Heres how an employer in Texas would calculate SUTA. File wage reports pay taxes more at Unemployment Tax Services.

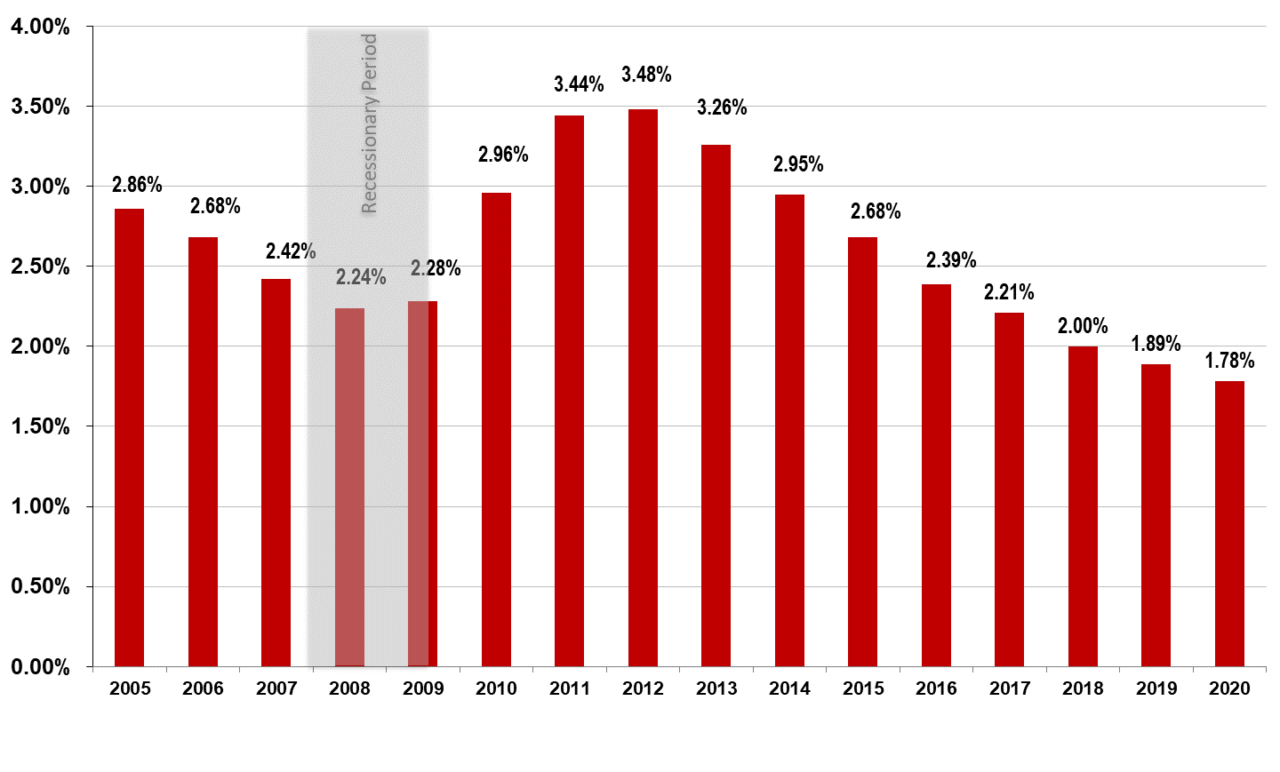

Texas Unemployment Tax Rate Decreases Vbr

The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their employer.

Texas unemployment tax rate. An obligation assessment rate. The Texas Workforce Commission TWC has set the 2022 unemployment insurance UI tax rates to reflect the current rate. Tax rates are unique to each company while the wage base is the same for all employers in one state.

The taxable wage base increases from 27000 to 28700 in 2022. The Texas Workforce Commission indicates. Texas has no state income tax.

The rate set is retroactive to January 1 for all employers in the state. Texas unemployment tax rates are not to change for 2022 the state Workforce Commission said Nov. For example the wage base limit in California is 7000.

Tax rates for 2021 are to be finalized in late June to allow the commission to take into account potential legislative action and economic changes before setting tax rates. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The lack of an increase in the tax rate is a result of the passing of Senate Bill 8 which was passed during the 3 rd Special Session of the 87 th Texas Legislature and signed into law by Governor Greg Abbott.

The reserve factor used in part to calculate an experienced employers unemployment tax rate will not be released until later. Using the formula below you would be required to pay 1458 into your states unemployment fund. We will update this information as the states do.

The UI tax funds unemployment compensation programs for eligible employees. Employer Tax Rate Range 2021 Alabama. For more information about estimated tax payments or additional tax payments visit payment.

Employers typically pay the State of Texas a percentage of the first 9000 in employee wages as an unemployment tax. The Texas Workforce Commission announced this week that 2021 unemployment tax rates will not be released until some time in February. For calendar year 2011 the unemployment tax rate is composed of four components.

Only one element of an employers. The number of unemployment claim. Changing Unemployment tax rate for manual payroll Changing state unemployment payment to e-pay State Unemployment Rate Change.

Only the Federal Income Tax applies. The yearly cost is divided by four and paid by quarter. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. File Wage Reports Pay Your Unemployment Taxes Online. The Texas Workforce Commission TWC announced that issuance of the 2021 state unemployment insurance SUI tax rate notices are further delayed until late June or July 2021.

The Texas Workforce Commission TWC is working diligently to keep the 2021 tax rates as low as possible for Texas employers. Lets say that your tax rate the percentage you pay on the wage base limit is 5 and you have 3 employees. You will pay 1050 in SUI.

Unemployment Compensation Subject to Income Tax and Withholding. Texas employers pay state unemployment tax on the first 9000 of wages paid to each employee. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports.

The fifth component of your tax rate is the Employment and Training Investment Assessment ETIAThe assessment is imposed on each employer paying contributions under the Texas Unemployment Compensation Act as a separate assessment of. A minimum of six quarters is required to obtain an experience rating in order to determine an employers revised rate. For example Texas will not release 2021 information until June due to COVID-19.

Texas just issued state unemployment rates in June that are retroactive back to January 1st. The TWC said in a news. The minimum and maximum tax rates are set annually.

In Texas state UI tax is one of the primary taxes that employers must pay. The Texas Workforce Commission TWC set the 2021 employers unemployment insurance UI tax rate in mid-June after a four-month delay as the state waited to see how the economic recovery progressed before setting Texas State Unemployment Tax Act SUTA Rates. Here is a copy of their press release.

Texas employers may choose to defer unemployment tax payments or pay tax at an estimated rate until 2021 tax rates are finalized the state Workforce Commission said March 2. In 2020 the minimum rate was 031 and the maximum rate was 631. If your small business has employees working in Texas youll need to pay Texas unemployment insurance UI tax.

The unemployment rate ranges from a minimum of 78 percent to. 350 x 3 1050. Here is how to do your calculation.

AUSTIN On November 23 2021 the Texas Workforce Commission TWC set unemployment insurance UI tax rates for 2022 at a stable level to avoid burdening Texas businesses with a significant increase of taxes resulting from pandemic-related closures outside of their control. The TWC had originally planned to issue rate notices in February 2021 a delay from the normal timeframe of December 2020TWC. This action is a result of the statutory authority of the.

SUI New Employer Tax Rate. Typically tax rates are released in Decemberbefore the new year. 065 68 including employment security assessment of.

However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the Texas sales tax and the Texas. AUSTIN The Texas Workforce Commission TWC has used legislative power to set Unemployment Insurance UI tax rates for 2021 at a stable level consistent with 2020 rates to avoid straining on Texas businesses a significant increase in taxes resulting from closures related to the pandemic beyond their control. The unemployment tax rates for new employers vary by industry and range from 10 to 131 in 2022 10 to 123 in 2021.

Is there a way to correct the rate back to that date and have the s. 1 2022 unemployment tax rates for experienced employers are to range from 031 to 631 the commission said in a news releaseThe rates include a replenishment tax rate of 02 up from 018 in 2021. 19 rows Texas Workforce Commission sets employer tax rates for 2020.

Texas is one of seven states that do not collect a personal income tax. Businesses that employ one or more individuals may be subject to the state unemployment tax. 7031 Koll Center Pkwy Pleasanton CA 94566.

5 of 7000 350. New employers pay 27 on the first 9000 of wages per employee.

Aussie Banks Desire To Sate Investor Housing Love Affair Untamed By Threats Love Affair Affair Threat

How Is Tax Liability Calculated Common Tax Questions Answered

Futa Tax Overview How It Works How To Calculate

2022 Federal Payroll Tax Rates Abacus Payroll

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

States With The Highest And Lowest Property Taxes Property Tax High Low States

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Pin On Basic Concepts In Economic Business And Finance

10 Best States For Entrepreneurs Small Businesses In The U S Infographic Small Business Entrepreneur

Twc Unemployment Insurance Tax Rates Up For 2017 Vbr

Revenue Corporate Tax Rate Tax

How Severely Will Covid 19 Impact Sui Tax Rates Workforce Wise Blog

No comments:

Post a Comment