The minimum weekly benefit rate is 100 104 starting January 1 2020 provided you meet eligibility requirements. In recent years the overall rate for new employers has been around 4.

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

For 2018 the size of fund index column in effect is the column labeled 20 but less than 25 The range of the normal portion of the rates is 03 to 73.

Nys unemployment insurance rate. If you lost work and you are working part-time 30 hours or fewer a week and making 504 or less per week the following guidelines apply when reporting your part-time. New york state unemployment insurance details. For January 1 2020 March 31 2020 the minimum benefit rate is 172.

The range of rates with the normal subsidiary and reemployment taxes is 09 to 83. The natural rate of unemployment is between 35 and 45. This rate is fixed each year according to the size of the Unemployment Insurance Trust Fund.

Each year you will receive a rate notice showing your Unemployment Insurance contribution rate for that year. This tool gives an estimate only. The account is only a bookkeeping.

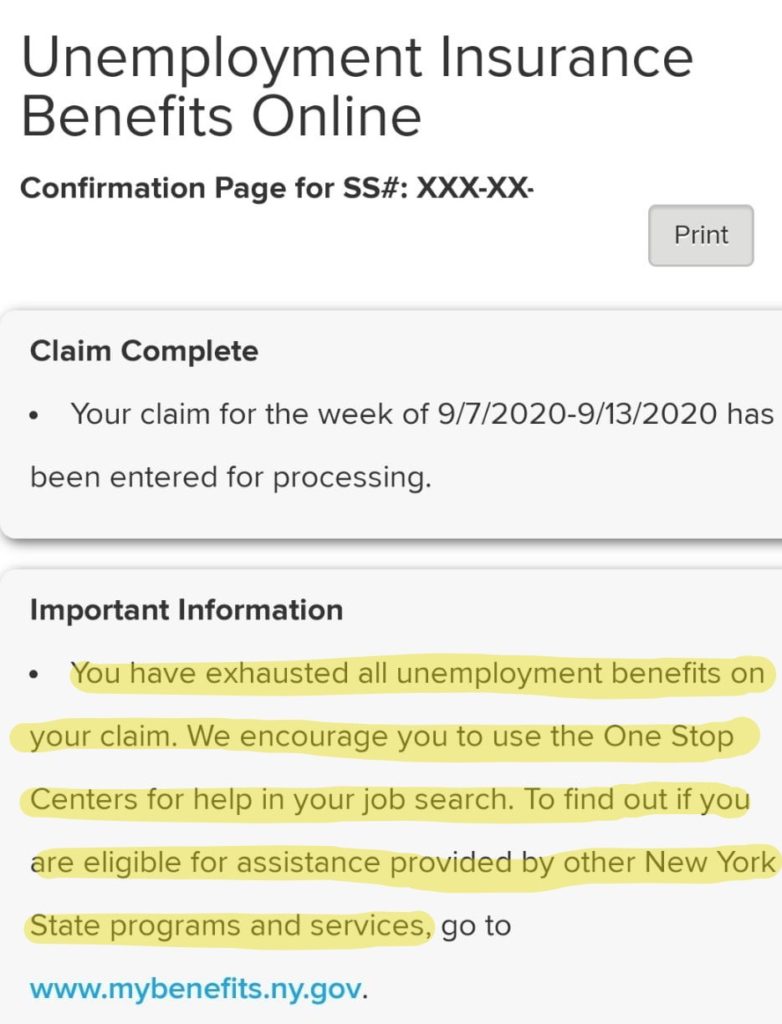

Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. Current 2022 Employer Contribution Rate. Those who qualify can receive a weekly benefit payment for a maximum of 26 full weeks during a one-year period.

Visit New York State Department of Labors website at wwwdolnygov Call 1-866-435-1499 24 hours a day or 518-485-2144 between 800 AM and 400 PM Fax information to 518-457-0024. You can use this tool to estimate a weekly Unemployment Insurance benefit amount. The maximum benefit rate is 504 the same as the maximum benefit rate for regular unemployment insurance benefits.

Disaster Unemployment Assistance. This rate cannot exceed 34. The beginning rate actually is the sum of three other rates.

Ohio 9000 9000 Oklahoma. It does not guarantee that you will be eligible for benefits or a specific amount of benefits. As of January 2020 the unemployment rate is 67 according to the Bureau of Labor Statistics.

The New York unemployment rate most notably reached a high of 1080 in 1982 following a recessionary period. You must have at least two calendar quarters with earnings within four consecutive calendar quarters in order to be eligible for a weekly benefit rate. New York 2021 SUI tax rates and wage base increased The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020.

The rate takes effect on January 1 for the NYS 45 due on April 30. Unemployment rates for a large state like New York give a good idea on the health of the economy. 10000 10000 Employee SUI.

The New York Unemployment rate measures the percentage of total employees in New York that are part of the labor force but are without a job. The minimum PUA benefit rate is 50 of the average weekly benefit amount in New York. Welcome tothe New York State Department of Labor Unemployment Insurance.

Unemployment Insurance Rate Information View current unemployment insurance rates and calculate your contribution rate. The normal contribution rate the subsidiary contribution rate and the Re-employment Service Fund rate. The percentage rate is based on unemployment claim experience of the individual employer and the losses of the entire state fund.

The unemployment rate in new york peaked in july 2020 at 159 and is now 63 percentage points lower. The new employer rate for 2021 increased to 4025 up from 3125 for 2020. Unemployment Insurance is temporary income for eligible workers who become unemployed through no fault of their own.

In New York State employers pay for benefits not workers. As of January 18 2021 New York State has implemented a new rule that redefines how part-time work impacts unemployment benefits. New York Unemployment Insurance On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825.

The partial unemployment system uses an hours-based approach. 52 rows Employee rate of 0425 including the Workforce Development and. 2 on taxable income from 4600 to 9099.

No deductions are taken from workers paychecks. For April 1 2020 June 30 2020 the minimum benefit rate is 182. Experience rates are updated.

The natural rate of unemployment is between 35 and 45. State taxes on unemployment benefits. Enter your Federal Employer Identification Number FEIN.

Generally unemployment insurance is paid into an account held by the New York State Department of Labor at a specified percentage of each covered employees wages up to a cap. Certain churches and non-profits are exempt from this payment. York States Unemployment Insurance Rates Small Business Owners Reporting Increases of Nearly 200 April 19 2021 Albany - New York States sudden change in unemployment insurance rates have imposed unanticipated financial burdens on an already struggling restaurant industry.

Report it anonymously by contacting the New York State Department of Labor Liability and Determination Fraud Unit by any of these methods. New York Unemployment Insurance. Please see the Notice of Unemployment Insurance Contribution Rates IA 98 form included with this guide for more information.

Employee SUI withholding rate is 0425 on wages up to 36200. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount.

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

/cdn.vox-cdn.com/uploads/chorus_asset/file/22253262/unnamed.jpg)

Change For Part Time Workers Receiving Unemployment Benefits The City

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

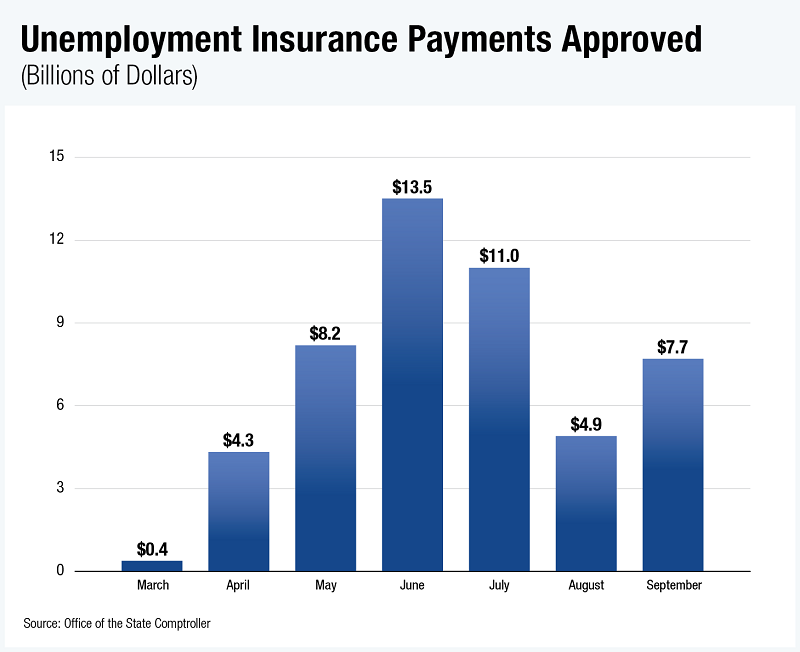

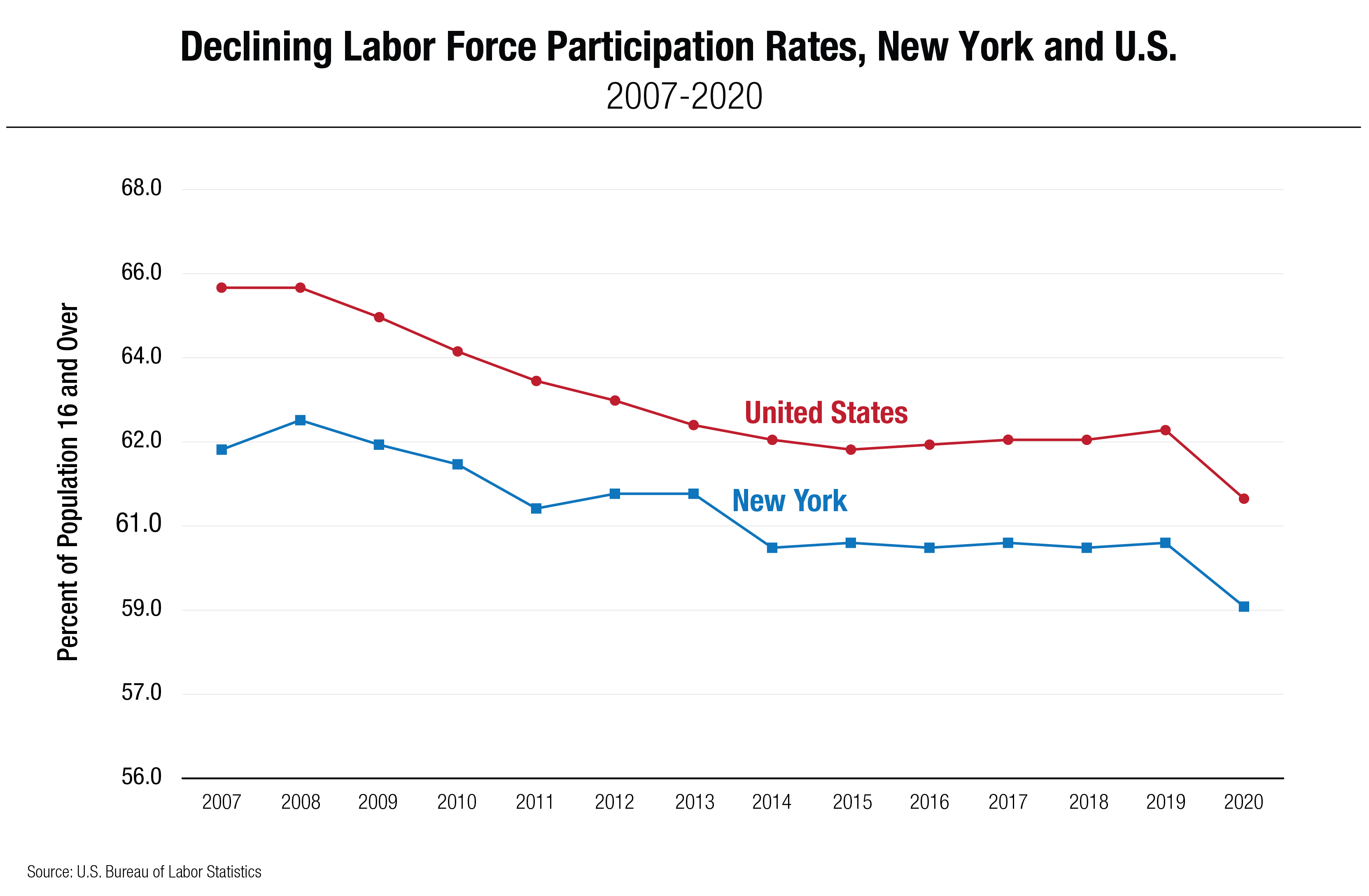

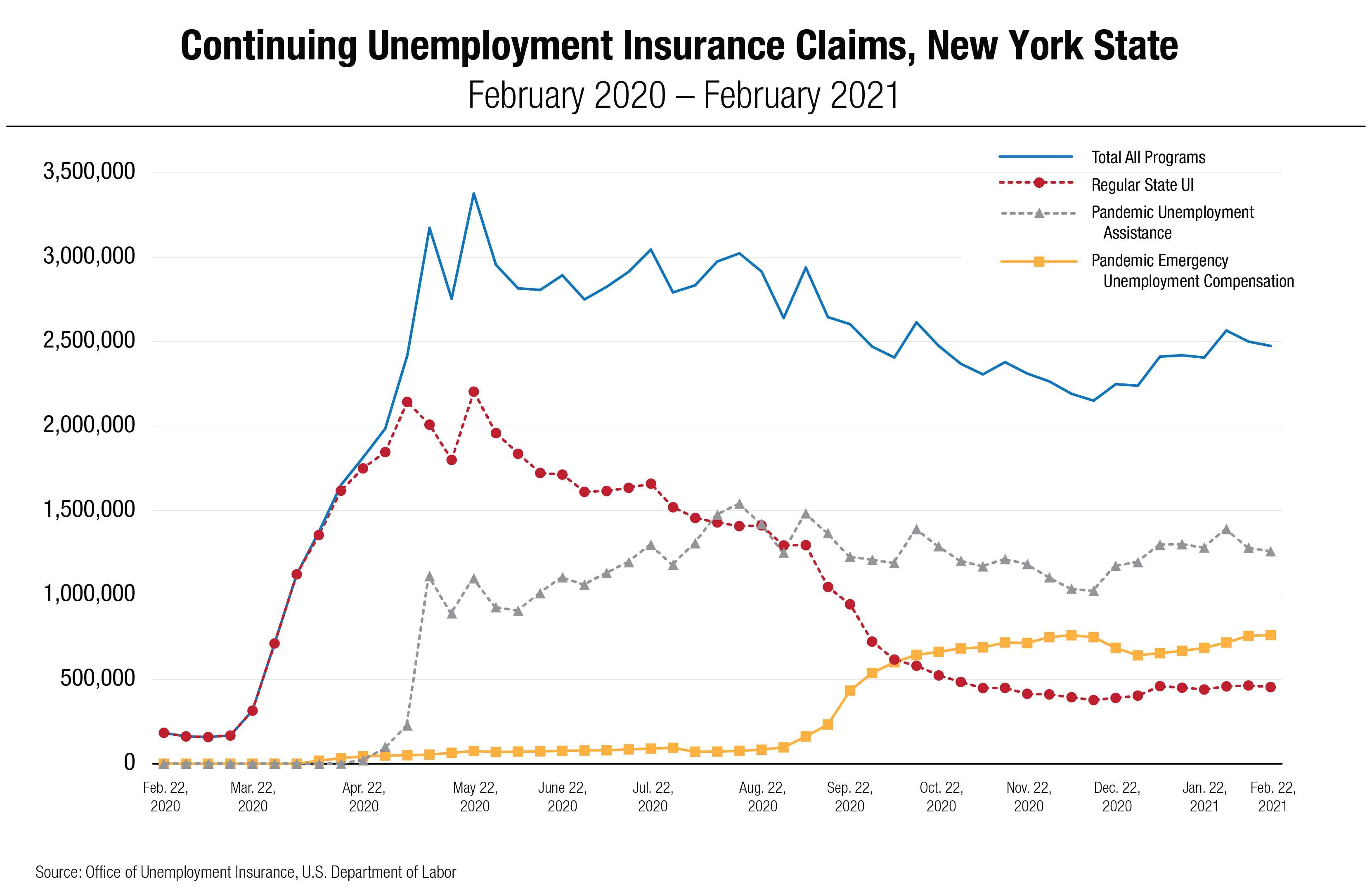

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

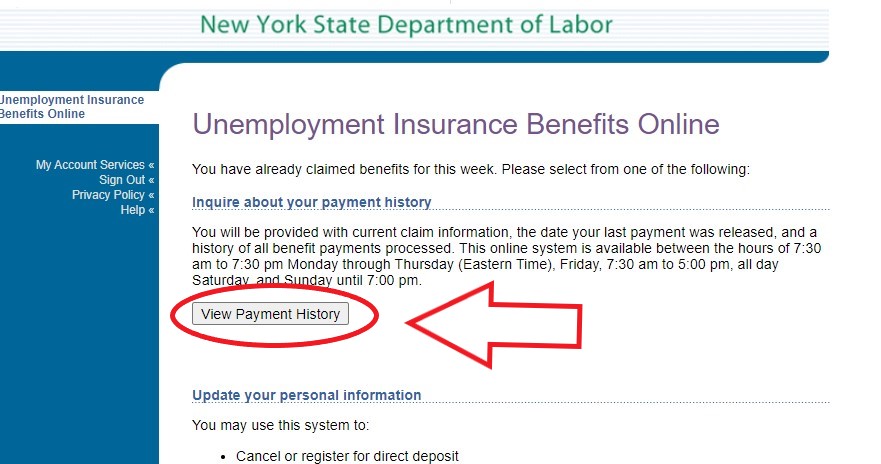

Certify For Weekly Unemployment Insurance Benefits Department Of Labor

Unemployment Benefits Comparison By State Fileunemployment Org

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

Nys Department Of Labor Nyslabor Twitter

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

How Much Unemployment Benefits Will I Get In New York As Com

Unemployment Claims Are Lowest Since Pandemic Began The New York Times

No comments:

Post a Comment