If you become totally or partially unemployed file a claim for. Additional Resources and Support.

Unemployment Benefits Extension 2022 Will Your State Send You Checks In 2022 Marca

A New Jersey employer subject to the Unemployment Compensation Law is also subject to the Temporary Disability Benefits Law except for certain government entities.

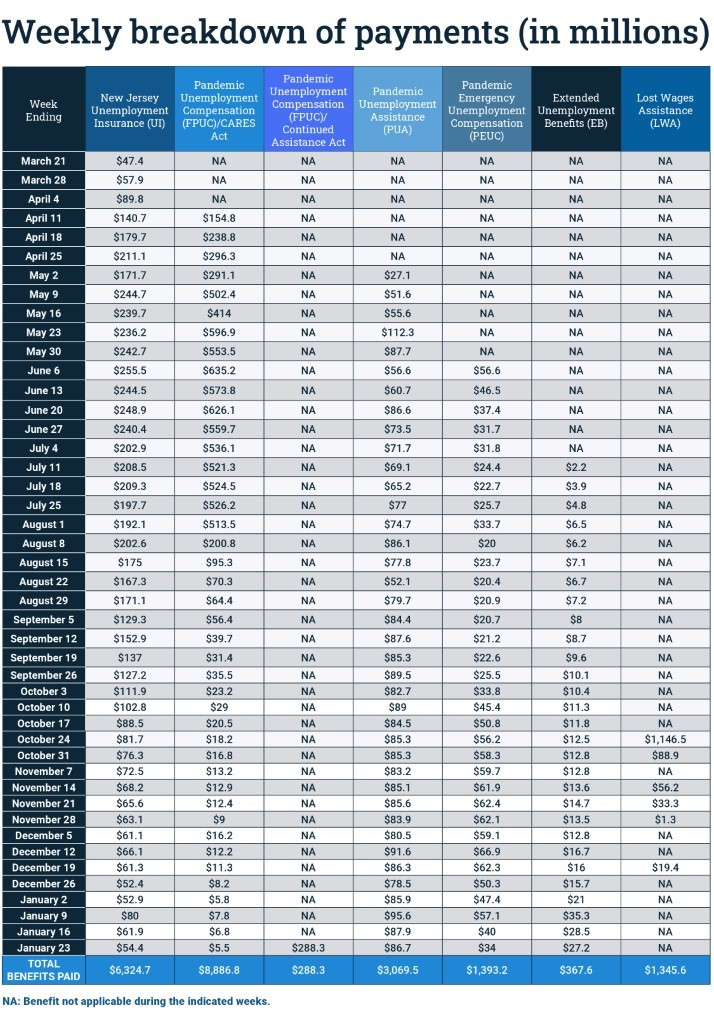

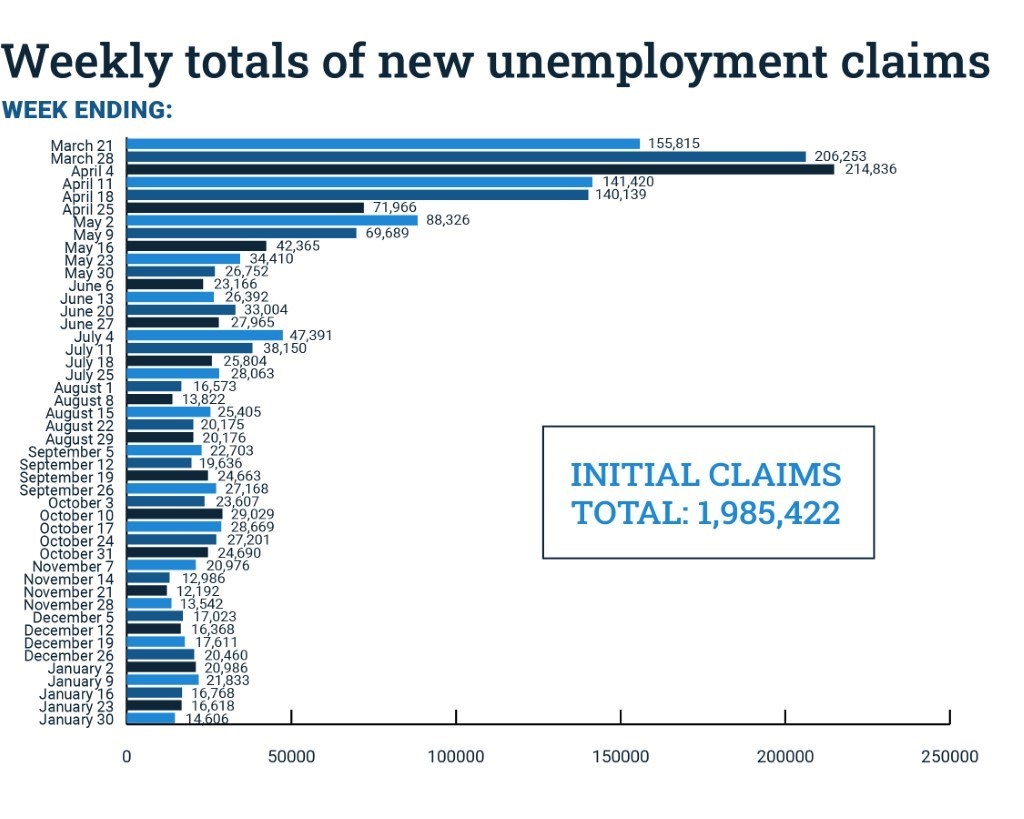

Nj unemployment temporary disability. Unemployment Insurance Benefits are payable to workers who lose their jobs or who are working less than full time because of a lack of full-time work and who meet the eligibility requirements of the law. You may become unable to work due to. Federal laws that expanded Unemployment Insurance benefits to more workers expired September 4 2021.

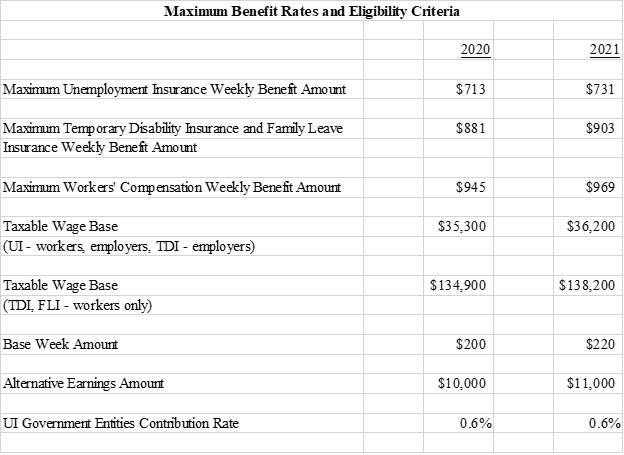

An Internal Revenue Service ruling states that New Jersey Temporary Disability benefits must be treated as third-party sick pay. The maximum benefit rates for New Jersey Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation will be increasing in. For example if you file an application for a period of leave in December 2021 but payments are not issued until January 2022 you do not need to download a 1099-G for your 2021 federal tax return.

Individuals should apply for the program that best fits their situation as applying for the wrong one could cause delays. Disability During Unemployment Insurance benefits Benefits are federally taxable during the year that payments are issued which may not always match up with when your leave occurred. If you have received a determination about your Unemployment Insurance or Temporary Disability Insurance benefits you will be able to file an online appeal of that.

Or you may download a form from our Website at wwwnjgovlabor. TRENTON The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation for calendar year 2022. Go to Temporary Disability.

Short title This act shall be known and may be cited as the Temporary Disability Benefits Law L1948 c. Known as temporary disability insurance or cash sickness insurance. Your employer is subject to the New Jersey Unemployment Compensation and Temporary Disability Benefits Laws.

Division of Temporary Disability Insurance. Listed below are the 2022 maximum benefit amounts taxable wages and earning requirements for New Jersey Un employment Compensation State Temporary Disability Family Leave and Workers Compensation Programs. TEMPORARY DISABILITY BENEFITS LAW ARTICLE I 4321-25.

You must have contacted your employer after you recovered and work is no longer available. See links to assistance with food housing child care health and more. Max NJ Weekly Jobless Benefit to Increase by 73 in 2022.

Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30. You may become unable to work due to. If you believe you have been denied benefits improperly or you just have additional questions you may want to consult with an experienced lawyer who knows about unemployment and disability benefits.

New Jersey has among the most comprehensive Temporary Disability Family Leave Insurance and Earned Sick Leave laws in the country which cover all types of workers full-time part-time temporary and seasonal. In New Jersey most workers whose employment is covered by the New Jersey Unemployment Compensation Law are also protected by a mandatory disability insurance program which covers a non-work related illness injury or disability. 609-984-4138 TEMPORARY DISABILITY INSURANCE Most workers whose employment is covered by the New Jersey Unemployment Compensation Law are also protected by a mandatory disability insurance system.

Federal benefits created during the benefit expired September 4 2021. A physical or mental illness injury or scheduled surgery. This designation requires Social Security FICA withholdings and matching employer FICA contributions on the portion of benefits financed by.

Purpose This act shall be liberally construed as remedial legislation enacted upon the following declarations of public policy and legislative findings of fact. You must have filed for Unemployment Insurance benefits within four weeks of your recovery. You may be eligible for Temporary Disability benefits through the Disability During Unemployment section if you become unable to work more than 14 days from your last day of work at an employer covered for New Jersey Temporary Disability Insurance whether you are still employed or not.

Department of Labor and Workforce Development. The Temporary Disability Benefits Law protects against wage loss suffered because of inability to perform regular job duties due to illness or injury. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience.

Read our FAQs on paid leave job protection and caregiving. Disability During Unemployment DDU If you have an illness injury pregnancy or another physical or mental health condition and have not been working recently you may be eligible for benefits under the Disability During. 2022 Benefit Rates Announced for Unemployment Compensation Temporary Disability Family Leave and Workers Compensation.

Trenton New Jersey 08625-0387 Claims Information. You may be eligible for Temporary Disability Insurance benefits if your physical or mental illness or injury prevents you from working and was not caused by your work or if you are at high risk for COVID-19 due to underlying health conditions. You will still be able to receive benefits for eligible weeks prior to September 4 2021.

Coverage is also extended to employees of the state of New Jersey. Can you collect long term disability and unemployment at the same time. A temporary disability covered by the Temporary Disability Insurance program.

You may be eligible for Temporary Disability benefits through the Disability During Unemployment section if you become unable to work more than 14 days from your last day of work at an employer covered for New Jersey Temporary Disability Insurance. Meanwhile Unemployment Temporary Disability and Family Leave benefits require an application to the State of NJ. You are required to pay disability insurance taxes and to give the Division of Temporary Disability Insurance certain information about your employees when they file claims for disability benefits.

You may obtain this form from employers or from the Disability During Unemployment office contact information is on the back of this pamphlet. Tax reporting requirements for Temporary Disability and Unemployment Insurance. Use Form DS-1 Claim for Disability Benefits to claim disability benefits during unemployment.

Thank you for visiting the NJ Division of Unemployments site for employers and claimants customers to file an appeal of an Unemployment or Temporary Disability Insurance determination. The increased rates will be effective for new claims dated January 2 2022 and later.

Unemployment Benefits In Nj How To Apply Credit Karma

.jpg)

Division Of Temporary Disability And Family Leave Insurance

Free New Jersey Unemployment Disability Insurance Labor Law Poster 2022

Department Of Labor And Workforce Development Nj Labor Dept Reports 3rd Week Of Decreases In New Unemployment Claims

Max Nj Weekly Jobless Benefit To Increase By 73 In 2022 Njbia New Jersey Business Industry Association

Nj Labor Department Njlabordept Twitter

Division Of Unemployment Insurance Information You Ll Need To Apply For Unemployment Insurance Benefits

Department Of Labor And Workforce Development Nj Labor Dept Reports 3rd Week Of Decreases In New Unemployment Claims

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

Pin By Eris Discordia On Economics Pie Chart Chart Diagram

Division Of Unemployment Insurance Training Education Programs

Collecting Unemployment While On Disability Roeschke Law Llc

No comments:

Post a Comment