How do I find Payers federal id number for NJ unemployment if its not on the 1099-G. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

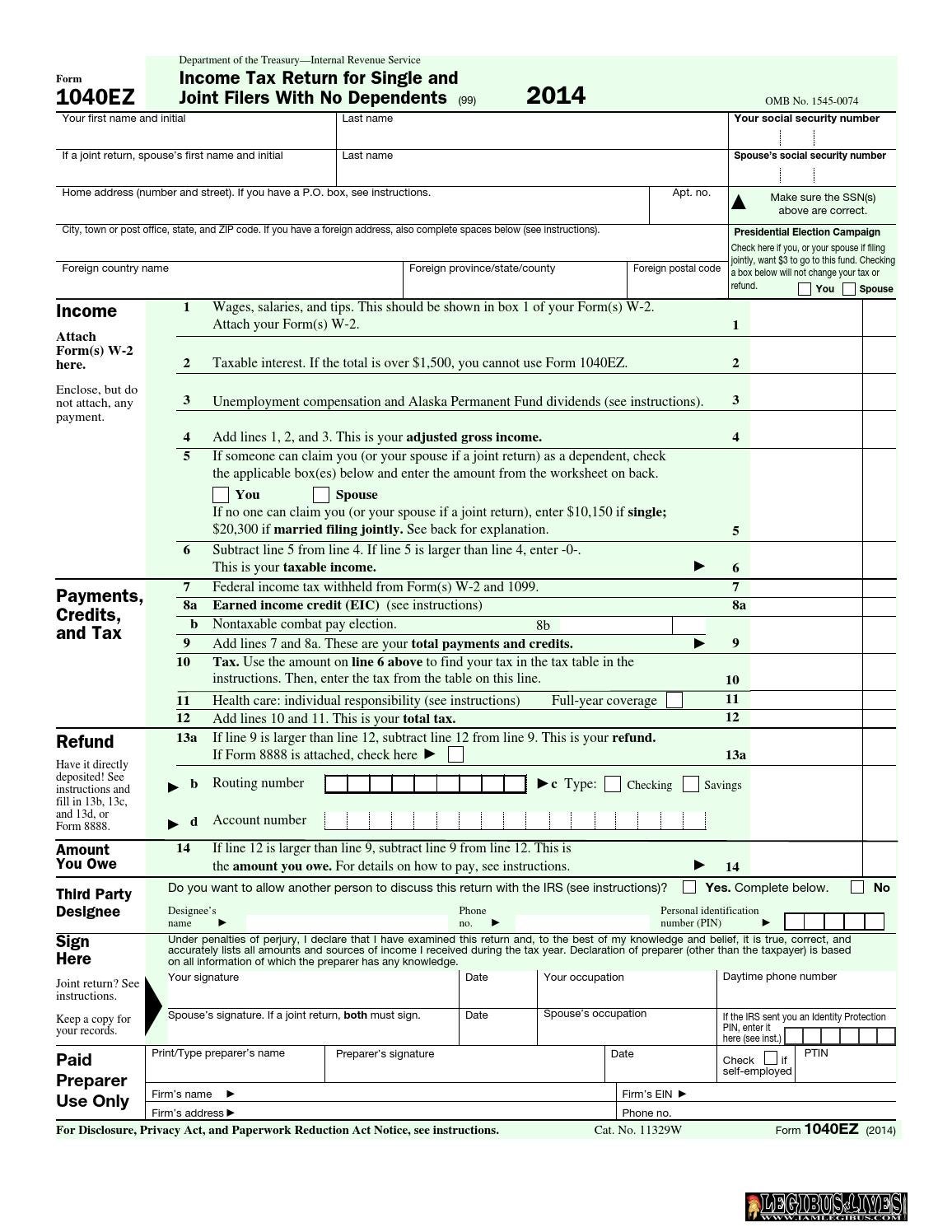

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on.

Nj unemployment g1099. Get Tax Forms 1099-G. Temporary Disability benefits and Unemployment Insurance benefits. Is there anything else the Accountant should know before I connect you.

Your Rights. If you need health insurance you or your family may be eligible for free or low-cost coverage from NJ FamilyCare. However the form will no longer be automatically mailed.

Federal income tax withheld from unemployment benefits if any. We provide the IRS with a copy of this information. How to File for New Jersey Extended Unemployment Benefits.

Disability During Unemployment Insurance benefits. Independent contractors do not receive such protections. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on.

The Accountant can help you get a copy of your 1099. Reopen an Existing Claim. Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view.

A 1099-G from the New Jersey Division of Taxation reflects in Box 2 the State taxes you overpaid through withholdings State tax payments or credits during the tax year which was then refunded to you. View the Current Schedule for Claiming Weekly Benefits. What to look for.

How To Get My W2 From Unemployment Nj. Unemployment Insurance benefits recipients will now have two options. Family Leave During Unemployment Insurance benefits.

Please use the link below to contact the Department of Labor and Workforce Development to obtain this number. NEW JERSEY Unemployment 1099-G Tax situation New Jersey Question So I received my 1099-G by email the other day and it says I received over 17000 in unemployment compensation and none of it was withheld. Here in NJ unemployment benefits are not taxable but for federal unemployment benefits are considered income and need to be reported on our 2020 taxes.

State of NJ is coming into the future. How To Get My W2 From Unemployment Nj. It looks like they have started to email the form 1099-G to some taxpayers.

Contact for New Jersey Division. You dont need to include a copy of the form with your income tax return. This information is also sent to the IRS.

Rest assured that theyll be able to help you. Individuals who collect these benefits will receive a 1099 form directly from the Department of Labor and Workforce Development listing the taxable income and any withholding. Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits.

File an initial unemployment claim in the State of New Jersey. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Certify for Weekly Benefits.

That is why its so important to make sure workers are properly classified. Form 1099-G Certain Government Payments is a report of income paid to you by a government agency. After each calendar year during which you get Unemployment Insurance benefits we will provide you with a 1099-G form that shows the amount of benefits you received and taxes withheld.

States report compensation to the individual and to the IRS by using the Form 1099-G. If your employer issued you a 1099 instead of a W-2 that alone does not mean that you are properly classified. Employees are protected by many labor laws in New Jersey including the Unemployment Compensation Law.

Google Translate is an online service for which the user pays nothing to obtain a purported language translation. You need to log in to your account to download a 1099-G form for your 2021 tax return if you received any of the following benefits in 2021. You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly.

Unemployment compensation is taxable although Congress waived the tax for 2020 for many people. If you received Unemployment Insurance benefits the New Jersey Department of Labor and Workforce Development LWD will provide you with Income Tax Form 1099-G Certain Government Payments. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments.

It was a little bit unintuitive to make it to the PDF. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

Filing your 2020 taxes. It wasnt all that difficult but I was a bit confused as I had done it every year and things seemed to be broken. You will need to give personal information besides information on your previous employment.

We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment. If You Already Filed a Claim. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately.

The Internal Revenue Service IRS requires. Family Leave Insurance benefits. The subject will say.

Unemployment After Disability. I need info on my 1099-G form from NJ Unemployment. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

For more information on health insurance options and to see if you qualify for financial help to lower the cost of a plan visit Get Covered New Jersey. File online or in telephone at the State of New Jersey Department of Labor and Workforce Development. Because of fraud and identity theft many taxpayers received Forms 1099-G for compensation they were not paid.

Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

.jpg)

Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

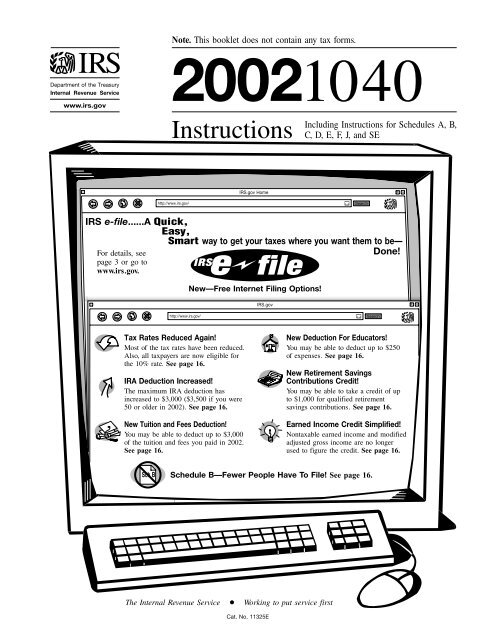

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

U S Income Tax Return For Single And Joint Filers With No Dependents Forms Instructions Tax Table By Legibus Inc Issuu

How To Get Your 1099 G From Unemployment Unemploymentinfo Com

Is Unemployment Taxable A Guide To Unemployment Taxes Benzinga

1099 Form Fileunemployment Org

Is Unemployment Taxable A Guide To Unemployment Taxes Benzinga

15 Lessons I Ve Learned From Formal Invitation Letter Template For Event Forma Event Forma Formal Invitation Ive Learned Lessons Letter Temp Kutipan

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Download 1553 1099 Images For Free

Instructions For Form 1040 Uncle Fed S Tax Board

No comments:

Post a Comment