Hundreds of thousands of New Jersey workers are coming up on a grim milestone. The Labor Department said it would automatically transition those people to.

Its not a glitch so do not open a new claim.

Nj unemployment 1 year. I made a claim in September of last year and Im still having issues getting payments. NJ combines any new earnings during your benefit year with any earnings from your previous employer not used in the base-year for your first claim - in this case 1231119500 - and calculates eligibility and benefits from those two sets of earnings. Ive never even received any UI benefit but been getting the benefit year glitch since I first filed UI.

States generally calculate the amount of ones weekly unemployment benefits based on work history over the past 12 to 18 months. Then after that is a 20 week extension that is available when NJs unemployment rate is over 5 which it is. The numbers mask the individual pain involved but the latest news from the labor department brings a chink in the clouds.

Showing 1 - 10 of 4739 - Page 1 of 474. Workers are eligible for that weekly. New Jerseys fiscal year for SUI tax rating purposes is July 1 through June 30.

New unemployment claims in the state declined last week to 10384 their lowest level in 52 weeks. For the week ending Feb. Questions about working freelance 1099 contracts w existing claim Unemployment 7 replies Collecting federal extension benefits for old claim but got approved for new year claim Unemployment 1 replies Break In Claim Form Question Existing Claim Unemployment 8 replies.

In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. On July 1 of each year. Your unemployment claim remains valid for one year from the date it is filed unless you exhaust benefits sooner.

Federal law requires a review of unemployment claims after one year for benefits to continue. When you first file for unemployment benefits you have an end date for your claim which stays open for a year or 52 weeks. Federal law requires a review for new wages after one year.

Your unemployment claim remains valid for one year from the date it is filed unless you exhaust benefits sooner. When your regular UI runs out theres PEUC which is a 13 week extension however it ends on 1226 unless a new stimulus package is passed that extends it. Get out your original monetary determination letter.

EY Tax Alert 2021-0395 2-19-2021 AB 4853 prevents moving to a higher SUI rate schedule over the next three fiscal years something that had been anticipated due to a reduction in the states UI trust fund from COVID-19 UI benefit payouts. Federal New Jersey Pennsylvania 725 effective 72409 1200 effective 1121 725 effective 72409 The maximum employee pretax con-tribution remains at 19500. 12th 2021 according to this article.

NJ will use wages from your first employer not used in the base-year earnings for the first claim plus your part-time earnings. All states New Weekly unemployment claims come in much higher than expected at 286000 a sign that omicron may be weighing on the economy and causing unemployment to rise Weekly unemployment claims shoot up to 286000. Unemployment benefit year.

Recent NJ Unemployment Issues Reported to GetHuman by Other Users. Additionally on July 1 2020 New Jerseys high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits if they meet among other requirements the minimum earnings. 27 New Jersey recorded 392 fewer new unemployment filings compared with the previous week a 35 decrease.

The effective tax rate for 2021 is 06. Federal law requires a review for new wages after one year. Many New Jerseyans say they are still encountering difficulties filing for unemployment benefits nearly one year into the pandemic.

Customer service issue with NJ Unemployment from January 20th 2022 by GetHuman7040245 I filed a claim online but never received a claim number. Op 9m New Jersey. It seems like this is happening to so many people whether its their first time filing claiming or extending benefits and it was supposed to have been fixed by Feb.

If you have a good quarter or more of wages from the old employer not previously used your second claim might not differ substantially in benefit amount. The wage base remains at 7000. New Jersey residents on unemployment will no longer have to file a new claim once they reach their one-year benefit mark the state Labor Department announced Wednesday.

Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period. Phil Murphy says the state has fixed any systemic. A person files for unemployment gets benefits gets the 13 weeks and is now ready for the 20 weeks but the end of the benefit year will come before the 20 weeks is.

Additionally on July 1 2020 New Jerseys high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits if they meet the minimum earnings requirement and the date of their initial UI claim is May 12 2019 or later. I just exhausted mine last week. The state no longer qualified for High Extended Benefits once the unemployment rate average below 8 for three months.

The effective rates per hour for 2021 are. The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. NJ benefit calculator here.

Claim Gets Reviewed You earned at least 220week for 20 or more weeks or. It will have been one year since they first filed for unemployment after businesses shuttered to stop the spread of. New Jersey claimants currently receiving benefits do not have to take any action.

How Can America Survive From Current Financial And Economic Crisis Subprime Mortgage Crisis Business Ethics Capital Market

Nice Helpful Gold Tips For Gold Rate Per Gram Crude Oil Stock Gold Exchange Gbp Usd

Unemployment Pakistan Essay Essay Format Essay Mission Statement Examples

Youth Unemployment Essay Economics Summary Writing Essay Love Essay

Payroll Payroll Report Template Payroll Template

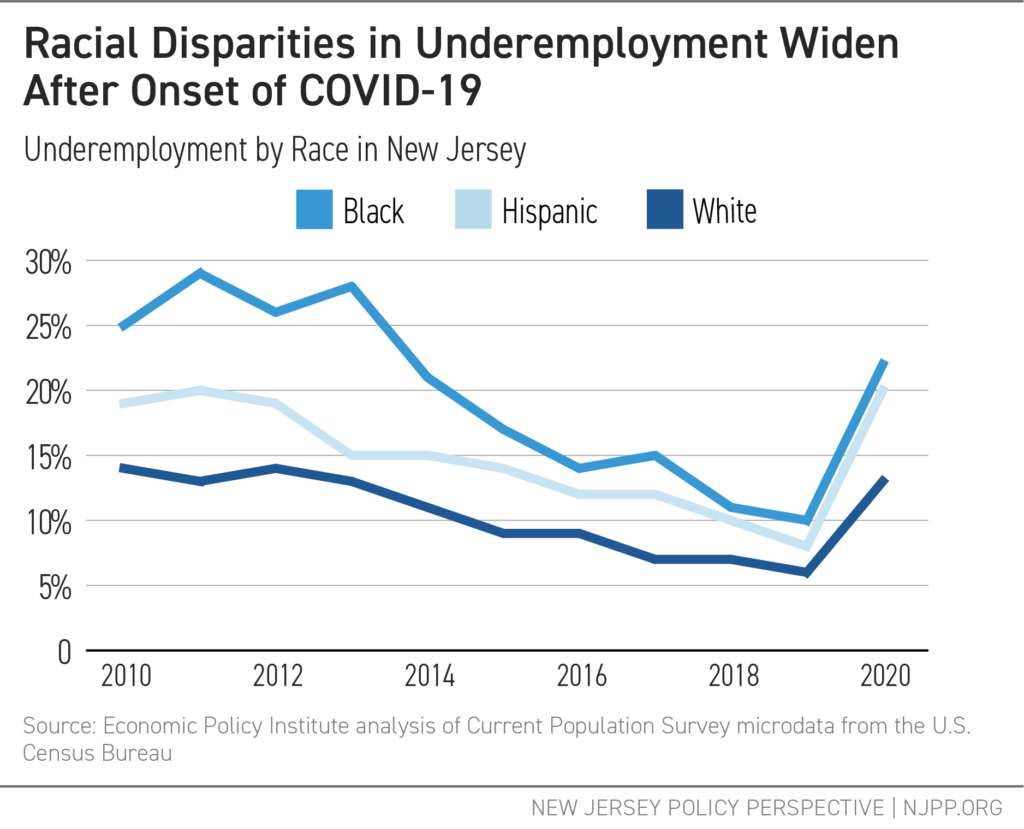

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

Screenwriting Story Writing Landing Page

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Facebook Newark City Irvington Rockhampton

Primary School Admission Application Letter Case Study Essay Learned Helplessness

Why Go To College The 9 Biggest Benefits Education Education College Educational Infographic

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

No comments:

Post a Comment