If you received unemployment benefits this year you will receive a Form 1099-G in the mail. Deferments are basically a pause button for your loan giving you time off from making payments so you can build up funds find a better job renegotiate for a higher salary and establish some savings.

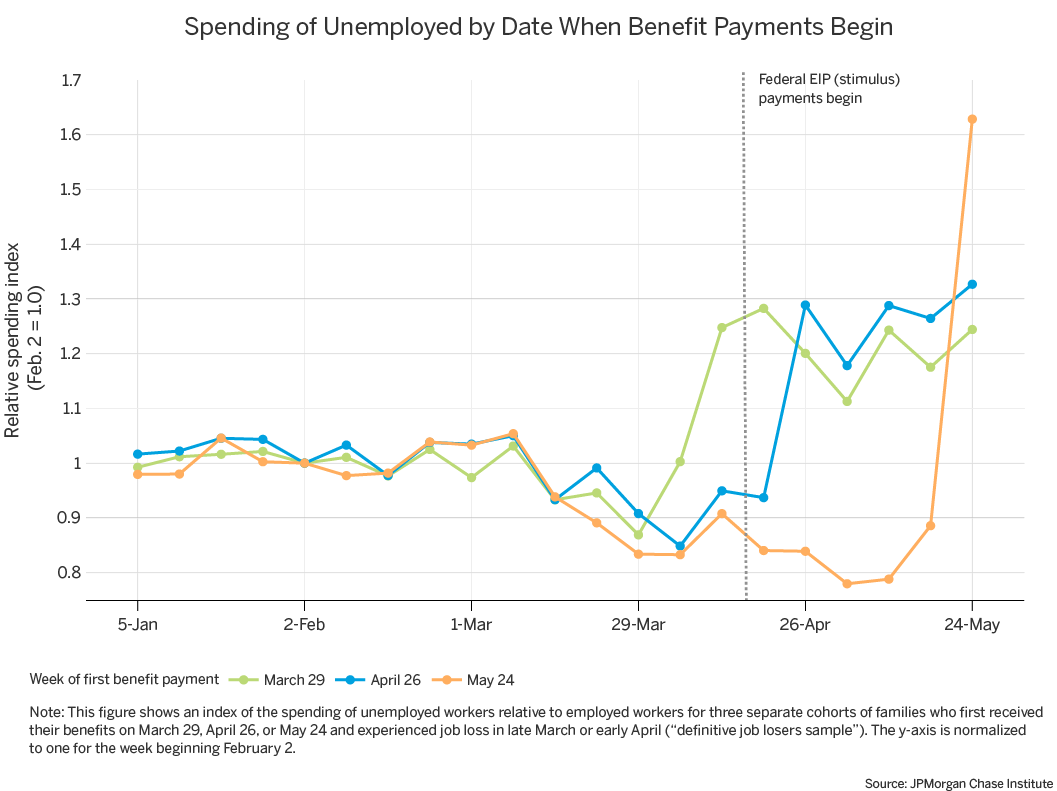

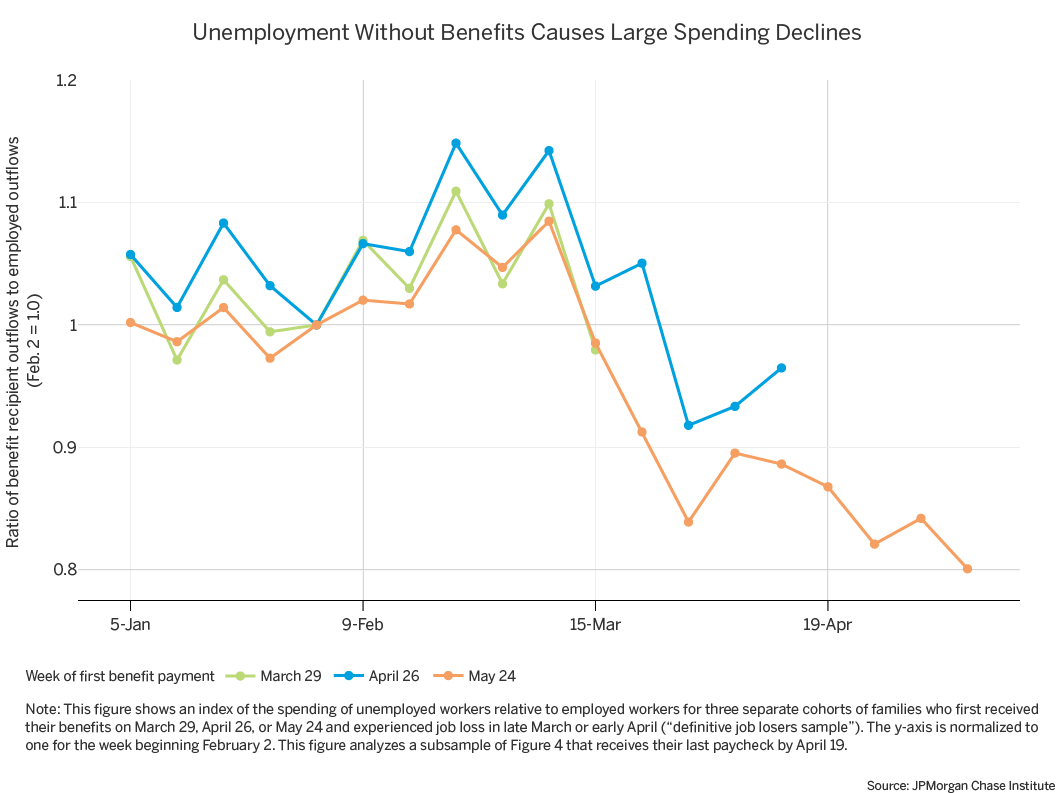

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Every state has unique requirements for these benefits which is why you need to check your local options.

Unemployment benefits guide debt relief program. Extension of tax filing deadlines. As part of the recent American Rescue Plan Act of 2021 you may be. Extended guidelines are expected to.

Take a look at the following link if you are seeking debt relief for your familys future. Follow our short survival guide for help with your out of control credit card debt. Kentuckys new unemployment insurance overpayment waiver is supposed to offer some relief to people who were mistakenly overpaid benefits but many who owe money are excluded from even asking.

Of those 311 went on to consolidate their debt with our help through a debt management program the average amount of debt enrolled was 12798. The 19 trillion stimulus package included stimulus checks tax credits housing assistance extended unemployment benefits and more help for small businesses. The Unemployment Benefits Guide is a directory of resources provided by state or federal governments and is in no way affiliated with endorsed or sponsored by the federal government any other governmental body or any private entity offering similar benefits.

These benefits can be helpful to minimize the amount of debt you accrue during this time of unemployment. Department of Health and Human Services HHS which has more than 300 grant programs that can help with hospital bills and medical costs. A number of public assistance programs are available.

The others received a free debt analysis and complementary budget evaluation and they were directed to the right. There are several different approaches to paying your bills when you find yourself unemployed but it definitely makes more sense to seek out your debt relief by legal methods. Those who did not enroll received a free.

President Biden signed into law the American Rescue Plan March 11 2021 providing more relief for Americans struggling through the Covid-19 pandemic. There are way too many people that have recently become unemployed due to our great recessionary times but they still have debt that must be paid. Credit cards can be helpful to get through times of decreased income such as while receiving unemployment benefits.

The new relief bill extends this program from up to 24 weeks to up to 53 weeks lasting through Sept. Unemployment benefits are considered taxable income. Small Business Debt Relief Program.

The Unemployment Insurance UI program is a federal assistance program that offers financial aid to displaced workers who have lost employment through no fault of their own. Small Business Debt Relief Program providing immediate relief to small businesses with. It also extends the federal pandemic unemployment compensation program which supplements unemployment benefits with an additional 300 per week until September 6 2021.

The federal government has more than 1000 benefits programs available to in their times of need. The American Rescue Plan breathes new life into temporary federal unemployment programs established under the CARES Act in March 2020 including the Pandemic Unemployment Assistance program which provides benefits to gig workers. Administered on a state level this program helps to ease some of the burdens that workers may be.

This program provides benefits for people who max out their regular unemployment compensation. Department of Labor has granted states more flexibility to provide benefits to people affected. Guide to Federal State and Local Resources and Actions.

In 2020 Consolidated Credit provided free credit counseling services to 21296 New York residents. The Student Loan Unemployment Deferment Program can be a life saver if youre having trouble making your monthly payments and this program remains fully-funded for 2016. Church and charity groups.

And there is a debt relief program for businesses. This form will tell you how much money to report on your tax return. The Pandemic Unemployment Assistance program also extends benefits to gig workers and freelancers as well as contractors and other self.

How Consolidated Credit helps Arizona residents find debt relief. Additional 600 per week in unemployment benefits and an expansion covering part-time workers gig workers self-employed workers and contractors. The new relief plan signed by President Biden on Thursday bolsters coronavirus unemployment programs for millions of unemployed Americans.

How Consolidated Credit helps New Yorkers find debt relief. Debt settlement is one of the most efficient ways to get your debt knocked down before letting it knock you down. Beneficiaries can have their funds automatically deposited onto their debit card as long as they continue to meet the eligibility requirements for the program and file their unemployment claims in a timely manner.

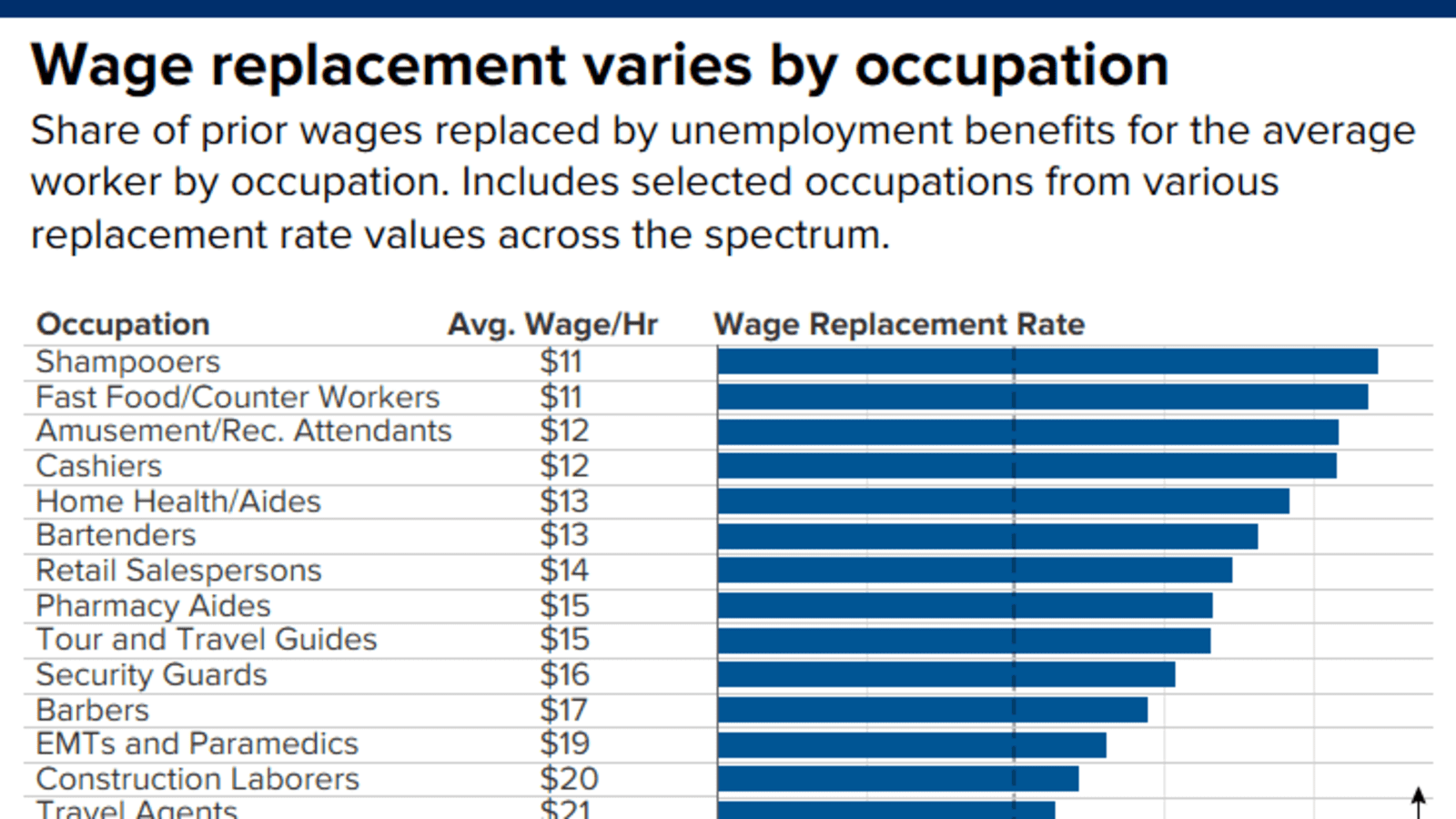

Allows workers who do not have a long enough work history to receive unemployment benefits. In most cases the benefit covers 50 or less of typical pay. How are unemployment insurance benefits taxed.

Pandemic Unemployment Benefits. Seeking Credit Card Debt Relief. Online Application for Unemployment.

Depending on where you live you might have the option to apply for unemployment online. Of those 1301 went on to consolidate their debt with our help through a debt management program. Consolidated Credit has provided free credit counseling services to 5037 credit users in the state of Arizona in 2020.

The CARES Act aims to increase subsidies to nearly 100 of lost wages by increasing payouts for most applicants by 600 per week for up to four months in addition to the state allotments. The state legislature first created the waiver program in March after. However the program is administered with the cooperation of state governments.

Every state uses a different formula to calculate benefits. Changes to tax filing for businesses. Unemployment benefits are payments made by the government to eligible unemployed persons.

Federal unemployment benefits have been renewed though they have been reduced to just 300 a week for 11 weeks in addition to the unemployment benefits offered by your state. However program participants should be aware of the potential disadvantages of using an unemployment debit card. Unemployment Debt Waiver Only Available To Those Ky.

A loan program that allows business owners to borrow up to 5 million who do not qualify for credit elsewhere. Unemployment benefits are meant to help people who are out of work through no fault of their own by maintaining a portion of their income until theyre able to find work again. Each state handles its own unemployment claims in compliance with federal law so the US.

The Unemployment Insurance Program was established by the federal government in 1935 and operates under guidelines established by federal law. A new coronavirus relief package signed into law Thursday extends unemployment benefits for self-employed workers. We produced a guide to COVID-19 debt relief programs to help you through the pandemic.

As such you must report and pay taxes on unemployment benefits as though they were wages. Directs 130 billion to hospitals and dramatically expands unemployment benefits allowing self. One thing that they need is debt relief.

What Are Unemployment Benefits.

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

These 33 States Are Still Offering 300 Lwa In Unemployment Benefits Forbes Advisor

New Federal Unemployment Benefits On The Way Nextadvisor With Time

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

Consumption Effects Of Unemployment Insurance During The Covid 19 Pandemic

It Pays To Stay Unemployed That Might Be A Good Thing

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Why Unemployment Benefits Fraud Jumped Nearly 3 000 Last Year Forbes Advisor

No comments:

Post a Comment