1 Applying the base period of a single state law to a claim involving the combining of an individuals wages and employment covered under two or more state unemployment compensation laws and 2 Avoiding the duplicate use of wages and employment by reason of such combining. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19.

Covid 19 Unemployment Benefits Hamilton Ryker

Axios reported the development on Sunday.

Ohio unemployment laws. You must be actively looking for a job and keeping a record of your job search. Ohio Unemployment Extension EUC08 Tier 3. Report it by calling toll-free.

Only employees who have lost their jobs through no fault of their own can claim unemployment benefits in Ohio. The unemployment benefit amount is based on the number of dependents helping workers with children spouse. Governor DeWine was well within his authority under Ohio law to opt-out of the extended pandemic benefits which were slowing Ohios economic recovery Candy Bowling of Hamilton County sued the state after DeWine ended the program June 26 saying a state law enacted in the 1930s required the governor to accept every federal dollar offered regardless of.

Under the usual rules employees who have quit their jobs or been fired are not entitled to claim unemployment benefits. Get The Ohio Unemployment Compensation Law Books now. Ohio Unemployment Extension EUC08 Tier 1.

Ohio labor laws require employers to provide employees under the age of eighteen 18 a 30-minute uninterrupted break when working more than five 5 consecutive hours. Ohio House Bill 197. A Lawyer Will Answer in Minutes.

Eligibility for Ohio unemployment how to apply for benefits in Ohio how much you can expect to receive each week what requirements youll need to meet to keep getting benefits and how to file an appeal if your application to the Ohio Unemployment Compensation Review Commission for benefits is denied. Apply for Unemployment Now Employee 1099 Employee Employer. Ohio does not require employers to provide breaks including lunch breaks for workers eighteen 18 years old or older.

Heres a rundown of the changes. 3 Unemployment Insurance Tax 7 Reporting Requirements Submit wage report quarterly even if there are no employees Due Dates 1st Quarter April 30 2nd Quarter July 31 3rd Quarter October 31 4th Quarter January 31 Note. An extension for people already receiving unemployment benefits.

Ohio Labor Laws -. Between March 2010 and August 2010 the unemployment rate fell from eleven percent to ten point three percent. Ask an Employment Lawyer - On-Demand Lawyers Answer ASAP.

Partially unemployed UC applicants who are working less than full-time may also be eligible for benefits. G In accordance with section 303c3 of the Social Security Act and section 3304a17 of the Internal Revenue Code of 1954 for continuing certification of Ohio unemployment compensation laws for administrative grants and for tax credits any interest required to be paid on advances under Title XII of the Social Security Act shall be paid in a timely manner and shall not be paid. Answers to your questions about Unemployment Law in Holmes County OH.

Ohio Unemployment Extension EUC08 Tier 5. Automatic additional payments of 300 per week to everyone qualified for unemployment benefits. Questions Answered Every 9 Seconds.

Unlike other instances of unemployment data this does not appear to be a case of individuals ceasing to be eligible. Though under the law there is no requirement to do so. There are no federal or state laws in Ohio that require any paid time off.

Ohio unemployment compensation claims are showing a general trend towards diminishing. The basics of right-to-work laws in Ohio which limits the ability of employers to give preference to either union or non-union workers when hiring employees. This chart will help you determine the dependency class you belong to.

Anderson Company published by Unknown which was released on 1947. Family and Medical Leave. Download or read online The Ohio Unemployment Compensation Law written by OhioOhio Bureau of Unemployment CompensationWH.

Note that however claiming benefits for unemployment in OH is not an option for all former workers. OH Statute 410907 C. Available in PDF ePub and Kindle.

Ohio Unemployment Extension Extended Benefits EB Ohio Unemployment Fraud Penalties. Ohio Unemployment Extension EUC08 Tier 2. Jury duty and voting leave are also included in unpaid time off requirements under state and federal law.

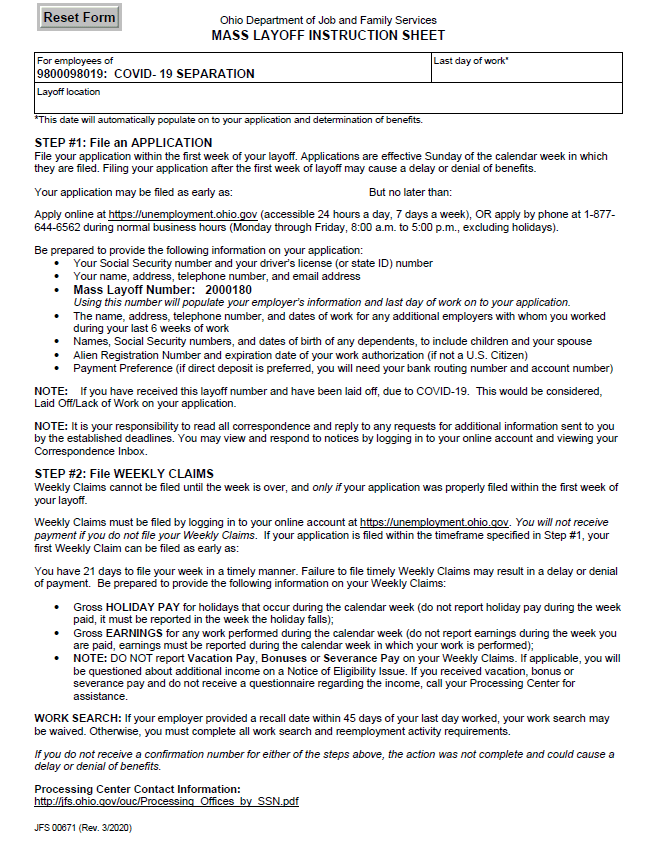

What are the requirements for unemployment in Ohio. Ohio Civil Rights Laws Ohio laws protecting the civil rights of its residents including the code sections with information about court procedures and links to related information and resources. By state law the Ohio Department of Job and Family Services ODJFS had 21 days to either decide on the appeal or transfer the appeal to the unemployment compensation review commission.

Extension of the Pandemic Unemployment Assistance PUA program for. Employers are required to extend unpaid work leave for reasons like medical family military and other types of leave. In order to receive unemployment benefits in Ohio you must follow these rules.

If the due date falls on a weekend or holiday the quarterly report is due the next business day. The State of Ohio has a special law which grants different unemployment eligibility benefits to unemployed personnel based on the number of dependents. Extending the validity of state issued licenses including drivers licenses codifying the removal of work search requirements and the waiting week for unemployment compensation.

You must be able to work and are not disabled. Ohio Will Pay Back Billions In Federal Funds Used For Unemployment Using Federal Coronavirus Relief Funds Ohio Capital Journal 9221 Out of work Ohioans are no longer given an extra 300 a week in federal unemployment benefits starting June 26. Ohio Unemployment Extension EUC08 Tier 4.

Unemployment Compensation For Low Paid Workers

Coronavirus Covid 19 And Your Employment Everything You Need To Know

Worker S Guide To Unemployment Compensation Ohio Gov Official Website Of The State Of Ohio

Covid 19 Unemployment Benefits Hamilton Ryker

![]()

What You Should Know About Unemployment Compensation

Ohio Federal Labor Law Posters

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Labor Law Poster Poster Compliance Center

Free Ohio Unemployment Compensation Labor Law Poster 2022

No comments:

Post a Comment