Beginning retroactively January 1 2014 unemployment benefits will no longer be payable to1 a holder of an H-2B visa which covers workers admitted to the United States temporarily to perform non-agricultural services and 2 a holder of a J-1 visa which covers workers admitted under the exchange visitor program. Can J-1 visa holders apply for the unemployment benefit.

Federal and state disability insurance.

J-1 visa unemployment benefits. Participants must file both a federal income tax return and a state. It is not one where you can only work in a pre approved job. In particular promises of cultural exchange and professional training are used in the J-1 internship program for.

J-1 Visa Status Exchange Visitor The J-1 visa status permits a qualified nonimmigrant alien ie an alien who is not a lawful permanent resident also known as a green card holder to temporarily reside in the United States to teach study observe conduct research consult demonstrate special skills or receive on-the-job training for periods ranging from a few. Senate Immigration Subcommittee as an expert witness. For example as seen in Figure 1 participants pay a fee to a sponsor and in some cases overseas agents as well as visa application fees to the Department of State.

The average J-1 sponsor fee ranges from 400 to 2000 and. Citizenship and Immigration Services. There are UI benefit programs found in the CARES Act that carry certain restrictions on eligibility.

J-1 students are eligible for on-campus employment if it is pursuant to scholarship fellowship or assistantship or off-campus employment if it is a summer worktravel exchange program or if it is necessary because of serious urgent and unforeseen economic circumstances that have arisen since acquiring J-1 status. This visa is a working holiday visa. J-1 students may work part-time and earn an income during their courses in order to supplement their finances.

The J-1 Visa offers cultural and educational exchange opportunities in the United States through a variety of programs overseen by the US. You can seek your own employment. Veterans benefits including but not limited to HUD-VASH and medical treatment through the Veterans Health Administration.

Money earned by a J-2 cannot be used to support the principal J-1 Visa holder. Government including federal and state pension benefits and healthcare. Versatility Flexibility Top Benefits for Employers.

A typical employer who hires 5 WorkTravel J-1 visitors and pays 8hour each may save over 2317 in a typical 4-months season. Unemployment benefits normally offer temporary 26 weeks worth of financial assistance in the form of regular cash payments in an amount thats a percentage of your earnings while employed. H-1B visas for example are generally allocated to noncitizens who work in fields with low levels of.

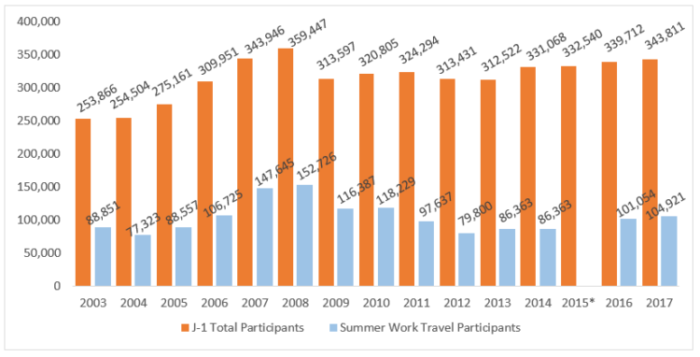

If you have multiple jobs but lose one and you find that you are eligible for benefits it is encouraged that you continue to work. About 300000 foreign visitors from 200 countries travel to the Unites States to study and work every year via the J-1 Exchange Visitor Program. Government announced that the Department of State has authorized consular officers to waive the visa interview requirement for F M and J visa applicants if they choose through the end of 2021This includes individuals previously issued any type of visa and who have never been refused a visa unless such refusal was overcome or waived and who.

The J-1 visa is a private sector exchange program and is primarily funded through participant and sponsor fees. Accepting such benefits as a J-1 or J-2 visa holder can lead to inadmissibility to the United States due to reliance on public assistance under the. Federal state county and local laws J-1 visa holders and their dependents may qualify for public assistance such as health insurance subsidized housing food assistance or unemployment benefits.

This allows for programs to be curated by host-employers highlighting what the visa recipient can expect to learn and for how long and who will oversee the program. Background The J-1 visa is a temporary non-immigrant visa that is utilized by the US government employers and visa sponsors to expand the guest worker program and bring in cheap labor from abroad without a pathway to permanent residency. When J-1 visitors do not pay Social Security Medicare or Federal Unemployment taxes employers do not have to match these taxes.

During the 60 day grace period some O-1 visa holders may receive certain unemployment benefits depending on the specifics of their case but they will not be able to continue receiving benefits after the 60 days are over. This could exclude many nonimmigrants such as those in H1B or L-1 status. To work a J-2 Visa holder must obtain an Employment Authorization Document from the Department of Homeland Security US.

The report notes that eligibility for unemployment insurance UI benefits is not entirely clear. Unlike other visa categories which require approval through the Department of Labor the J-1 visa is approved through the Department of State. He is a Certified Specialist in Immigration Law who has testified before the US.

Have various employment positions for their students which are located on the schools campus. This allows for a diverse field of. Generally a J visa holder would not be eligible for unemployment benefits.

In addition to J-1 visas the COVID-19 non-immigrant visa ban also affected L-1 visas intracompany transfers H-1B visas high-skilled workers and H-2B visas seasonal workers. The organization will automatically deduct federal and state income taxes from the paycheck. Most universities in the US.

Generally all J-1 Visa holders are considered non-residents. Student intern scholar trainee teacher professor research and summer work among others. You may engage in either on campus or off campus work.

Carl Shusterman former INS Trial Attorney 1976-82 has 40 years of experience practicing immigration law. These visas benefitand do not harmthe American economy. J-1 Exchange Visitor programs include au pairs summer work travel interns high school and university student exchanges physician exchanges and more.

Participants do not pay Social Security and Medicare taxes FICA or Federal Unemployment tax FUTA because they are not eligible for these benefits. The visa does not provide an alien registration number. The J-1 visa allows for recipients to enter under different approved categories impacting all markets.

That percentage is usually 50 but can receive an added bump of up to 600 per week through July 31 2020 through the federal Coronavirus Aid Relief. Eligibility for Unemployment Benefits Less Clear.

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Unemployment Benefits For H4 Ead Dependent Visa Holders How To Apply Where To Apply Complete Document List Path2usa Travel Guide For Usa

Edd Images Stock Photos Vectors Shutterstock

Free Study In Germany Free Education Education World Germany

Employment Verification Letter Sample Letter Of Employment Letter Sample Employment

Mutual Benefits The Exchange Visitor Program J 1 Visa National Immigration Forum

The Uscis Public Charge Barrier Legal Immigration Just Got Tougher

Human Resources Organizational Chart Human Resources Human Resources Quotes Organizational Chart

Quick Guide On Germany S Unemployment Benefits Applying As An Expat Expatrio Com

Unemployment Benefits Images Stock Photos Vectors Shutterstock

Unemployment Benefits For Green Card Holders Citizenpath

Covid 19 Are Nonimmigrants Eligible For Unemployment Benefits Business Immigration Insights

No comments:

Post a Comment