After you file an application for unemployment you will be notified that your claim is processed. The only way to file a claim is online.

To receive unemployment benefits you are required to actively look for work and keep a record of all work search activities.

Unemployment benefits ct. We understand its a very stressful time for you. Absolutely no political bashing. Under Connecticut state law an unemployed person who qualifies for UI benefits can get their weekly benefit for up to 26 weeks.

The Connecticut Department of Labor CTDOL is working hard to help our claimants have access to the. Officials with the state Department of Labor said Connecticut will drop out of the federal. This site was created to show who is eligible for unemployment insurance coverage in CT and to instruct how to apply for EDD unemployment benefits.

Disaster Unemployment Assistance. As a resident you will be subject to Connecticut income tax on the benefits. Monday through Friday.

Otherwise if you would prefer to call to file a continued weekly claim you can use the TeleBenefits line at the following times. 1099-G Tax Form. The Connecticut Department of Labor runs the states Unemployment Insurance UI program.

UC-1099G Tax Form Available On-Line. Department of Revenue Services. No bashing each other.

The tiers of unemployment benefits extension in CT are as follows. Jobless Connecticut residents will soon no longer qualify for federal extended unemployment benefits. Citizens can access up-to-date news login and find unemployment assistance.

Filing Your Claim Online. This is not the time for Republican vs Democrat. However this time period has been extended by federal pandemic unemployment legislation to a maximum of 70 weeks of benefits.

Taxation of Unemployment Compensation Connecticut residents are subject to Connecticut income tax on unemployment benefits accrued. Extended Benefits FAQs Unemployment Insurance Federal UI Stimulus Programs FAQs for Employers o General Employer FAQs o For Reimbursing Employers Updated October 14 2021. The Unemployment Insurance CT Direct Benefits online system will allow you to complete applications for new and reopened claims for benefits.

The Connecticut Tax and Benefits System CTABS will allow you to file your weekly claims select payment options and provide answers to questions regarding unemployment benefits. States with unemployment rates above 65 for three months are allowed 13 weeks of jobless aid from the US. Connecticut Department of Labors Unemployment Insurance Online Claims System is best viewed with a resolution setting of 1024 x 768.

Salesforce is certified by the Federal Risk and Authorization Management Program to manage confidential information. An extension for people already receiving unemployment benefits. Contact your states unemployment insurance program for the most up-to-date information.

Unemployment Insurance is temporary income for workers who are unemployed through no fault of their own and who are either looking for new jobs in approved training or are awaiting. You can file online 247 by heading to this website. UC-62TUC-61 PDF Unemployment Separation Notice - Fillable UC-61 aka.

You can discuss what is going on with regards to the state - but no bashing CT employees. The individual receiving unemployment. Unemployment Benefits Online is a full-access portal for unemployment benefits.

The American Rescue Plan Act of 2021 temporarily authorized. In order to use this system you must establish an account with a new User ID. The Connecticut Department of Labor administers unemployment insurance benefits for workers in the state who are either partially or fully unemployed and who are either looking for new jobs in training or waiting to be recalled back to their jobs.

Automatic additional payments of 300 per week to everyone qualified for unemployment benefits. Connecticut Department of Labors Unemployment Insurance Online Claims System is best viewed with a resolution setting of 1024 x 768. Find work search and reporting info on CTDOL work search page.

The revised rate is 18 above the current 631 weekly maximum rate and will apply to claims filed for the benefit year starting on and after October 6 2019. Beginning October 20 2021 through. If the unemployment compensation was paid to you by the.

Maximum unemployment extension of 20 weeks. The states CT Direct Benefits is the system that is used to administer and process benefit requests. Individuals who filed a claim prior to this date and who have been collecting unemployment insurance benefits are unaffected by this revision.

Regular unemployment benefits in Connecticut currently range from 15 to 649 without dependency allowances. Claimants Guide to Unemployment PDF 500KB Direct Deposit or Debit Card. These benefits commence with weeks ending April 4 2020 and through the week ending July 25 2020.

Over 20000 Connecticut residents will lose their federal unemployment benefits in January due to the states unemployment rate dropping below the federal level for extended benefits according to Hearst Connecticut Media. Maximum unemployment extension of 14 weeks. The EUC tier of benefits you are given will depend on the states unemployment rate at the time of the programs activation and on the case of the applicant.

Keep in mind unemployment insurance was designed to help those who are temporarily out of work to still receive compensation over the course of 26 weeks. What is the maximum unemployment benefits in CT. UC-1099G Tax Form Information The UC-1099G Tax Form details the amount of unemployment benefits an employee received for a specific tax year.

The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. If you have not filed a UI claim in CT in the past you will need to. Pink slip PDF Work Search Effort Form - English Spanish.

In general unemployment compensation income whether received from the Connecticut Department of Labor or from an equivalent agency in another state is subject to both federal and Connecticut income taxes. The additional FPUC will bring the range to 615 to 1249 without dependency allowances. To file an application you click on the link below and that will take you off the CTDOL page and to the CT Direct Benefits page.

Connecticut law provides for up to 26 weeks of unemployment insurance. See the 1099-G web page for more information. To do so select Create an Account from the appropriate menu below.

If you are wondering where to apply for unemployment weekly benefits online you can visit the same government site.

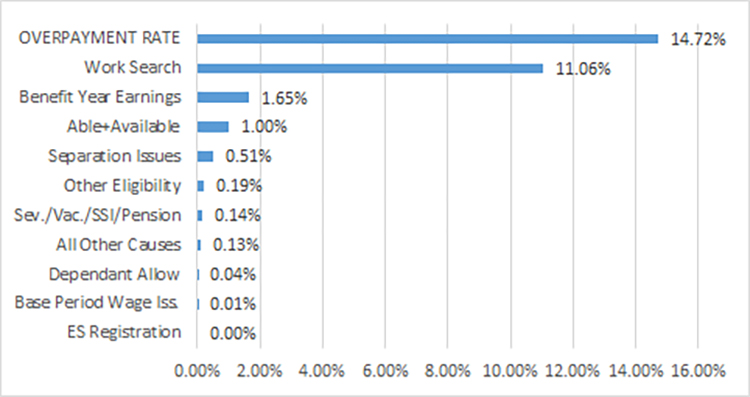

Ct Lawmakers Call On State To Forgive Unemployment Overpayments

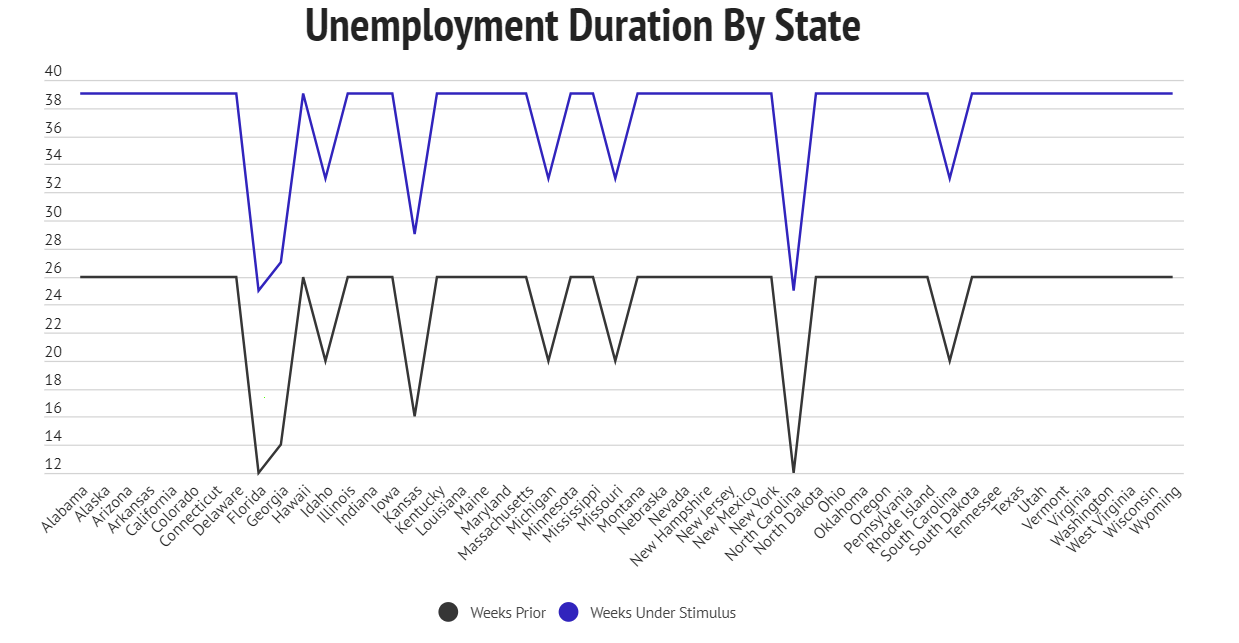

State Of Connecticut Labor Market Information Initial Claims Profile

Pandemic Unemployment Assistance Pua Calculator For Self Employed Freelancers And Gig Workers Zippia

State Of Connecticut Labor Market Information Initial Claims Profile

Sponsorship Inventory Definition Free General Cover Letter Regarding Blank Sponsorship Sponsorship Form Template Lettering Certificate Of Completion Template

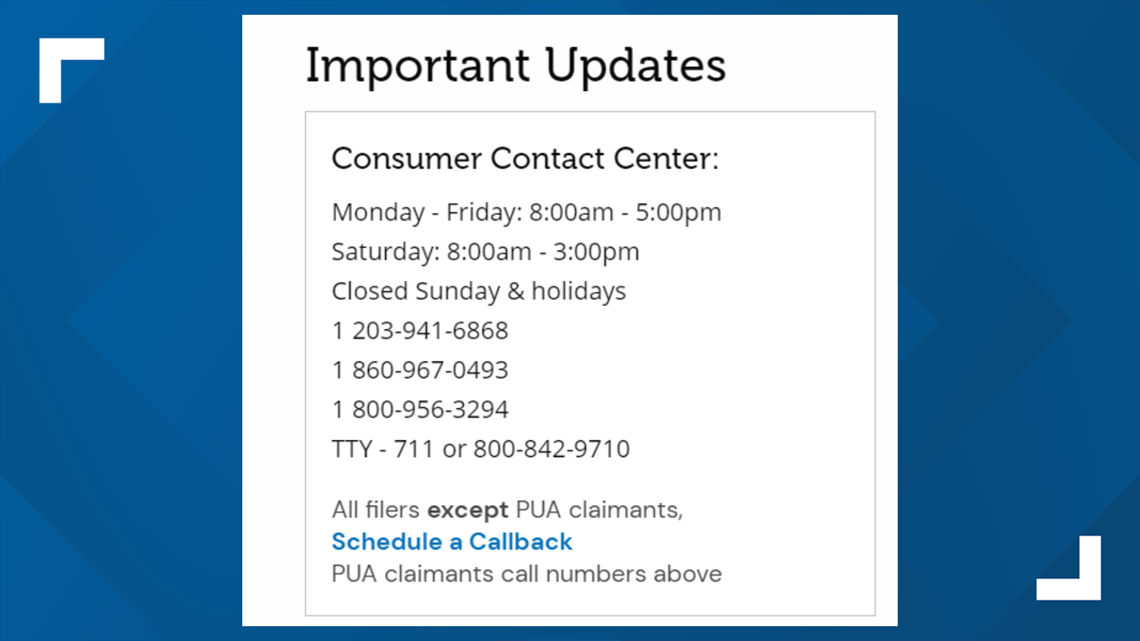

Ct Department Of Labor Announces Customer Contact Center To Help With Unemployment Claims Connecticut News Wfsb Com

Ct Dept Of Labor Recent Irs Guidance On The 1099g Tax Form

Connecticut Unemployment Helpline Phone Number Fox61 Com

American Rescue Plan Federal Programs

Connecticut U S Department Of Labor

No comments:

Post a Comment