In 2011 I got another job in NJ. Create an Online Account.

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey does not tax unemployment benefits.

Nj unemployment ny. How many weeks do I need to work. Report the same amount on your New York State tax return as. But the lagging economy in New York City has driven the overall state rate up to 76 percent the second highest in the country.

Kathy Hochul will support an extension but the new. Can I collect unemployment in NY and NJ. If NY withheld NY state income tax from your NY unemployment and you didnt have any other taxable income you.

From 2000 through all of 2009 I worked in NJ. Refer to this step by step process on how to certify for your weekly benefits. Disaster Unemployment Assistance.

Unemployment benefits are reported to the state where you live not to the state you got them from unless you still live there. Eligibility Requirements of Unemployment Benefits in New Jersey. So even if you live in New York if you work in New Jersey you should apply in New Jersey.

In 2010 I got a job in NY. In general you should apply for unemployment in the same state in which you work. 73 Percent Monthly Updated.

However Unemployment compensation is taxed by New York State. You can file your claim online or you can call the Reemployment. Then click Certify to Claim Your Weekly Benefits Here and follow the instructions.

Consumer Price Index - New York-Newark-Jersey City NY-NJ-PA 1982-84 100 Consumer price indexes. So even if you live in New York if you work in New Jersey you should apply in New Jersey. Does anyone have experience or advice.

NJ wins here too. Health and Safety During COVID-19. Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county.

A comprehensive list of all of New Jerseys unemployment offices is provided below. To be eligible for unemployment benefits an employee must have earned at least 8300 or have worked for a minimum of 20 weeks. That means that unemployment eligibility requirements are identical for out-of-state claimants and for New York residents.

Local Area Unemployment Statistics - New Jersey. Now with the change of leadership in the governorship the 400000 New Yorkers on the verge of losing unemployment assistance wonder if Gov. If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 during regular business hours.

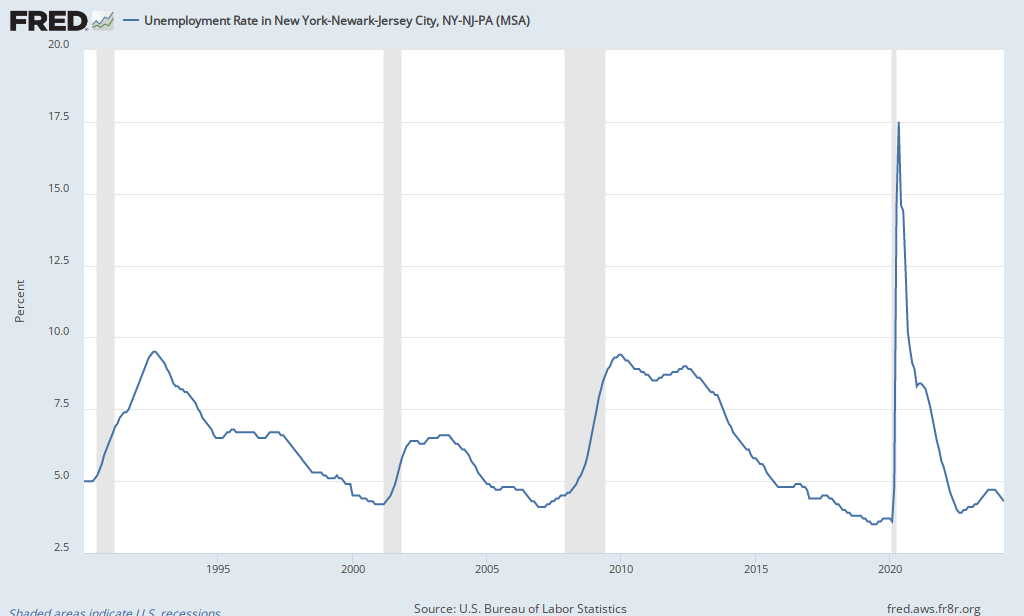

Information for Working Parents and Caregivers. Unemployment Rate in New York-Newark-Jersey City NY-NJ-PA MSA NEWY636UR Unemployment Rate in New York-Newark-Jersey City NY-NJ-PA MSA NEWY636UR Oct 2021. No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ.

North New Jersey Reemployment Call Center 201 601-4100. 2007-05-30 2021-12-30 Release Metropolitan Area Employment and Unemployment. Central New Jersey Reemployment.

Although for most people this will mainly be relevant for your 2020 tax return its important to note that if you are receiving unemployment from New York you should report it on that tax return. The case surrounds a Deutsche Bank employee who provided services to her companys New Jersey office but telecommuted out of her home in North Carolina. I am a NY resident.

Click the Unemployment Services button on the My Online Services page. Enter your NYgov username and password. New Jersey Unemployment Offices.

In the city the unemployment rate is 105 percent. Bureau of Labor Statistics. Unemployment Rate in New York-Newark-Jersey City NY-NJ-PA MSA 2015-02-04 2021-12-30 Source US.

Additional Resources and Support. Otherwise you should contact the Out of State Residents Office. A New Jersey appellate court has ruled for the first time that an employee who provides services to a state business through telecommuting is not eligible for New Jersey unemployment benefits.

Weekly max is 657 NJ vs 430 NY. Bureau of Labor Statistics New York-New Jersey Information Office Suite 808 201 Varick Street New York NY 10014 Telephone. Locate the NJ unemployment office nearest you to.

To create an account to apply for unemployment online go to. Do I apply for unemployment in NY or NJ. Consumer Price Index - New York-Newark-Jersey.

Wages from the previous 52 weeks are used to determine eligibility. New Jersey residents and New Jersey workers who are unemployed can obtain information about the states unemployment program by contacting a local unemployment office. 1-646-264-3600 wwwblsgovregionsnew-york-new-jersey Contact New York-New Jersey.

Americas unemployment rate currently stands at 54 a big improvement from the near-record high of 148 in April 2020 but New York has an employment rate of 76. Unemployment The State of New York. Eligibility Requirements of Unemployment Benefits in Connecticut.

However New York does tax. June 6 2019 117 PM. No you dont need to file a NY state tax return just because you received unemployment benefits from NY.

You must file for Unemployment Insurance benefits in New Jersey if you worked in New Jersey in the past 18 months and moved out of New Jersey before becoming unemployed. Federal and State Extended Unemployment Benefits. It looks like a maximum 26 weeks of benefits in either state.

Consumer Price Index Overview Table New York-New Jersey.

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

Nj Unemployment 75 000 Residents Still Owed Thousands In Benefits Abc7 New York

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

![]()

New York Unemployment Tips Hotel Trades Council En

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

New Jersey New York New Jersey Information Office U S Bureau Of Labor Statistics

Nj Labor Department Njlabordept Twitter

New York Unemployment Benefits Eligibility Claims

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Unemployment Benefits Comparison By State Fileunemployment Org

New Jersey Unemployment Tips Hotel Trades Council En

No comments:

Post a Comment