Michigans online unemployment system crashed Monday after the site began processing claims for low-wage and self-employed workers amid record-setting filings due to hardships spurred by the. To Vickys Management.

Michigan Unemployment Agency Paid Out 3 9 Billion In Improper Benefits To Ineligible Claimants Audit Says Mlive Com

Only to get a response 4 12 hours later spend 5 minutes with 1 of the 4 ladies working to find that you didnt get paid because of a GLITCH ARE YOU KIDDING ME.

Michigan unemployment glitch. When you call as soon as your are connected the recording will say welcome to the state of michigan press 91110 like you were trying to win a radio call in contest and if the message says anything other then given high call volume HANG UP and try again. Heard from a number of folks after I wrote about the Oxford Township man who over the course of the past year had received a crap ton of letters from the Michigan Unemployment Insurance folks. Although it did not come online until 2013 the State of Michigan used an error-prone computer system that has wrongly accused tens of thousands of people of unemployment insurance fraud to assess.

In one such case because of the glitch a fictional Kimberly Kardashian was able to file from an address in Traverse City and within two days get eight weeks of backdated unemployment pay more than 7000 before the states fraud management software flagged the claim as needing additional identity verification. The busiest times to call are on Monday and mornings. The Program works with judges courts lawyers bar associations nonprofit legal aid agencies legal self-help centers libraries and many others to promote coordinated and quality assistance for persons representing themselves in civil legal matters in Michigan.

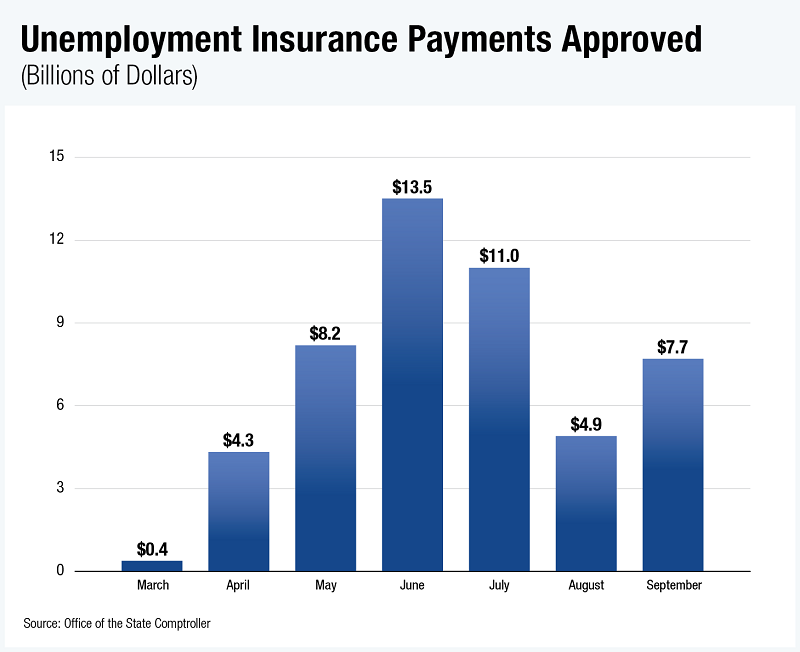

Over 17 million applicants push Michigan unemployment system to the brink. Many of the people who waited months for payments as UIA was overwhelmed with applicants now find themselves wondering once again if their next payments could be in jeopardy. Michigan has been approved for three more weeks of funding through the federal Lost Wages Assistance benefit program.

A second round of 300 in additional weekly jobless benefits should reach laid-off Michigan workers before the end of month while the state continues to fix glitches in its unemployment system and investigate fraud. 29 -- Michigan paid 85B in fraudulent COVID unemployment claims Copyright 2022 by WDIV ClickOnDetroit - All. The state of Michigan paid up to 85 billion in fraudulent unemployment assistance claims during the pandemic a new audit has found.

For those who didnt read last weeks Dont Rush Me shame on you let me recap. You can call the UIA at 1-866-500-0017. Michigan has been approved for three more weeks of funding through the federal Lost Wages Assistance benefit program.

Gretchen Whitmer cares deeply and help is on the way state officials. 400K unemployment claims now flagged in Michigan fraud investigation. While some speculate that the issue is a glitch in the unemployment system affected individuals say they are unable to phone into the UIA to resolve the possible mistake.

But again I just now glanced over it. Will stay tunedreply as I re read. The Michigan Unemployment system is SO JACKED UP that if you hire people like this when there are 300 others sitting there PRAYING for work.

LANSING Records obtained by the Free Press point to a major glitch in importing data into a 47-million computer system the Unemployment Insurance Agency used to detect claimant fraud meaning. A second round of 300 in additional weekly jobless benefits should reach laid-off Michigan workers before the end of month while the state continues to fix glitches in its unemployment system and investigate fraud. Gretchen Whitmer cares deeply and help is on the way state officials.

Michigan mistake means up to 650000 could be forced to repay unemployment benefits. The Michigan Legal Help website and affiliated local self-help centers are part of the Michigan Legal Help Program. Whats up with unemployment claims.

Michigan I just glanced over the correspondence and it looks like they added the 4 new options at some point and they are just covering their bases to be sure we didnt qualify under THOSE options. Took me 30 calls yesterday each call lasting only 5 to 7 seconds before I hung up and tried again. Rachel Kirkbride a mother and Battle Creek resident.

5 -- Michigan unemployment agency flags 10K claims for fraud over holidays Dec. A new problem is keeping more Michigan residents from getting their unemployment checks and this time it has nothing to do with a computer glitch. State officials said fraud investigations along with glitches in the system are delaying payments to people out of work during the pandemic.

On a daily basis Estlund Olson said over 60 of. An unemployed worker looks at the State of Michigan unemployment site Wednesday April 29 2020 in Detroit. Michigans unemployment claims ending March 28 topped 311000 more than doubling from 128000 the week before.

Michigans unemployment claims ending March 28 topped 311000 more than doubling from 128000 the week before. Atop three weeks that. The report prepared by Deloitte Touche found that Michigans Unemployment Insurance Agency paid an estimated 84 billion to 851 billion in potentially fraudulent claims from March 1 2020 to Sept.