In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. The total amount that you might collect is called the maximum benefit allowance.

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

370 Individual up to 442 wdependents AK Unemployment Insurance State Website.

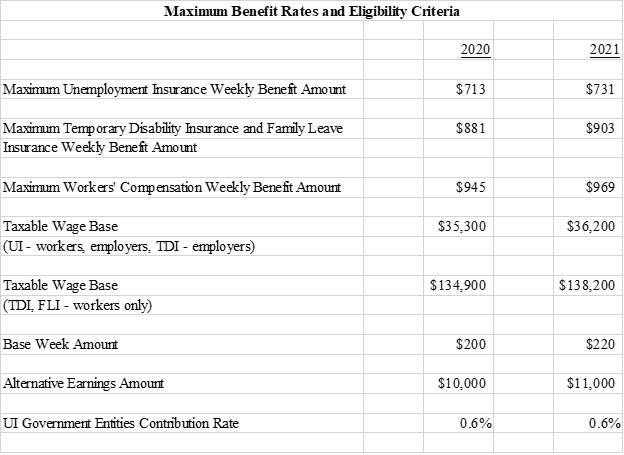

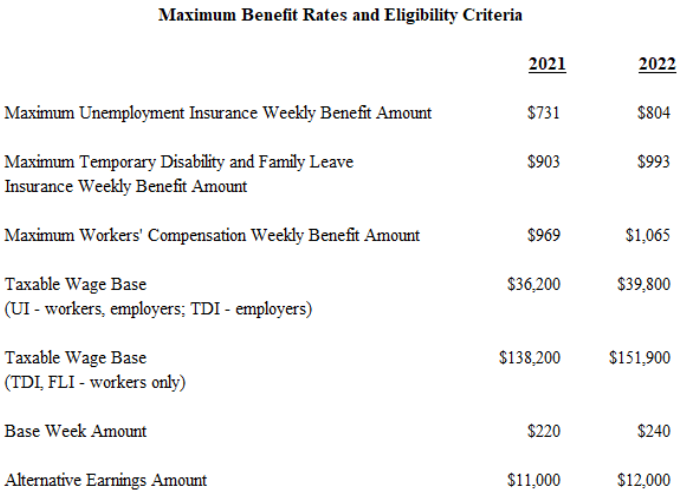

Nj unemployment benefits maximum. This number is then multiplied by the number of weeks that you worked during the base period up to a maximum of 26 weeks. The benefit rates and taxable wage base for 2022 reflect the 141952 average weekly wage for 2020 which rose by 99 from 2019 largely due to the number of low-wage workers who were out of work during the pandemic and the higher wage paid to those. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731 the New Jersey Department of Labor Workforce Development NJDOL said.

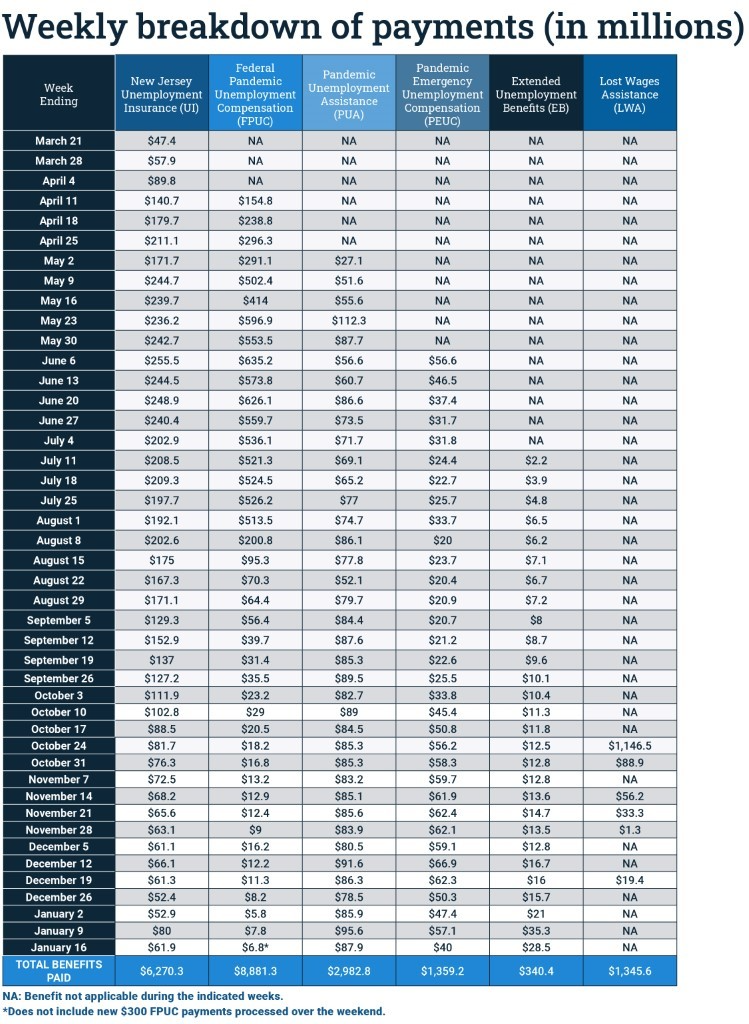

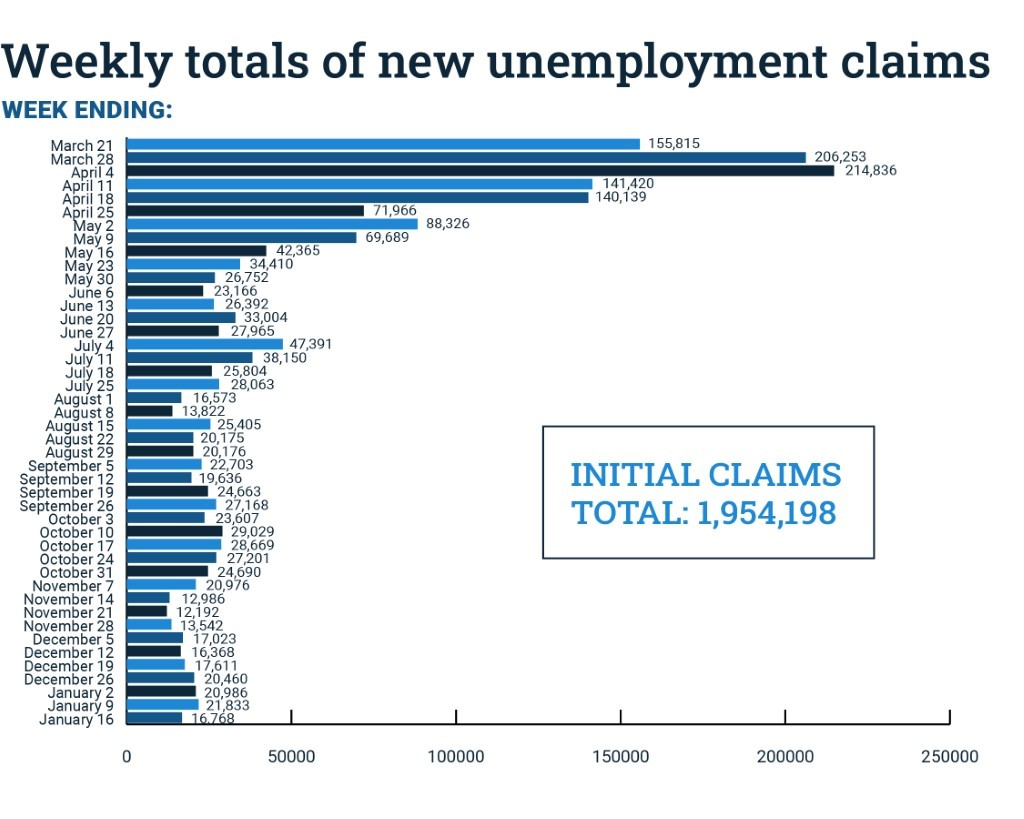

In roughly 22 months the Labor Department has paid 36 billion to about 15 million claimants said spokeswoman Angela Delli-Santi. The maximum New Jersey unemployment amount in 2020 is 713. Although the state relied on archaic systems and complex outdated benefit requirements the technology performed remarkably well she said.

The formula caps weeks worked at 26 weeks. You should expect to receive approximately 60 percent of your former income up to the maximum of 697 per week. An estimated 75 million workers lost benefits on September 6 2021the largest cutoff of unemployment payments in history many times larger than any previous cessation of disbursements such as the 13 million Americans whose support ended in 2013 or the 800000 in 2003.

No more than 3 dependents may be claimed for a maximum of a 15 percent WBR increase. The maximum benefit rates are recalculated each year based on the statewide average weekly wage. Your MBA is your WBA multiplied by your weeks worked during the base period.

Your weekly benefit rate will be calculated at 60 of the average weekly wage you earned during the base year up to the maximum of 713. How much will the unemployment benefit be in New Jersey. TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum.

Supplemental Federal Pandemic Unemployment Compensation FPUC Through July 31 2020 the federal government is supplementing those who receive unemployment benefits with an additional 600 per week. Her maximum benefit amount will be 300 x 26 7800. Amount and Duration of Unemployment Benefits in New Jersey.

Unemployment benefits in New Jersey are calculated based on your highest-earning quarter. A claimant can collect a maximum of 26 weeks of benefits on a regular unemployment claim. A New Jersey unemployment benefits claim including a dependent will increase the WBR by 7 percent for the first dependent and 4 percent for each additional dependent.

Dependent benefits may be granted if the claimant is not receiving the maximum WBR. Phil Murphy has the authority to extend the payments using. If you do not receive the maximum rate you may be eligible for Dependency Benefits.

AZ Department of Economic Security. Your maximum benefit amount depends on how much money you earned in your base period. How unemployment payments are calculated.

The weekly benefit rate is capped at a maximum amount based on the state minimum wage. The maximum weekly amount is recalculated annually and is equal to 56 23 percent of the statewide average weekly wage. No more than 3 dependents may be claimed for a maximum of a 15 percent WBR increase.

In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. Whats the maximum amount of unemployment you can get in NJ. Dependency Benefits are 7 of your weekly benefit rate for the first dependent and 4 for each of the next two.

The maximum weekly benefit for state plan Temporary Disability Insurance and Family Leave Insurance claims increased to 650 from 637 and the maximum weekly benefit for Workers Compensation rose to 921 from 903. For PUAPEUC recipients the balance represents the maximum that was available for weeks of unemployment before 9421. In the new year the maximum weekly benefit amount for eligible Unemployment Insurance beneficiaries increased to 696 from 681.

Unemployment Benefit Rate- In NJ the maximum Unemployment Benefit Rate is 713 per week for claims filed in 2020 and 731 for claims filed in 2021. Estimated Maximum Benefit Amount MBA Your estimated maximum benefits amount MBA is the total amount you can collect in unemployment insurance benefits over the course of a year. A New Jersey unemployment benefits claim including a dependent will increase the WBR by 7 percent for the first dependent and 4 percent for each additional dependent.

New Jerseys programrun by our Department of Labor and Workforce Development NJLWDprovides jobless workers with 60 of their average base pay on a weekly basis. Those who qualify for regular unemployment benefits in NJ receive 60 of their average weekly wages up to a maximum of 713 per week. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26 weeks of regular state unemployment up to.

What is the unemployment rate in New Jersey. Dependent benefits may be granted if the claimant is not receiving the maximum WBR. Arkansas Division of Workforce Services.

The maximum anyone can receive regardless of how many weeks they worked during the base year or how much they earned is 26 times the maximum weekly benefit rate. Your weekly benefit rate which is 60 of your average weekly wage up to the maximum benefit amount which is 713 in 2020. Maximum of Weeks.

The New Jersey Department of Labor and Workforce Development determines your unemployment benefit rate based on. New Jersey defends its handling of unemployment matters. What is the maximum weeks for unemployment benefits in NJ.

For 2020 the maximum weekly benefit rate is 713. Your base period is defined as the first four quarters out of the past five quarters before you file your initial New Jersey unemployment weekly claim. If you are eligible to receive unemployment your weekly benefit rate WBR will be 60 of your average weekly earnings during the base period up to a maximum of 713.

Right now the maximum total benefit amount any one claimant can receive during their annual claim period is 20904 804 x 26. Weekly Benefit Amount State Unemployment Info Max Weeks Alabama. New Jersey provides a maximum weekly benefit of 713 for up to 26 weeks.

How Unemployment Benefits Are Calculated By State Bench Accounting

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Njdol Jobless Residents Receive New Stimulus Payments

Unemployment Benefits For The Jobless

Nj Unemployment Server Is Down Backlog Of Claims Continue To Grow Parsippany Focus

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Njdol Jobless Residents Receive New Stimulus Payments

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

A Guide To The Extended Unemployment Benefits In New Jersey

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Unemployment Benefits Comparison By State Fileunemployment Org

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Total Pandemic Relief To Nj Workers Nears 35b As Federal Benefits Expire New Jersey Business Magazine

New Jersey Unemployment Rate 2020 Statista

No comments:

Post a Comment