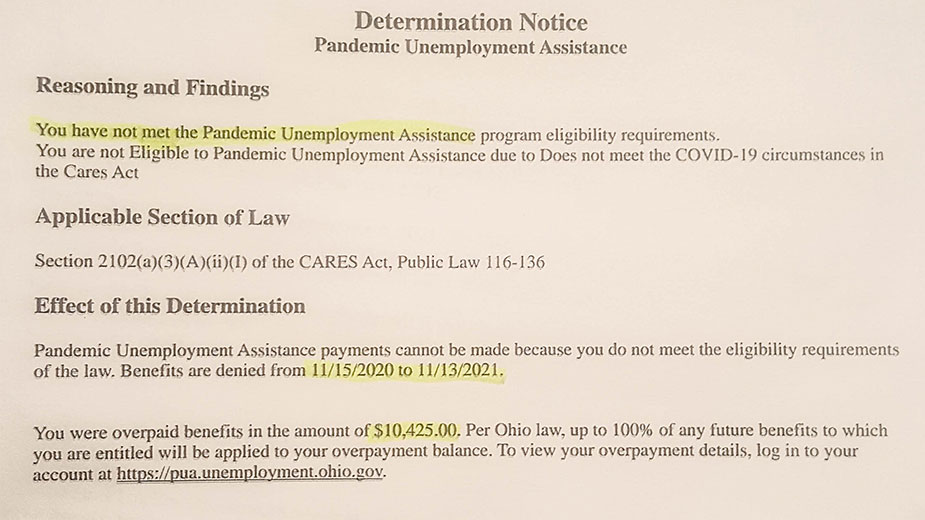

Ohioans Can Now Apply To Keep Overpayment Of Unemployment Benefits

Do You Owe Odjfs Because Of A Pandemic Unemployment Assistance Overpayment Loveland Magazine

Waivers Now Available For Pandemic Unemployment Overpayments Business Journal Daily The Youngstown Publishing Company

No comments:

Post a Comment