Those who started receiving the extra 600 benefit could get it weekly for a maximum of 17 weeks in NJ from the week ending April. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

N J Unemployment Claims Rise Slightly As 600 Extra Federal Check Ends Nj Com

The payments arrived separately from the regular state unemployment benefits.

Nj unemployment $600. If you didnt elect to have federal taxes withheld you can go to your unemployment account and change that. Workers who are eligible for PUA but for whom available wage records are incomplete will be issued weekly PUA payments for the minimum amount of 231 plus the separate 600 weekly supplemental benefit once they certify for. The 600 federal unemployment benefit has provided billions to Pennsylvania and New Jersey jobless workers.

The 600 supplement will be paid weekly but it is possible that this payment will be made separately in a separate deposit from unemployment benefits. Federal Pandemic Unemployment Compensation FPUC The new stimulus bill funds another 25 weeks of weekly supplementaryextra unemployment at the current 300 level. I woke NJ UNEMPLOYMENT ended and so did my 600 what to expect extension receive - benefits rate legislation insurance jobless extension jobs employers employees hiring resumes occupations government laws unions contracts workers - City-Data Forum.

Figuring maybe because I certified late the 600 would be deposited late as well. There are so many questions around unemployment insurance benefits the 600 additional benefit and the pandemic unemployment assistance program which has been designed to help those who are not eligible for traditional benefits. Usually certify benefits on Thursday and get deposit on Saturday with the additional 600 depositing on Monday.

Unemployed workers will get 600 in additional benefits this week. That 600 will barely make a car payment for most people and wont even come close to their property tax bill. Unemployment benefits are not taxable for New Jersey.

This 600 a flat amount will be paid to anyone receiving unemployment benefits even those receiving partial benefits in addition to the individuals regular unemployment benefits. Last week I certified late on Saturday 530 and my deposit came through on Monday 61 but the 600 did not. Unemployment compensation received from the State of New Jersey as well as the additional 600 per week provided as part of the CARES Act is not taxable on your New Jersey tax return.

It just makes it a little less painfull. You may also have been eligible for 600 per week on top of regular benefits retroactive to the week ending April 4 2020 through July 25 2020. Unemployment climbs as 600 payments begin.

Over the past three weeks more than 576000 New Jerseyans have filed for unemployment benefits as. Provided an additional 300 per week to all PUA and regular Unemployment Insurance recipients from January 2 2021 through September 4 2021. Lets be honest- most people in NJ arent going to qualify for the 1200 stimulus and the additional 600 is not going to make up for lost salary and benefits.

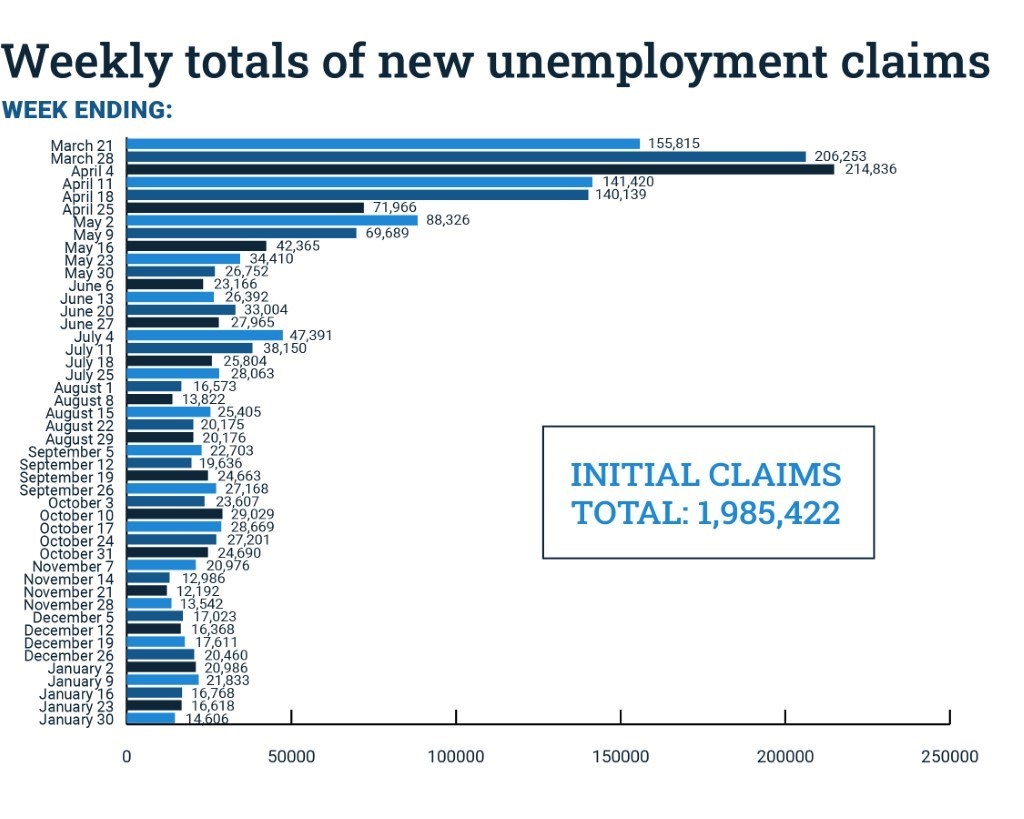

New Jersey unemployment claims dipped last week to about 141000 down from the record-shattering mark set in the previous two weeks but still exorbitantly high by historical standards. Pandemic Emergency Unemployment Compensation. Thousands of people collecting unemployment benefits from the New Jersey Division of Unemployment Insurance have reported their 600 FPUC Federal Pandemic Unemployment Compensation missing.

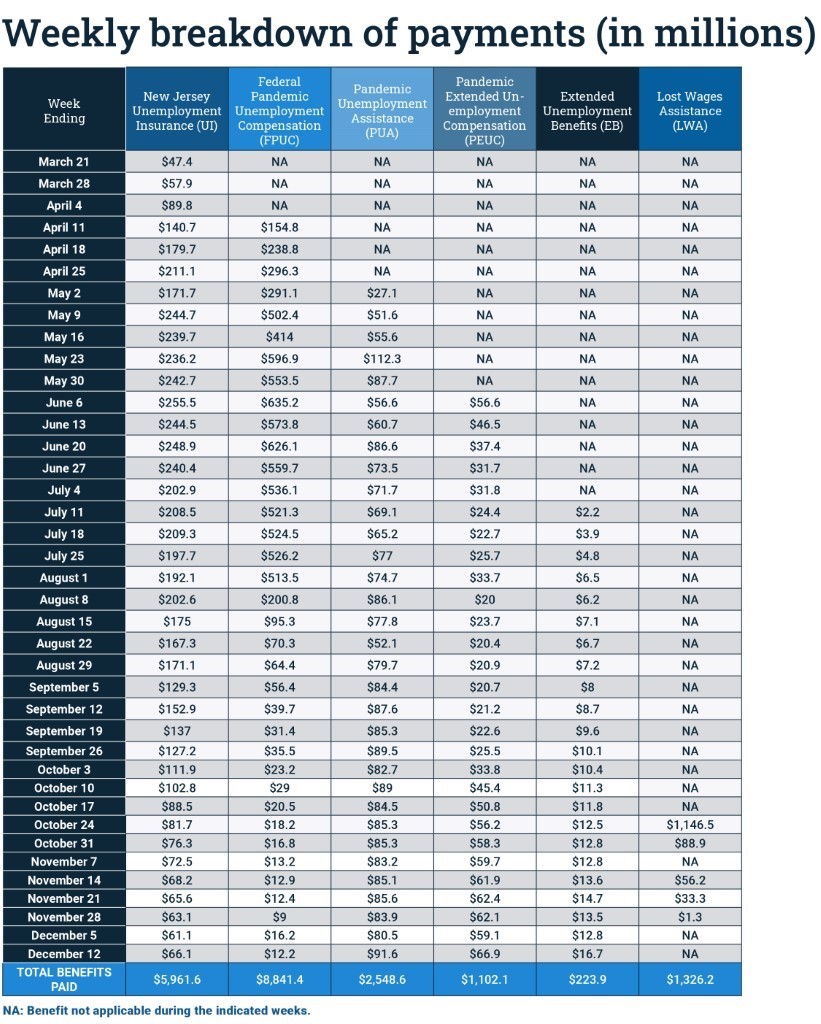

Provides an additional 600 per week on top of regular benefits to all recipients of Unemployment Insurance. Department which was unable to process supplemental benefits last week is giving each claimant two weeks worth of extra benefits. Federal Pandemic Unemployment Compensation.

More than 700000 New Jersey workers have now filed for unemployment benefits in the past month the latest state. Is the 600 unemployment taxed in NJ. Unemployment recipients started to get the 600 weekly payments on April 13.

Pandemic Unemployment Compensation. New Jersey Department of Labor Workforce Development Commissioner Robert Asaro-Angelo joined ROI-NJ for a. These unemployed workers now have access to emergency paid leave to care for themselves or a loved one they are in line for a 600 per week supplement to their unemployment benefit theres a federal extension of unemployment benefits for 13 weeks even for those whose claims have expired and unemployment benefits are becoming available for freelancers gig.

Provides an additional 13 weeks of Unemployment. Additionally on July 1 2020 New Jerseys high unemployment rate triggered extended benefits for NJ workers who have exhausted unemployment benefits if they meet among other requirements the minimum earnings requirement and the date of their initial UI claim is May 12 2019 or later. Per federal regulations on April 17 2021 NJ state extended unemployment.

So idk about it necessarily coming in a week later however the extra 600 dollars does get deposited separately usually at a later time than the first deposit. Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government. Since March 15 Pennsylvania has distributed 135 billion under the program compared with 11 billion in regular unemployment.

Retroactive to the week ending April 4 2020. The FPUC is a temporary federal program adding a 600 weekly payment to individuals collecting Unemployment Insurance Benefits. The minimum PUA payment is still 50 of a states average weekly benefit amount and limited to the states maximum weekly benefit amount WBA.

For me my extra 600 usually gets deposited like 2 or 3 business days after the first. I collected two payments of the 600 dollars.

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

How To Apply For The Free 600 Weekly Unemployment Benefit Youtube

Department Of Labor And Workforce Development Nj Labor Dept Reports 3rd Week Of Decreases In New Unemployment Claims

Nj Unemployment Claims Fall As 600 Federal Weekly Supplement About To End Latest Headlines Pressofatlanticcity Com

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

Njdol Unemployment Payments To Nj Workers Top 20 Billion

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Unemployment Payments To Nj Workers Top 20 Billion New Jersey Business Magazine

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

600 Checks Pushed Back A Week But Some Could See Retroactive Payments First State Update

Coronavirus Update N J Unemployed Getting 600 Checks Whyy

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

No comments:

Post a Comment