I live in ny but used to work in nj. That means that unemployment eligibility requirements are identical for out-of-state claimants and for New York residents.

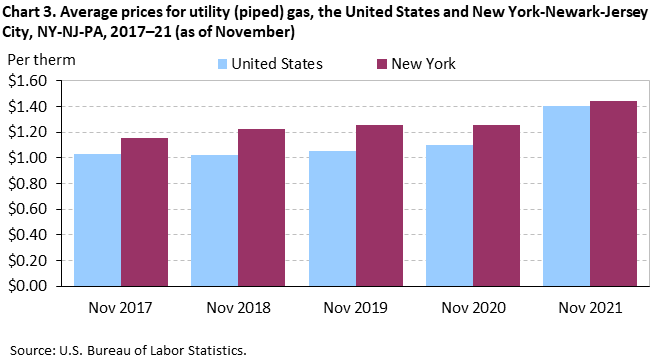

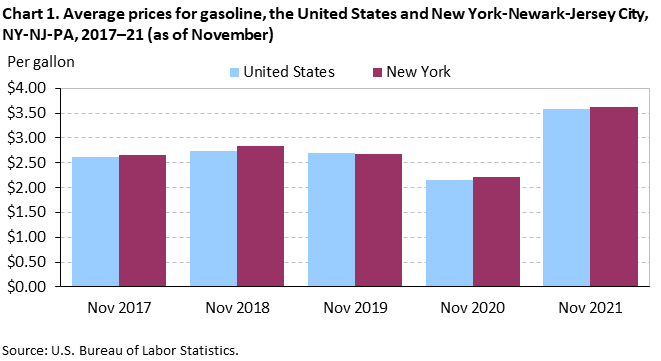

Average Energy Prices New York Newark Jersey City November 2021 New York New Jersey Information Office U S Bureau Of Labor Statistics

Ask Your Own Tax Question.

Ny unemployment living in nj. Wages from the previous 52 weeks are used to determine eligibility. However Unemployment compensation is taxed by New York State. So even if you live in New York if you work in New Jersey you should apply in New Jersey.

Today I talk about filing for NYC unemployment and not being able to complete the process without calling a phone number that is. However New York does tax. A New Jersey appellate court has ruled for the first time that an employee who provides services to a state business through telecommuting is not eligible for New Jersey unemployment benefits.

To be eligible for unemployment benefits an employee must have earned at least 8300 or have worked for a minimum of 20 weeks. NY unemployment SUCKS. In general you should apply for unemployment in the same state in which you work.

Eligibility Requirements of Unemployment Benefits in New Jersey. In addition while the American Rescue Plan Act exempts a certain portion of your unemployment compensation New York has not adopted this tax exemption. Me personally I would start with the state you work in and go from there.

In reaching this conclusion the court found physical rather. Report the same amount on your New York State tax return as. The OP stated that his most recent employement was in Jersey City along with NJ UE deductions.

No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ. Bagyi Esq SPHR In a recent decision the New York Court of Appeals held that a Florida resident telecommuting to her job with her New York employer was ineligible to receive New York unemployment insurance benefits. Although for most people this will mainly be relevant for your 2020 tax return its important to note that if you are receiving unemployment from New York you should report it on that tax return.

Your unemployment claim will be subject to the state law where you worked not the place where you live. For instance if an individual lives in a state abutting New York such as New Jersey and worked in New York for the duration of his base period that individual may file for unemployment benefits from New York. You must file for Unemployment Insurance benefits in New Jersey if you worked in New Jersey in the past 18 months and moved out of New Jersey before becoming unemployed.

In general you should apply for unemployment in the same state in which you work. In NJ the max unemployment is 584 a week. Can I collect unemployment in NY and NJ.

The New York state tax starts at 4 and goes as high as 882 while in New Jersey rates start at 14 though they go as high as 118 if you make more than 5000000. Unemployment benefits are reported to the state where you live not to the state you got them from unless you still live there. NJ does not tax unemployment.

101 Hudson Street 21st Fl Jersey City New Jersey 07302 United States 201 252-6703. If NY withheld NY state income tax from your NY unemployment and you didnt have any other taxable income you might want to file a NY return in order to get a refund. June 6 2019 117 PM.

NY Unemployment Benefits for Out-Of-State Telecommuters John M. If they do it does not matter whether they reside in New York. That means someone living out of state can claim UI benefits in New York.

For the last few years i filed ny and nj state taxes. To create an account to apply for unemployment online go to. In rare cases those receiving New York state unemployment benefits may continue to receive those benefits in another state.

Out-of-state unemployment claims can be filed via telephone online through the state paying your benefits. After they take out taxes you end up with a maximum of about 385 a week. You can file your claim online or you can call the Reemployment.

The case surrounds a Deutsche Bank employee who provided services to her companys New Jersey office but telecommuted out of her home in North Carolina. Your state of residence is irrelevant to this process. New Jersey doesnt tax unemployment compensation but you will need to pay non-resident New York State taxes on this income says Engel.

Hopefully you dont get laid off but if you do make sure you file a claim the VERY next day you can collect unemployment simultaneously while getting your severence. New Jersey does not tax unemployment benefits. Filing for NYC Unemployment Living in NJ - YouTube.

So even if you live in New York if you work in New Jersey you should apply in New Jersey. Unemployment insurance claimants from outside New York can make use. No you dont need to file a NY state tax return just because you received unemployment benefits from NY.

If NY withheld NY state income tax from your NY unemployment and you didnt have any other taxable income you. In the begining of this year i received unemployment benefits from the state of new jersey did not work ther. New York State offers unemployment insurance benefits to qualified workers who have worked in the state during the prior 18 months and who meet certain criteria.

As previously explained any claim the OP files in NJ will not be accepted because under NJ rules ALL your work for the last 18 months has to have been in NJ -- which is not the case for the OP. Eligibility Requirements of Unemployment Benefits in Connecticut. Therefore unemployment is fully taxable at the federal level.

Essay Brain Drain Problem India Essay Brain Drain Long Arm Quilting Machine

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

Paris S Most Decadent Era And Where To Recreate It Paris Montmartre Tourist Trap

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

New Jersey Ends Covid Unemployment Benefits The New York Times

New Jersey Unemployment Tips Hotel Trades Council En

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

Tom Jones Green Green Grass Of Home Green Grass Cool Countries Beautiful Voice

Average Energy Prices New York Newark Jersey City November 2021 New York New Jersey Information Office U S Bureau Of Labor Statistics

World Economic Forum On Twitter Cover Letter For Resume Job Resume Resume Tips

Ny Covid Latest Saturday January 1 2022 Pix11

New York New York New Jersey Information Office U S Bureau Of Labor Statistics

![]()

New York Unemployment Tips Hotel Trades Council En

Nj Unemployment 75 000 Residents Still Owed Thousands In Benefits Abc7 New York

No comments:

Post a Comment