In Ohio the Department of Job and Family Services is entrusted with the responsibility of administering unemployment compensation related services to its citizens. Related to the Ohio Department of Job and Family Services the Department or ODJFS administration and fraud prevention and detection efforts pertaining to the Unemployment Insurance UI program including the federal funding related to the COVID -19 pandemic unemployment under the authority of Ohio Revised Code Section 11711.

Ohio Unemployment Phone Number Ohio Unemployment Customer Service Number Pua Ohio Unemployment Login

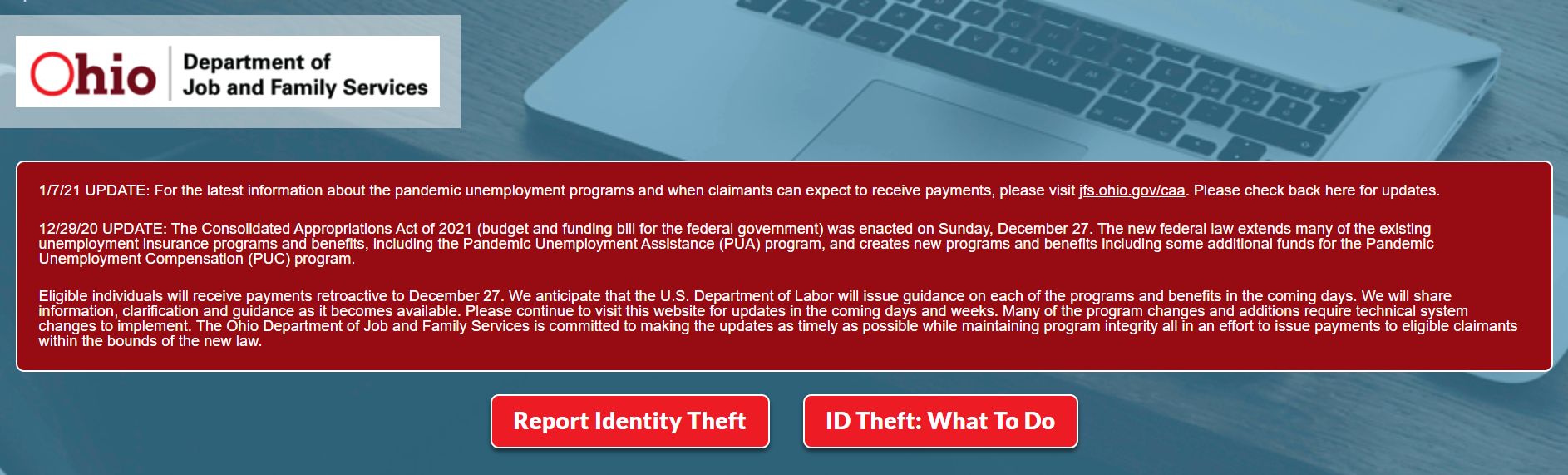

The Ohio Department of Job and Family Services administers its own unemployment benefits program.

Ohio unemployment department. 1 2022 total unemployment tax rates for experienced employers are to range from 08 to 75 for positive-rated employers and from 77 to 102 for negative-rated employers the department said on its website. False Identity Theft and Unemployment Benefits Unfortunately identity theft is a widespread national challenge. Changes in how Unemployment Benefits are taxed for Tax Year 2020.

You must have worked and earned more than a specific amount in the base period. The Ohio Department of Job and Family Services is actively investigating the situation ODJFS is working with the US. Ohios unemployment tax rates are to generally are to increase for 2022 the Department of Job and Family Services said Dec.

7 days ago Mar 07 2020 The weekly claim application will include space to enter your weekly job contact information. COLUMBUS Ohio WKEF- The Ohio Department of Job and Family Services is warning of a scam impacting. May 26 2021 On April 6 2021 the Department of Taxation issued the tax alert Ohio Income Tax Update.

Your weekly benefit is calculated as a percentage of your actual earnings during that period. Report it by calling toll-free. In order to answer the.

COLUMBUS Ohio Last January many Ohioans found out they were victims of unemployment fraud when they unexpectedly received a tax form in the mail for benefits they never asked for or received. For other general questions about our. If you receive an unemployment insurance overpayment because of unreported or underreported wagesearnings you must repay that debt to ODJFS within 60 days.

The Ohio Department of Job and Family Services supervises the states public assistance employment services unemployment insurance child and adult protective services adoption child care and child support programs. The Ohio Department of Job and Family Services. Ohio paid out millions of dollars in unemployment to fraudulent claims while also overpaying some legitimate claims.

For frequently asked questions about these programs visit the Our Services page. To primarily qualify for compensation in Ohio the aspiring claimant should have sufficient employment in the 20 weeks preceding the application and should have earned at least 243. As an alternative you may call the following numbers to reach a customer service representative.

The Ohio Department of Job and Family Services noted a performance review from the state auditors office said months of unusually high demand staffing shortages an antiquated processing system and four new unemployment programs created the opportunity for fraud. If you do not the overpayment will be reported to the Ohio Attorney General for collection and any federal income tax refund owed to you could be intercepted. The unemployment system in Ohio is administered through the Ohio Department of Job and Family Services ODJFS or the Department Office of Unemployment Insurance Operations OUIO.

File by calling 1-877-OHIO-JOB 1-877-644-6562 from a touch-tone telephone. The director of the Ohio Department of Jobs and Family Services recently announced the department is working with state and federal law enforcement to recover hundreds of millions of dollars in. Ohio warns of fake unemployment websites attempting to steal personal banking information.

Ohios unemployment system says it has paid five contractors a total of 1047 million to date to provide call-center workers during the coronavirus crisis when the number of Ohioans receiving. This tax alert provided guidance related to the federal deduction for certain unemployment benefits. For taxpayers who filed federal and Ohio tax returns without the unemployment benefits deduction.

Learn about Ohio unemployment benefits from the Ohio Department of Job and Family Services. Our audit focused on OUIO administration and operations. Employee FAQs Expanded Eligibility FAQs.

Attorneys Office to arrest those responsible More than 255000 Ohioans have reported identity theft related to. A report from the state auditor shows ODJFS paid out. This is the fastest method of filing your weekly claims.

Many Ohioans have become victims and their identities used to file fraudulent unemployment claims in both the traditional unemployment and Pandemic Unemployment Assistance programs.

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Department Of Job And Family Services Filing For Your Weekly Unemployment Benefits Youtube

More Ohioans Are Discovering They Ve Been Targeted By Unemployment Scammers Thanks To Unexpected Letters Cleveland Com

Ohio Unemployment Benefit Reimbursement Due To Fraud Nbc4 Wcmh Tv

How My Personal Experience Exposed Massive Ohio Unemployment Fraud Letter From The Editor Cleveland Com

Ohio Update To Allow Thousands More To Claim Unemployment Benefits Wrgt

How To Apply For Unemployment Benefits Online In Ohio Youtube

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Ohio Unemployment Office Intercepting Fraud Wksu

No comments:

Post a Comment