This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits. You can only get 20 weeks of unemployment benefits in a benefit year.

Michigan Ends Extended Benefits And Pandemic Unemployment Assistance Benefits

Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of wheter you find a job stop.

Michigan unemployment benefit year. Applicants must have wages in at least two calendar quarters in the base period. If you are eligible to receive unemployment your weekly benefit in Michigan will be 41 of what you earned during the highest paid quarter of the base period. Michigan only allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of if you find a job stop benefits and need to reapply later on in the year.

Applicants must have wages in at least two calendar quarters in the base period. What is a benefit year. 4 end date applies even if a claimant has benefit weeks remaining on their claim.

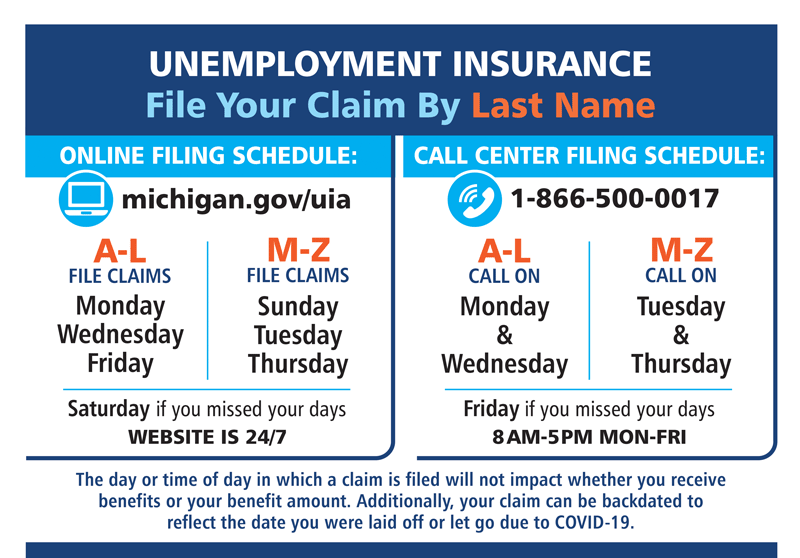

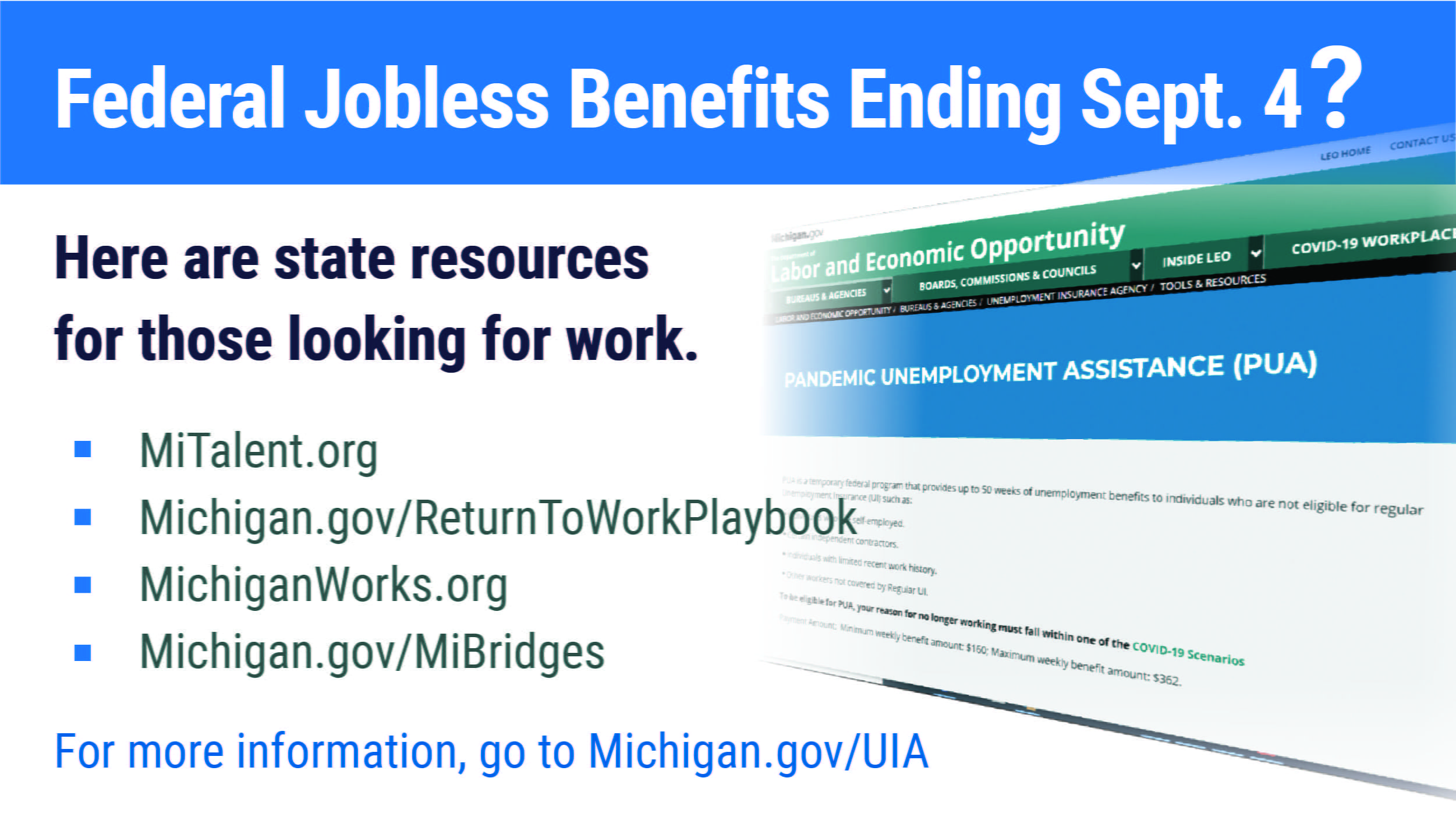

Benefit amount - 160 - 362. Visit the UIA website at MichigangovUIA for more information about Work Registration. The UIA defines your benefit year as the 52 consecutive weeks that start when you file an unemployment claim if you qualify for unemployment.

In claiming benefits for unemployment if the UI beneficiary cannot meet the first three wage tests in either the regular base period or the alternate base period the Michigan law permits an alternate earnings qualifier which requires candidates to satisfy two wage tests. You can also receive an allowance of 6 per week per dependent up to 30. The tax is only charged on the first 9000 per year an employee earns with the employer and ranges from 06 to 103 and is based on the history of that employer.

In claiming benefits for unemployment if the UI beneficiary cannot meet the first three wage tests in either the regular base period or the alternate base period the Michigan law permits an alternate earnings qualifier which requires candidates to satisfy two wage tests. This is your benefit year. Unemployment benefits are paid out of the trust fund.

The weeks you get benefits are called benefit weeks. For a list of local Michigan Works. I was laid off on March 202008 and was paid severance every two weeks for 8 months ending Nov 20 2008.

Program expired on Sept. Your benefits year is. A benefit year ends one year from the effective date of the claim.

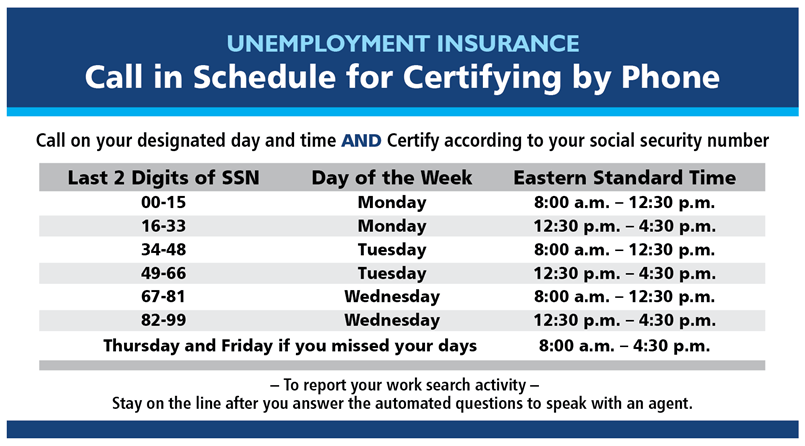

After the first certification which is done during the third week of unemployment they will receive their payment in about 2-3 days but can vary depending on circumstances. Claimants must certify report every two weeks that they are eligible for benefits. What happens after I certify for unemployment Michigan.

The most you can receive per week is currently 362. It ends the Saturday one year later. Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of wheter you find a job stop benefits and need to reapply later on in the year.

To qualify for unemployment benefits we look at the wages you were paid in the first four of the last five calendar quarters the standard base period. A person can also qualify using the Alternate Earnings Qualifier. Michigan like all other states charges employers a tax to cover unemployment benefits.

And the base period wages are. Work registration is required with every new benefit year. A person must earn at least one and a half times the highest amount of wages paid in any quarter of the base period.

And b total wages for all four quarters must equal at least one and a half times the highest amount of wages paid in any quarter of the base. This year they have decided that anyone receiving a 1099-G aka unemployment cant use the free version and now has to pay 39 dollars per tax. Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of wheter you find a job stop benefits and need to reapply later on in the year.

A For benefit years beginning 162008 through 132009 you must have wages in at least two quarters in your base period. And the base period wages are. In one quarter your wages must be at least 2774.

My Michigan unemployment benefit year ended on Nov 21 2009 and my claim for an extention period was denied due to reference code 2 which states earnings do not equal at least 5 times the most recent weekly benefit amount on last claim. The benefit year starts the Sunday of the week you file. This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits.

A benefit year is the 52 week period following the date you file your claim. A claim is established for 52 weeks from the week you file it. The 52 consecutive calendar weeks beginning with the first calendar week in which the claimant files an application for unemployment benefits.

The maximum number of weeks of benefits you can receive in. The maximum amount of unemployment is 362 a week. This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits.

Unused benefit entitlement may not be used to pay benefits more than 156 weeks 3 years after the week the claim began. Michigan only allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of if you find a job stop benefits and need to reapply later on in the year. Also the worker cannot use preserved unused benefit entitlement to set up a claim if the worker has enough base period wages to set up a claim without using preserved unused benefit entitlement.

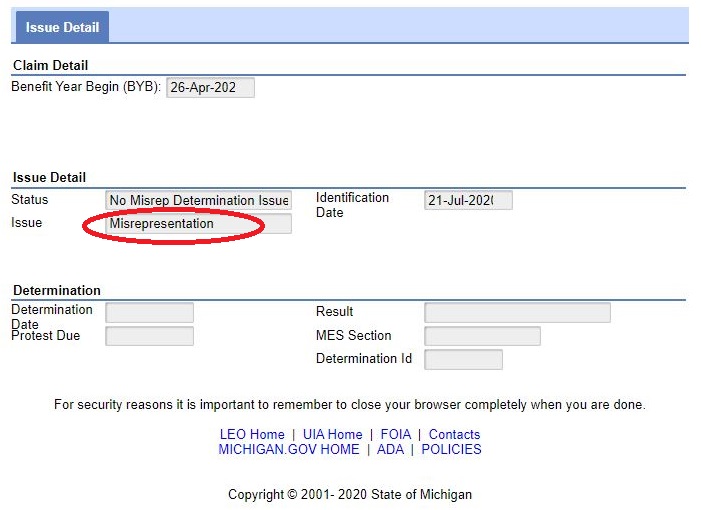

A claimants work registration is valid for one year after their initial claim for unemployment benefits. A chargeable employer may protest a claim filed after October 1 2014 to establish a successive benefit year under section 46c if there was a determination by the unemployment agency or decision of a court or administrative tribunal finding that the claimant made a false statement made a misrepresentation or concealed material information. What does additional claim mean.

Amount and Duration of Unemployment Benefits in Michigan. This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits.

What Does Michigan Uia Misrepresentation No Misrep Determination Issued Mean Michigan Unemployment Help Career Purgatory

Unemployment Resources Aft Michigan

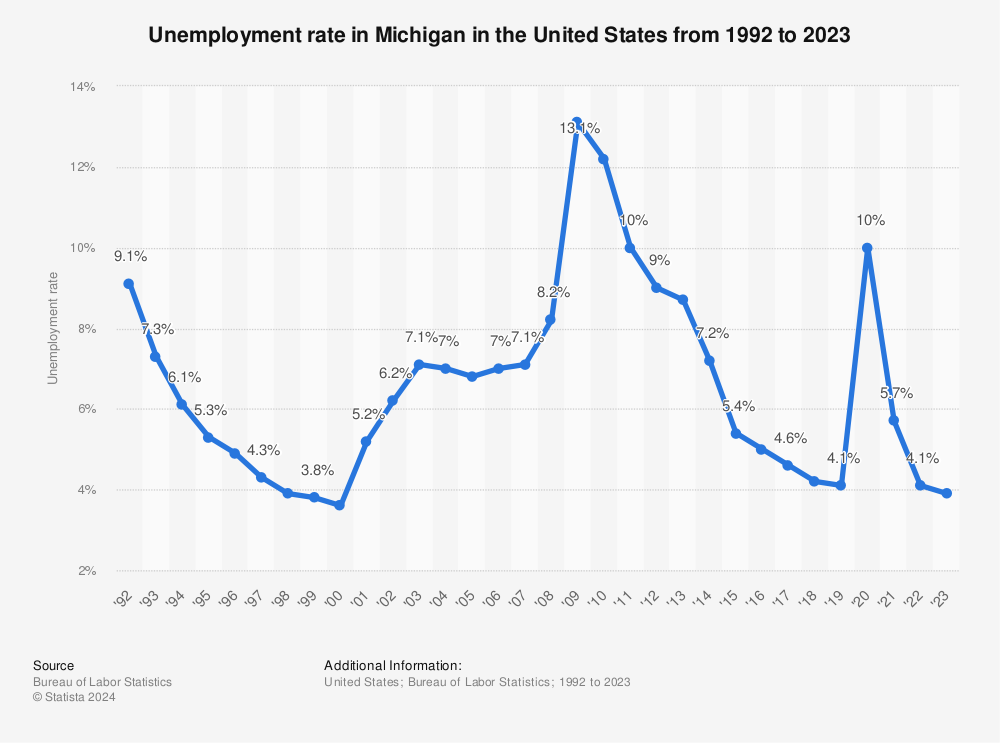

Michigan Unemployment Rate 2020 Statista

Michigan Unemployment Know Your Rights Aboutunemployment Org

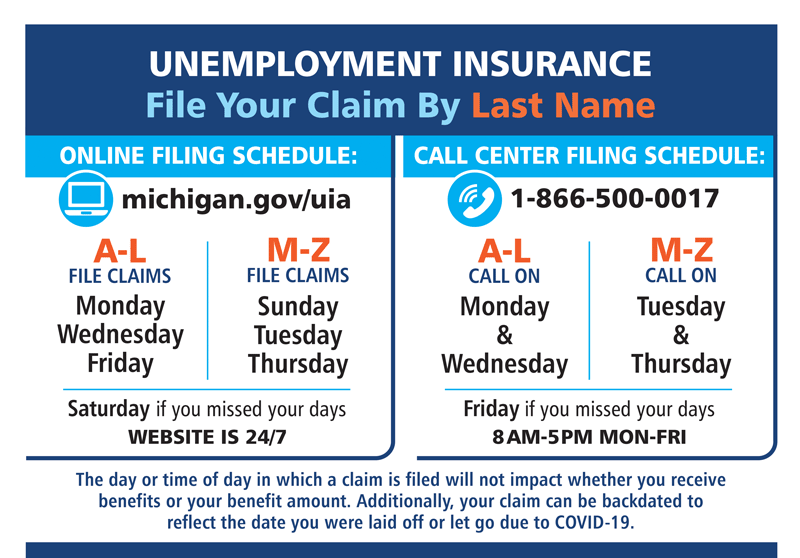

Covid 19 Jobseeker Michigan Works Southeast

Base Period Calculator Determine Your Base Period For Ui Benefits

Up To 59 Weeks Of Extended Unemployment Benefits Announced For Michigan

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity How To Certify For Benefits

Coronavirus Uia Update Michigan Activates Federal Extended Benefits

Labor And Economic Opportunity Federal Benefits Update

How Unemployment Benefits Are Calculated By State Bench Accounting

No comments:

Post a Comment