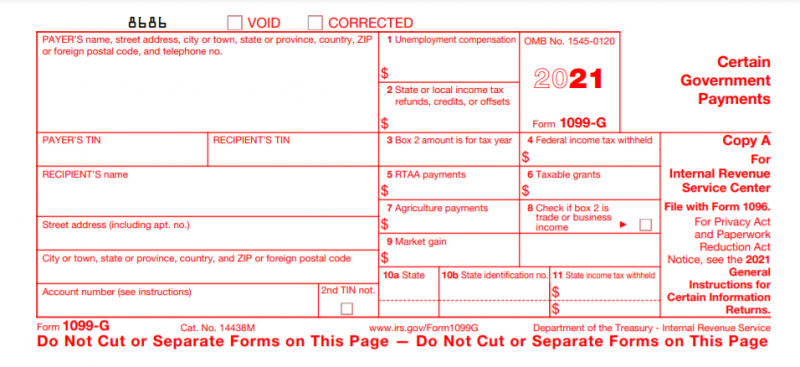

For Internal Revenue Service Center. This shows the amount you were paid and any federal income tax you chose to.

Unemployment Claimants To Receive 1099 G Tax Form By End Of Month Penbay Pilot

For all unemployment claimants that received benefits in 2020 the 1099-G form is now available to download on the DLT website.

Unemployment 1099 for 2021. To verify andor update your mailing address please visit our Claimant Portal. To access your Form 1099-G online log into your account at unemploymentstatemius. Visit the Department of Labors website.

File with Form 1096. The Tax Department issues New York State Form 1099-G. The department urges claimants to review the address listed on their claim account for accuracy.

The 1099-G tax form includes the amount of benefits paid to you for any the following programs. No a tax break on 2021 unemployment benefits isnt available. If you did not select electronic as your delivery preference by January 9th 2021 you will automatically be mailed a paper copy of your Form 1099-G.

Workers receiving a Form 1099 typically dont qualify for unemployment benefits. This will also be mailed to claimants. What is the IRS Form 1099-G for unemployment benefits.

If you received unemployment compensation you should receive Form 1099-G from your state. Under I Want To select View 1099-G. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

That changed with COVID-19 and the enactment of the CARES Act in March 2020. However 1099-Gs are available online here. Unfortunately for a lot of unemployed workers those benefits expired on September 5 2021.

Unemployment insurance payments are taxable income. By January 31 2021 the Division will deliver the 1099-G for Calendar. Once the 2020 1099G forms are uploaded PUA claimants can access their PUA-1099G via their PUA Dashboard.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per. The Pandemic Unemployment Assistance PUA 1099G form will also be made available to download online. For Privacy Act and Paperwork Reduction Act Notice see the.

2020 1099-Gs are now available for download. In this case you will claim it on your 2021 tax return in 2022 and label it as unemployment income from 2020. You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for unemployment income you received in 2021.

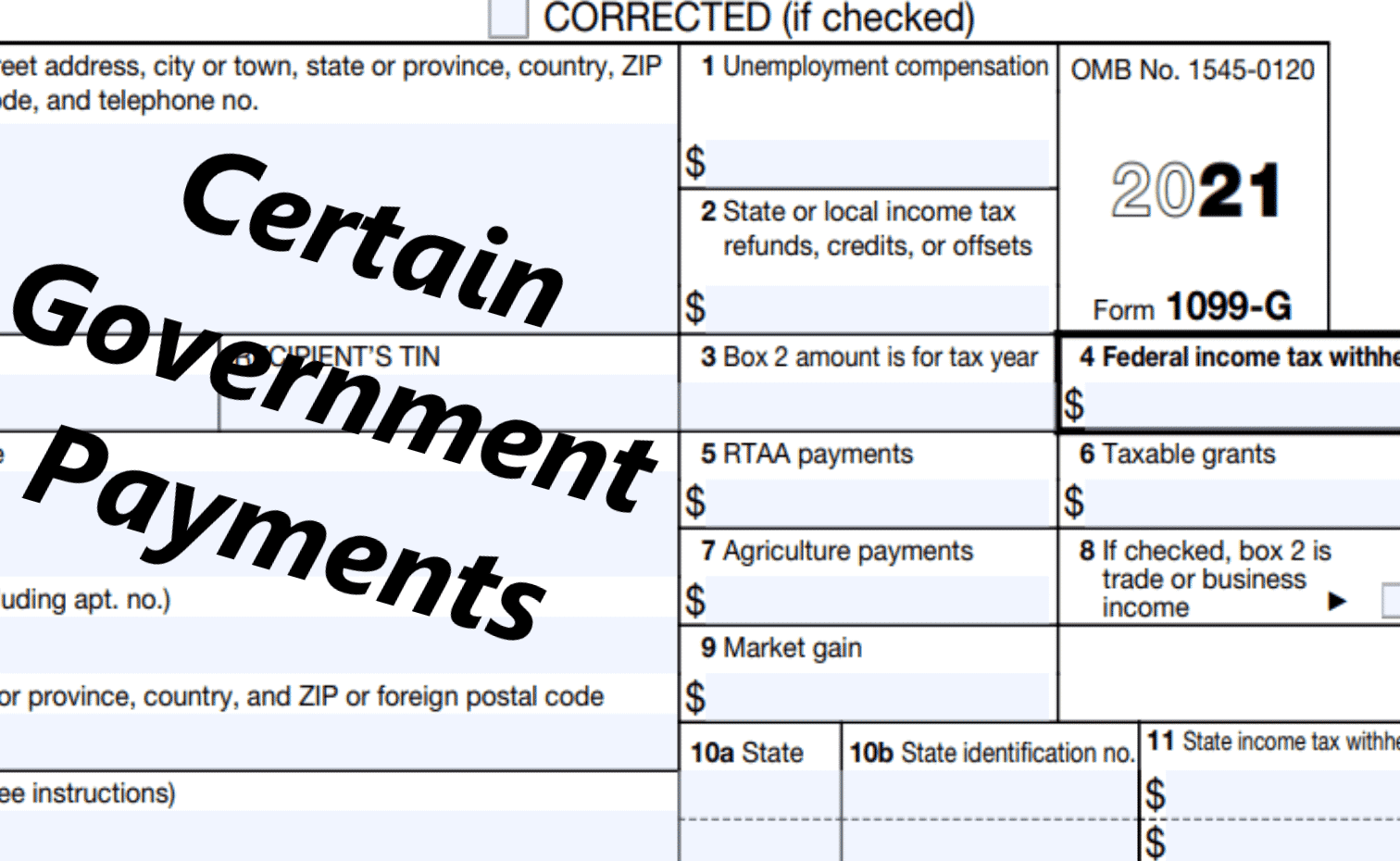

The form will show the amount of unemployment compensation you received during 2020 and any federal and state income tax. ILogin is required to view your 1099-G form online. Department of the Treasury - Internal Revenue Service.

However you can also view this form from. 31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G.

Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes. Need To Know - Claims Eligibility. Log in to your NYGov ID account.

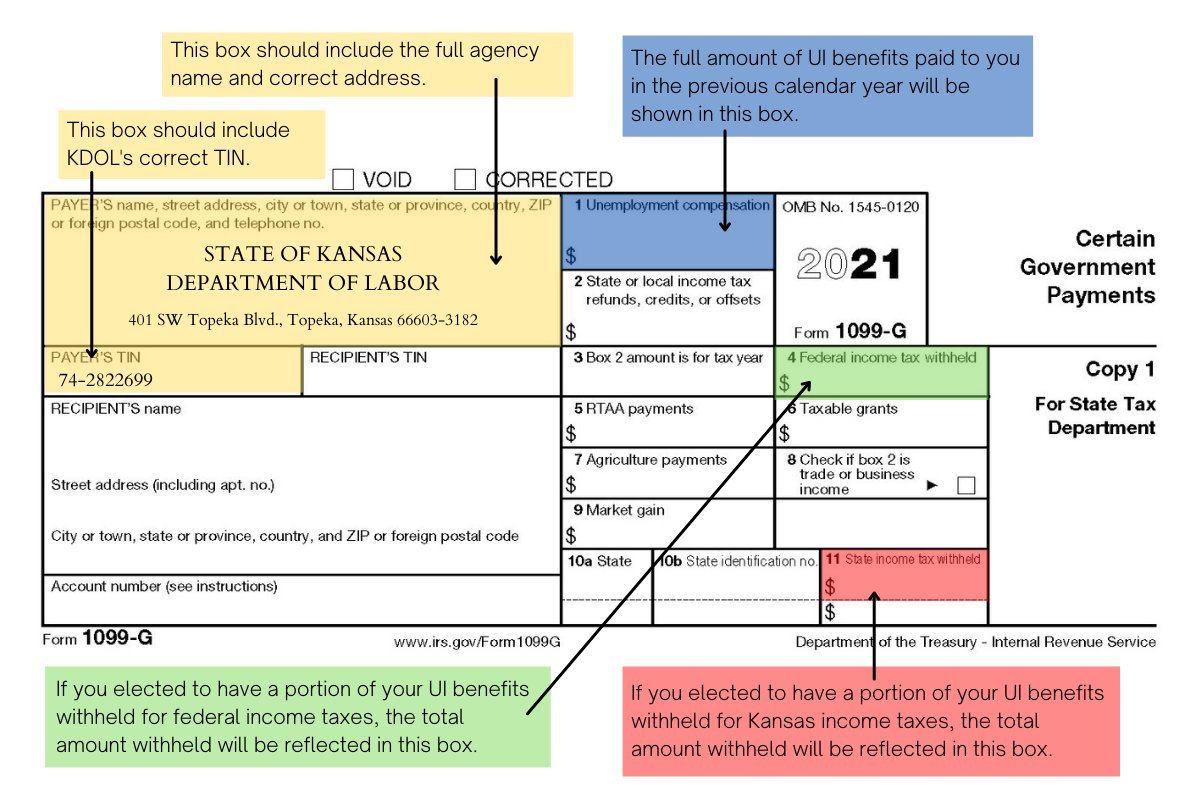

The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. First Quarter 2021 Form 1099G for Unemployment Compensation The California Employment Development Department EDD released information and resources to help individuals who received a Form 1099G for unemployment compensation as these payments must be reported on the individuals state and federal tax returns. The full amount of your benefits should appear in box 1 of the form.

31 2021 all individuals who received unemployment benefits in 2020 will receive an IRS Form 1099-G from the Division of Employment Security. UC 1099-G and PUA 1099-G forms must be mailed by January 31 st of each year. 1099-Gs are required by law to be mailed by January 31st for the prior calendar year.

Working for cash or received a 1099. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account. Unemployment Tax Forms 1099 By January 31 all 1099-Gs will be mailed out to individuals who had claimed Unemployment Insurance UI benefits in the previous calendar year.

2021 General Instructions for Certain Information Returns. In order to do this you should receive a Form 1099-G from your state or the entity. Please check back soon.

Your 1099-G form will be available in January 2022. Log on using your username and password. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic.

This may be different from the week of unemployment for which the benefits were paid. These documents WERE MAILED TO THE ADDRESS OF RECORD BY FEBRUARY 1 2021 as is required by law. This form does not include unemployment compensation.

Forms will be mailed to all claimants by the January 31 st deadline. After 1099-G forms for 2021 are available online select Get your 1099-G from My UI Home in the online claimant portal to access your 1099-G tax forms. It opened the door for such workers to receive benefits.

1099-G tax forms are not available online at this time. For tax year 2021. 1099-G forms are delivered by email or mail and are also available through a claimants DES online account.

ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families. 31 2022 all individuals who received unemployment benefits in 2021 will receive an IRS Form 1099-G from the Division of Employment Security. The 1099G forms for Regular Unemployment Compensation UC is now available to download online.

You must include this form with your tax filing for the 2021 calendar year. To access prior year forms select My UI Summary then select 1099-G Tax Information in the online claimant portal. If you received any unemployment benefits in 2021 your will need the 1099-G tax form to complete your federal and state tax returns.

UC dashboard PUA dashboard.

1099 G Unemployment Compensation 1099g

1099 Form Unemployment Benefits

1099 G Forms Available For Recipients Of Unemployment Insurance Benefits In 2020 Wrul Fm

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 G Tax Form Why It S Important

1099 G Form 2021 Irs Forms Zrivo

Taxpayers Get 1099 Forms From Unemployment Office For Income They Never Received Cbs Pittsburgh

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Kansas Department Of Labor On Twitter If You Have Received A 1099 G Form In The Mail Make Sure The Following Information Is Correct Kdol S Address Kdol S Tin Total Unemployment

1099 Form Unemployment Benefits

Accessing Form 1099 For 2020 Unemployment Recipients

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

1099 G Tax Information Ri Department Of Labor Training

1099 G Scheduled To Be Mailed On Or Around Jan 27 Hawaii News And Island Information

No comments:

Post a Comment