When prompted log in using your Social Security number and existing PIN. To be submitted if an employer has acquired any portion of a trade or business.

Pin By Darrin Ashton On Choose The Forestry Equipment Manufacturer That Will Take The Pressure Off American Jobs Infographic Work Family

What is the deadline to file W-2 with Ohio.

Ohio unemployment w-2 2020. The 2020 SUI taxable wage base reverts to. Ohio Unemployment - Unemployment claim disallowments. It is in the form of a PDF file that can be printed and saved.

But you dont have to wait for your copy of the form to arrive in the mail. 31 to send it to you. Form W-2c reporting of employee social security tax and railroad retirement tax act RRTA deferred in 2020.

However the American Rescue Plan Act of 2021 allows an exclusion of unemployment compensation of up to 10200 for individuals for taxable year 2020. If you were out of work for some or all of the previous year you arent off the hook with the IRS. The due date to file Ohio W-2s is January 31 2020.

1099-G income tax statements for 2021 will be available online mid-January 2022. Select the SSN Social Security Number for this W-2G. Enter Ohio Withholding State income tax withheld box 15 only if box 13 indicates Ohio or OH.

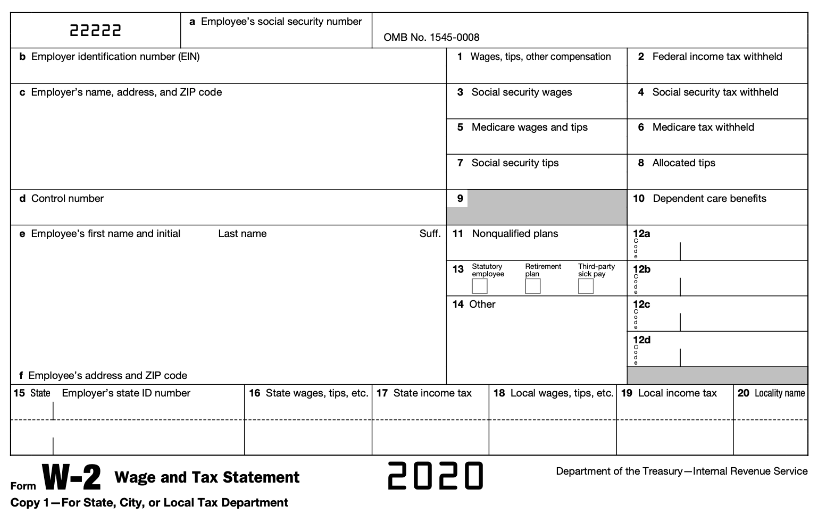

W-2 Upload Specifications V 1. The specifications for tax year 2020 W-2s submitted in calendar year 2021 are contained in this document. To qualify for.

If Form W-2 is required but not given on time you must give the employee notice about 2020 EITC by January 31 2020. - 2 - Ohio Department of Taxation. I am filing a complaint against OJDFS due to Unemployment claim disallowments based on not meeting the weekly income requirement of 280 which is false and have provided paystubs to prove it and not meeting the minimum requirement of 20 weeks questionable based on a timeframe of.

The Ohio Department of Taxation ODT follows the EFW2 layout required by the Social Security. If you are entering a W-2G document then. Karen Kasler Statehouse News Bureau Posted on.

Ohio income tax update. If you do not remember your PIN call 1-866-962-4064 to reset it. Unemployment benefits including Pandemic Unemployment Assistance PUA Federal Pandemic Unemployment Compensation FPUC Pandemic Emergency.

In Ohio but did not have Ohio individual income tax or Ohio school district taxes withheld from their wages. If you deferred the employee portion of social security or RRTA tax under Notice 2020-65 see Reporting of employee social security and RRTA tax deferred in 2020 later for more information on how to report the deferralsAlso see Notice 2020-65 2020-38 IRB. For the tax year 2021 the deadline to file Ohio Form W-2 with the Ohio Department of Taxation has been extended from January 31 to March 02.

They have until Jan. The Department has lowered the threshold for the electronic filing of W-2 and 1099-R information for calendar year 2021 information submitted in 2022 All employers and retirement system payers that issue 10 or more W-21099-Rs are required to upload their W-21099-R information electronically through the Ohio Business Gateway. Appeal requests may be submitted online at unemploymentohiogov by email to UITaxAppealsjfsohiogov by fax to 614 752-4952 or by mail to Unemployment Tax Appeals P O.

2021 IRS Form 940 Mailing Address. Tuesday May 12 2020. Click the Unemployment Services button on the My Online Services page.

Enter FEIN Federal identification number. The appeal must be in writing and it must state the reasons the employer believes the determination was incorrect. Thanks for visiting our site.

To access your Form 1099-G log into your account at labornygovsignin. The Ohio Department of Taxation is dedicated to providing quality and responsive service to you our individual and business taxpayers our state. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92.

Used by employers to apply for an unemployment tax account. You are eligible for benefits from the time you lost work due to COVID-19 INCLUDING any time after February 2 2020 until you receive 39 weeks of benefits or until December 31 2020 which ever happens first. Enter Federal Withholding Federal income tax withheld box 4.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. PUA coverage is available retroactively from February 2 2020 and ends on December 31 2020. Ohio Department of Job Family Services PO Box 182404 Columbus OH 43218.

Form 940 is an annual form needed by employers to report Annual Federal Unemployment TaxesEmployers can either file paper copies or e-file this form. I dont know if this is considered a legal copy by the IRS but it does give the compensation for the year and withholding information. Box 182830 Columbus Ohio 43218-2830.

If you received unemployment your tax statement is called form 1099-G not form W-2. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Withholding Taxes From Your Payments.

You pay all the required contributions for 2020 to your state unemployment fund by April 15 2022. Changes in how unemployment benefits are taxed for tax year 2020. JFS-20101 Transfer of Business.

Jobless Benefits System to Pay Ohios 1099 Self-Employed and Other Workers Online By. Youll also need this form if you received payments as part of a governmental paid family leave program. If you dont receive it in the first week of feb.

See also Instructions for Employee on the back of Copy C. Railroad employer and more than 535080 in Tier 2 RRTA tax was withheld you may be able to claim a refund on Form 843. JFS-20100 Report to Determine Liability.

Updated on November 19 2021 - 1030 AM by Admin TaxBandits. W-2 UPLOAD SPECIFICATIONS. When e-filing Form W-2 for Ohio the state requires School district number 4 digits if there is school income tax withheld.

Your FUTA tax for 2021 is 42 7000 x 06. Enter Gross Wages Gross winnings box 1. Beginning May 18 if youve contacted your employer and were not able to obtain a copy of your W-2 we can provide you with a state wage and tax transcript that includes any information your employer has reported to us.

May 14 2021 Unemployment compensation is taxable. If you claimed traditional unemployment PEUC or EB benefits within the last 12 months simply go to unemploymentohiogov click on Get Started Now and answer the questions. To obtain your Employer ID immediately please visit httpsthesourcejfsohiogov to register your unemployment account.

If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. In the case of married individuals filing a joint Form 1040 or 1040-SR this exclusion is up to 10200 per spouse. Updated 5262021 - Unemployment Benefits for Tax Year 2020.

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

How To Write An Essay Question Essay Questions Essay Writing Essay

W2 Online No 1 W2 Generator Thepaystubs

Creative Extruded Products Announces Global Expansion To Mexico The Calibaja Manufacturing Partnership Will Shoulder The High Demand For Specialty Moldings Wi Tipp City Mexico Mexicali

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Where Are Home Values Headed Over The Next 12 Months In 2020 House Prices Real Estate Tips Home Values

Chris Prybal On Twitter Stock Market Chart 10 Years

2019 Tax Information Form W 2 Wage And Tax Statement Form 1099

20 Off At Bath Body Works Coupon Via The Coupons App Printable Coupons Free Printable Coupons Bath And Body Works

Join Garrett For Inktober 2021 And Grow Your Social Media Following Inktober Secret To Success Prompts

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Stimulus Check Irs Payment

No comments:

Post a Comment